Best and Worst Bond ETFs Of 2014 ETF News And Commentary

Post on: 16 Март, 2015 No Comment

Zacks Equity Research — ZACKS — Mon Dec 29, 9:00AM CST

- Article Comments (0)

The U.S. stock markets delivered a somewhat muted performance this year (at least when compared to 2013) with the S&P returning about 12% YTD gains. The towering market of last year turned into a market that saw fears about a global slowdown and its effect on U.S. corporate earnings, plummeting oil prices, sluggish growth in Japan, concerns of a triple dip recession in Europe and the outbreak of the Ebola virus that forced many investors to look for safety and shun risky assets.

Needless to say, the above threats kept bond yields at the lower side throughout the year causing investors to hunt for income bets. While long-term bond ETFs were weak last year due to taper threats, short-term bond ETFs hit the brakes this year due to rising rate concerns (read: 3 Overlooked Bond ETFs Holding Up in The Market Slump ).

Despite the Fed’s repeated assertion of keeping the rates low for longer, the recent strength in economic data has led to concerns that the Fed could start raising rates after the first quarter of 2015 instead of the initial June or September 2015 timelines.

This in turn has lowered the appeal for short-term bond ETFs giving leeway for long-term bond ETFs to score higher in the face of dwindling global growth and an oil price rout. Flight from risk has caused the yield on the benchmark 10-year Treasury note to hover around 2%.

Amid such a situation, it would be interesting to note which ETFs were the leaders and laggards in the bond space during 2014:

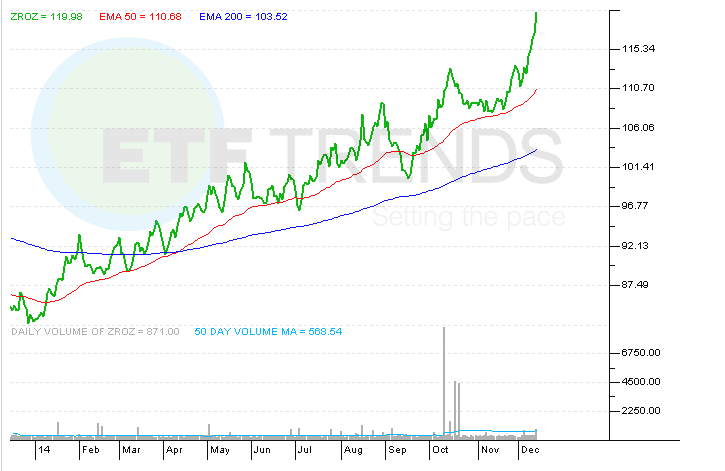

Two bond ETFs – PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF ( ZROZ ) and Vanguard Extended Duration Treasury ETF ( EDV ) – soared this year having returned more-or-less 45%. ZROZ tracks the BofA Merrill Lynch Long US Treasury Principal STRIPS index with effective maturity and effective duration of the fund being 28.99 years.

On the other hand, EDV follows the Barclays U.S. Treasury STRIPS 20–30 Year Equal Par Bond Index. The fund has average maturity of 25.3 years and average duration of 25.0 years. The next best performers in the space comes in the form of iShares 20+ Year Treasury Bond ETF ( TLT ) , SPDR Barclays Capital Long Term Treasury ETF (TLO ) and iPath US Treasury Long Bond Bull Exchange Traded Note ( DLBL ). These long-term bond ETFs have returned about 25% each this year.

SPDR Nuveen Barclays Build America Bond ETF (BABS ) – a long-term muni bond ETF too returned smartly (up 21.6%) in 2014. To beat the potential rise in U.S. inflation and rack up gains on the real return, long-term TIPS bond ETF 15+ Year U.S. TIPS Index Fund ( LTPZ ) was in demand in 2014 and has added about 19.3% (read: Real Return ETF Investing 101 ).

In short, the trend clearly indicates the inclination toward long-term bond ETFs. Beyond the border, PowerShares DB Italian Treasury Bond ETN (ITLY ) added about 19% this year thanks to the extremely easy monetary policy (read: Guide to European Bond ETF Investing ).

Thanks to the flattening of the yield curve, US Treasury Steepener ETN ( STPP ) turned out as an acute loser in this space. The product tracks the returns of a notional investment in a weighted long position in relation to 2-year Treasury futures contracts and a weighted short position in relation to 10-year Treasury futures contracts. Bullish stance on 2-year Treasury made the product a loser. The product was down 18%.

Apart from this, junk bond ETFs like Peritus High Yield ETF ( HYLD ) lost about 13% as returns were great in the safe government bonds space. Needless to say, short-term bond ETFs like S&P/Citi 1-3 Yr Intl Treasury Bond ETF (ISHG ) were defeated in the race. The fund is down 10% this year. The fate was similar for WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund ( AGND ) with a loss of about 8.5% (read: Short-Term Bond Yields Rising: Where to Go Now for Fixed Income ETFs? ).

Having presented the scorecard of the year, we would like to note that the trend will be quite similar in the year ahead. However, like 2014, TIPS ETFs should be out of the betting list courtesy of a tepid inflationary outlook across the globe (read: Bleak Global Inflation Backdrop: Sell TIPS ETFs? ).

Apart from the long-term government bonds, investors having a stomach for risk can also have a look at the long-term investment grade corporate bond ETFs to earn some regular income along with securing the portfolio. To do so, investors might tap Long-Term Corporate Bond Index Fund ( VCLT ) , SPDR Barclays Capital Long Term Corporate Bond ETF ( LWC ) and iShares 10+ Year Credit Bond ETF ( CLY ) .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report