Benefits of ETFs

Post on: 21 Апрель, 2015 No Comment

ETFs offer the same benefits as other pooled investments, but provide substantial flexibility as well as other advantages.

Cost-effective diversification

ETFs can be a very cost-effective way to build a portfolio or obtain targeted exposure to a specific sector. The cost of investing in ETFs is generally less than the cost of investing in most mutual funds. ETF management expense ratios (MERs) are typically well under 1%, compared to 1.5% to 3% for traditional mutual funds. Of course, ETF transactions will generate brokerage commissions, but the savings from lower fund costs can help offset these fees.

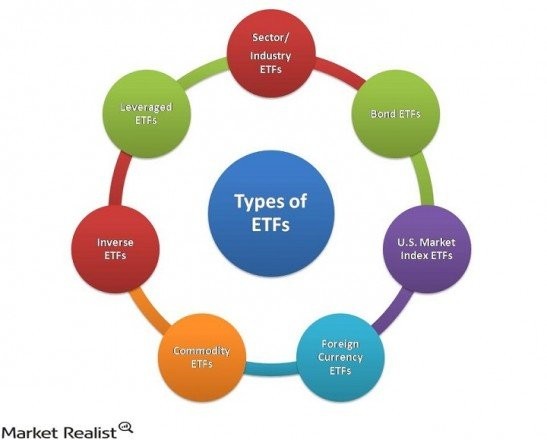

ETFs cover the US and Canadian investing scene from many angles, making them an extremely flexible investment tool. You can invest in ETFs by market capitalization, sector or asset class. There are international ETFs available too, which are hedged to Canadian dollars so you won’t need to worry about the impact of currency exchange-rate changes on your returns.

With this variety investors can make targeted investments easily and still attain a level of diversification that would be time-consuming and expensive to replicate by buying individual securities.

Trading convenience of stocks

Unlike mutual funds which are priced once at the end of each day, ETFs can be traded anytime during normal trading hours, using all transaction types associated with stocks. You can place market orders, limit orders, short sales and stop orders on ETFs. You can also buy ETFs on margin. Some ETFs have listed options, offering a wide variety of investing and hedging strategies.

You can buy and sell ETFs through your Disnat account, just as you would trade a stock. An example to highlight the versatility of ETFs versus mutual funds is that you can place a month-long stop-loss order for an ETF and rest assured that your position will be sold if your stop order is triggered.

Although ETFs trade like stocks, they are not shares of a company; they are units of a trust which holds a portfolio designed to closely track the performance of any one of an array of market indexes.

Transparency

When you invest in ETFs, you know exactly what you’re buying. Since most ETFs replicate underlying indexes, their components are disclosed every trading day. Traditional mutual funds, however, generally reveal their entire holdings quarterly. Only when you can actually see what’s in the fund portfolio can you evaluate how closely the fund manager is sticking to the objectives and the style of the fund.

Source: Barclays Global Investors Canada Limited. Used with permission. Adapted for use by Desjardins Online Brokerage.