Best Dividend Paying Stocks

Post on: 16 Март, 2015 No Comment

Dividend stocks can be a great way to earn a consistent return on your investment, especially given the low interest rates many bonds are paying these days. In this article, I will be going over the best dividend-paying stocks which not only pay out great dividends, but also are strong companies which are likely to remain relevant over the next 10 years (or more).

Note that there are some fly-by-night dividend stocks which are not very stable; the stocks in this best dividend paying stocks list are large companies that have been stable and readily growing year after year despite their high dividend payouts.

Additionally, all 5 of the best dividend paying stocks in this list are in 5 different sectors. If you want to reduce the risk of your investment, you can split your investment amongst all of these companies. Note that I have no vested interest on stock in any of these companies, so these are unbiased opinions.

Best Dividend Paying Stock in Tech Intel Corporation (NASDAQ: INTC)

Intel (INTC) is a great tech company which specializes is computer chips. Not only do they pay out a great dividend, but they are also the primary maker of processors that power the Android phone smartphones.

Previously, the future of Intel was uncertain with the dominance of the iPhone and the launching of Apples own processor for its devices. However, these fears have been laid to rest as Intel makes the vast majority of Android-powered smartphones, and Android has recently become the #1 platform for smartphones in the USA, growing at a rapid rate. This is great news for Intels longevity and profitability.

Best Dividend Paying Stock in Healthcare Abbott Labs (NYSE:ABT)

I really think that this is a great stock and it definitely pays out high dividends (just under 1% each quarter at the time of this writing). The best thing about Abbott Labs is they are invested in technologies that are likely to grow over the next decade, regardless of recession.

In particular, Abbott Labs has a big holding in diabetes-related technology. Over the next 15 years, as the baby boomers started to reach 65+ years old, the number of people with diabetes in this country is going to skyrocket. While disastrous for our health care system, it will be great for Abbott stockholders.

The only downside to this stock is that health care regulations may regulate the profitability and growth of this company. If you invest heavily here, be sure to keep an eye on legislation that could affect its bottom line.

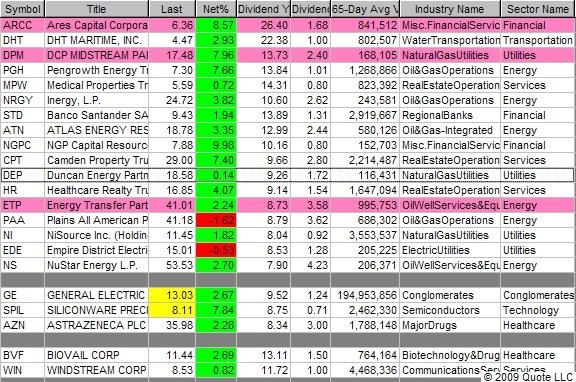

Best Dividend Paying Stock in Energy Exxon Mobil Corporation (NYSE:XOM)

Oil overall remains strong and is not likely to go out of style anytime soon as commodities always do well in an economic downturn and turmoil in the middle east may also drive prices of oil up.

With the advancement of renewable energy sources and finite nature of oil production, its hard to say whether or not this will be a viable long-term investment. However for now many investors are bullish on this company and this stock does pay out great dividends.

Best Dividend Paying Stocks in Business-to-Business Automatic Data Processing (NASDAQ: ADP)

ADP has been the object of many gurus affection simply given their fool-proof business model. This company is by far the largest payroll company in the United States, taking a very small fee out of the millions of paychecks they produce each week.

Given how the size of the company and how much of their system is automated as their name would suggest, it allows for high levels of profitability and extremely low prices, meaning that this company is only likely to grow in the future even in spite of high dividend payouts.

Best Dividend Paying Stocks in Consumer Products Clorox (NYSE:CLX)

Household products are not something we can live without, and Clorox has those in spades. While once known for their bleach, they now own quite a few major brands such as Glad (famous for bags), Brita (water filters and pitchers), and several other consumer good and food brands.

From July 2001 to July 2011, this stock moved from a

.5% dividend payout and being worth

35$ to paying out a .8% dividend and being worth as much as 70$. Any company which can pay out great dividends like this and still manage to double in value over the last 10 years is certainly a strong stock indeed.

Best Paying Dividend Stocks Conclusion

Always be sure to do your research and invest in dividend stocks wisely, as these tend to do best over the long haul. For this very reason, invest in multiple industries (to spread risk) and only invest in companies that you think will continue to grow and be viable over the next decade.