Best Coal Stocks 3 Picks to Show Coal is King Contrarian Profits

Post on: 15 Июль, 2015 No Comment

Best Coal Stocks: 3 More Picks That Show Coal is King

Best coal stocks continued…3 top picks that prove coal will still be king and power the future.

Last week, I got up on my soapbox and we examined the reality about the global energy usage of coal. In short, were going to be using coal for many decades to come.

It means that the greenwash American consumers and investors have been fed by big corporations is all a big lie. It also means that there are some forgotten and contrarian values hidden in a number of dirty coal companies. On Friday in Part 1. we talked about Peabody Energy Corporation (NYSE:BTU ) .

If you need more visual proof on why coal is going to be a good investment for decades to come, take a look at this chart of world power production by source.

World Net Electricity Generation by Fuel (trillion kilowatt-hours)

Today were digging into three more coal options for you. And Ive got another raft of stock charts.

But first, several readers asked what met coal was. Met coal is short for metallurgical coal. It describes coal that has a high content of carbon that produces higher outputs of heat when it is treated properly.

We use a lower and more readily abundant grade of thermal coal for energy while met coal, also known as coking coal, is primarily used for foundry applications and steel production.

Best Coal Stocks: Pick 1

Our first company is Natural Resource Partners L.P. (NYSE:NRP ). The stock fell off a cliff in January on news that it would cut its quarterly dividend from $.55 to $.35 per share. It crushed the effective yield from 11 to 9%.

We generally stay away from companies that slash dividends. However, in the case of a commodity producer, when prices go south cutting dividends becomes the only option. You can see from the relative strength and moving averages in the chart below that this stock is now oversold.

The stock has a current price to earnings (P/E) ratio of 9.1, and a forward P/E of 11. Thats dirt-cheap considering the S&P 500s P/E ratio is closer to 19.5.

And NRP isnt the only bargain bin coal stock out there.

Best Coal Stocks: Pick 2

Take a look at Alliance Resource Partners, L.P. (NASDAQ:ARLP ). The stock currently delivers a 5.9% dividend and has a P/E ratio of 11.1 and a forward ratio of 9.6. Its an outlier among the companies were talking about; its moved up strongly over the past quarter. Take a look.

This stock has been consolidating for most of 2013 and is close to retesting its all-time highs of around $84.50.

ARLP should be more interesting to investors who like the momentum style of trading. Like many of the stocks we pick in our Rogue Capitalists Trader service, these stocks are the performance engines that are moving fast.

Unlike a value trade that takes longer to set up and profit, momentum trading is a way to consistently keep your money moving at peak velocity.

Like all trading styles, it comes with its own risks. Now if youre looking for a coal stock that is a deep value contrarian play –and in the more speculative category – we might have just the pick for you.

Best Coal Stocks: Pick 3

Our next stock, Alpha Natural Resources, Inc. (NYSE:ANR ) is a victim of lack of diversification. Like its larger colleague Arch Coal, ANR is heavily dependent upon met coal to power its earnings. New competition and lack of cost cutting has cost Arch heavily, and has also hurt ANR.

However, we believe that Alpha is in a better position to return to profitability. Among the coal companies weve mentioned, ANR is the most aggressive and presents the most risk. However, it also has the potential for the greatest increase if met coal prices pick back up on improving economic activity.

You can see from the chart below that the stock has taken a beating. The stock has been cut in half since its 52-week high, and sits at a mere 10% of its 2011 highs. It currently has negative earnings and does not pay a dividend like our other selections.

While Im more inclined to buy the best and strongest stocks in a beaten down industry, I also know that rising tides float all boats. And ANR is one company you might consider adding to your speculative portfolio.

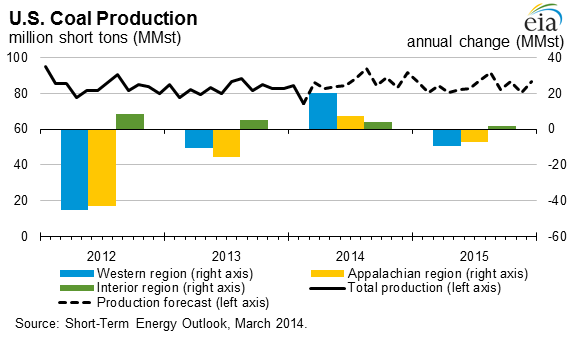

Its true that coal prices have pulled back lately.

Coal mining is an industry that is greatly dependent upon strong economic activity. The industrys profits are seriously reliant upon production levels related to supply and global demand. Too many competitors destroy margins.

Lower coal prices from excess production and a slowdown in economic activity has affected the entire group. Some have hedged their production sales prices, while others have let them float. These strategies have helped and hurt producers depending upon the deal price and the timing.

But even with all of this negative news clouding coal – pun not quite intended – the fact remains that China and India are still using more of it.

I also want to mention something else about this impending wave of new renewable and green production thats coming online.

Another dark industry secret is that we havent found an effective way to store large amounts power for later use. So when the sun goes down and the wind stops blowing, the only solution energy providers have is to turn on older plants.

Coal, natural gas and nuclear power can supply energy almost on demand depending upon consumer needs. They are still widely used in this country to back up even the renewable dependent markets. And thats not going to change.

The difference now is that these plants will be turned on only at peak capacity times when producers can now charge much more for the power they are supplying. For this reason, among others that weve mentioned in the past few articles, we think coal is a great contrarian value right now.

Its a perspective shared by my colleague over at Contrarian Advantage . Brett Owens. You might have remembered his opt-editorial here a few weeks ago in Three Top Cheap Commodities .

What do you think? Tell us about it. You can add your response to the conversation below. Please keep your comments respectful of others. Alternatively, you can contact our editorial team directly at editor@roguecapitalists.com. Please understand that our editors cannot give specific investment advice or commentary.