Before You Build a Portfolio of Mutual Funds

Post on: 5 Июль, 2015 No Comment

Basic Tips For Planning Your Investment Objective and Strategy

You can opt-out at any time.

Before you learn how to build a portfolio of mutual funds. there are some steps to take that will help you know which investments to choose.

What is the purpose of your money? What do you want it to do? How much time do you have until you need this money? How much risk are you willing to take to achieve above-average returns? Do you want your money to grow or do you want to preserve it’s current value?

The answers to these questions will help you arrive at your investment time horizon and risk tolerance. which are the fundamental elements of determining your investment objective .

Whether you do it yourself or choose an expert for financial advice, you are choosing an advisor. Start the decision process of hiring an advisor by asking a few reflective questions: If a friend needed an advisor, would you recommend you. Do you really want to hire yourself as the advisor or do you need to hire someone else? What is the value of your time compared to the monetary cost of using an advisor? Do you enjoy the process of investment research and financial planning or do you dread doing it to the point of neglecting your finances?

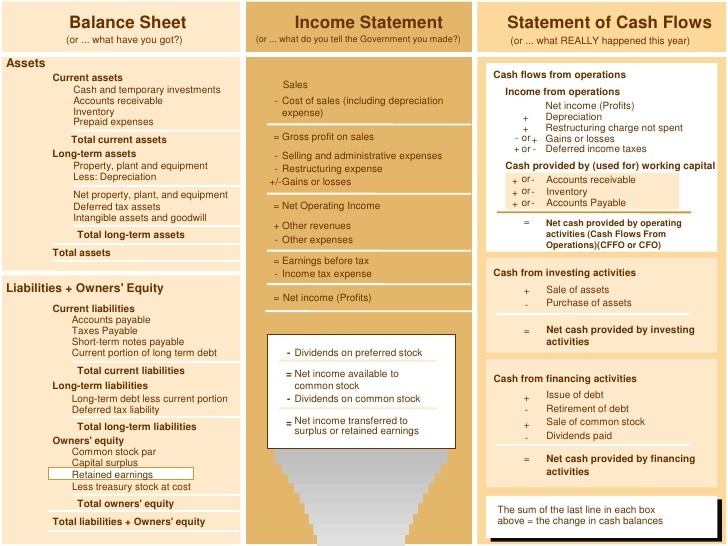

If you decide to be your own adviser and build your own portfolio of mutual funds. you may as well do it like the professional planners and follow the 6 steps of financial planning. Here are the steps and the basics of each:

- Establish the goal: If you are reading these tips carefully, you’ve already covered this step by forming your investment objective, which is essentially the reason and time frame you are investing, as well as the amount of risk you are willing to take.

There are many features, aspects and categories of mutual funds. However there are a few basic things to know, such as how to analyze mutual fund performance and things that can affect performance, such as the fund’s expense ratio .

Before beginning the real research and analysis, you will want to select your online tool for doing it! Also, researching and analyzing mutual funds is not just about the research and analysis: It can also help you to learn more about the types of funds available to you.

- Morningstar. They may be best known for their star rating system, which is on a scale of one to five stars, that helps investors choose mutual funds. Morningstar also offers tools, such as software for professionals, and research information available to all levels of mutual fund investors online. Morningstar also extends their information and commentary to Exchange Traded Funds (ETFs) and Hedge Funds. Morningstar has both free and premium services for investors.

- Lipper Leaders. A Thomson Reuters company, Lipper is a global leader in supplying mutual fund information. analytical tools, and commentary. This online fund research tool by Lipper is useful to both professional mutual fund advisors and individual investors. Lipper rates mutual funds compared to their peers and provides an instant measure against five metrics, called Leaders — total return. consistent return, preservation, expense, and tax efficiency.

- Kiplinger Mutual Fund Finder. With this search and comparison tool from long-trusted financial resource, Kiplinger, investors can research a specific fund, find funds that match a specific search criteria, compare multiple funds and download and save fund data for personal analysis.

There are many different types and categories of mutual funds but one fundamental choice is to decide if you want to use index funds. actively-managed funds or some combination. Essentially, index funds are passively managed, which means the funds are not designed to beat the market; they are designed to match market performance by holding the same securities found in a particular benchmark index. Actively-managed funds are managed to outperform the market.

If you take the do-it-yourself route, you will likely decide to invest in no-load funds because they do not have sales charges, called loads. The sales charge is intended to pay a commission-based broker or adviser for their advice. Essentially, if you are not receiving advice, you should not be paying a load. So when doing your research, you will look for no-load funds .

You’ve been told not to put all of your eggs in one basket. This is sound advice but there are exceptions to this rule with mutual funds. You may be a beginning investor without enough money to meet the minimum initial investment amount. which can be more than $2,000 per mutual fund, or you may have a 401(k) plan with poor investment choices. No matter what your reasoning, if you find that you can only start your portfolio with one mutual fund, consider a diversified choice, such as a balanced fund or a target-date fund that will have a diversified mix of stocks, bonds and cash. From this fund you can continue to build your portfolio.

Core and Satellite is a common and time-tested investment portfolio design that consists of a core, such as one of the best S&P 500 Index funds. which will represent the largest portion of the portfolio, and other types of funds —- satellite funds —- each consisting of smaller portions of the portfolio to create the whole. The primary objective of this portfolio design is to reduce risk through diversification (putting your eggs in different baskets) while obtaining returns sufficient to meet your investment objective.

The 5% rule is a simple way to remember not to allocate too much of your portfolio assets to one concentrated area of investing. For example, if you use the core and satellite portfolio structure, you may allocate a larger portion, such as 25% of the portfolio, to the core fund. But if you use sector funds in your portfolio, try to keep the allocation percentages to these funds near 5%.

Here is an example of a portfolio with three sector funds. using the 5% rule:

65% Stocks

25% S&P 500 Index Fund