Best Dividend Stocks Canadian Business

Post on: 10 Сентябрь, 2015 No Comment

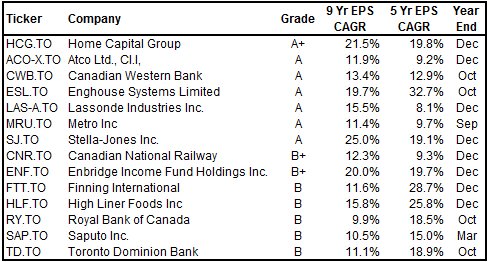

To find Canada’s best dividend stocks, we looked for companies that had a dividend yield greater than 2.5%, and a payout ratio amounting to 60% of earnings or less, to ensure those dividends are backed by capital. The five companies above also have a beta of less than 1.0 (indicating low volatility) and a five-year annualized dividend growth rate of 10% or more.

By offering regular cash payments, dividend stocks provide both income and (hopefully) capital gains, but they are rarely the best choice for swift gains. This makes them popular with retirees, who enjoy the steady cash flow, and with investors looking for stability when growth in the equity markets is uncertain. While dividend payouts come with no guarantees—many companies slashed dividends during the recession—the risk of seeing your dividends cut is lower for the companies on this list. It bears noting that our picks last year saw a robust 11% return.

Over the past few years, low interest rates and bond yields have made dividend stocks very popular with investors. And while Bank of Canada governor Mark Carney has hinted that rates will be rising, it’s likely to be a gradual increase. While no banks made the cut for 2012, last year’s top performer, Enbridge, is back on our list for the third year in a row. It may have the most modest dividend yield of this year’s five winners, but the company has consistently increased those payments, even during a recession. At the end of fiscal 2011, it crossed the billion- dollar profit line, reaching $1.11 billion in adjusted earnings.

Rogers Communications (owner of Canadian Business ) struggled in the first quarter of 2012 and continues to face stiff competition in the smartphone market, but offers the highest five-year dividend growth rate. Shaw, which offers the highest yield, is also feeling the industry’s competitive pressures, and recently reduced its 2012 cash flow guidance by $100 million. Spending on marketing and promotions was largely to blame.

Halifax-based Killam Properties, one of Canada’s largest residential landlords, completed $106.5 million in acquisitions last year and is on track to continues its strong growth. Meanwhile, Black Diamond Group, which builds and rents modular buildings, among other business activities, has seen a steady increase in its stock price since 2009 along with continuing to offer a healthy dividend.

___________________________