Beat the Market with SmallCap Value Stocks

Post on: 16 Март, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

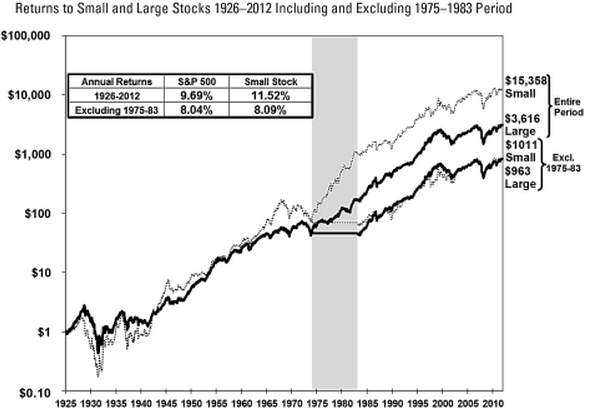

Small companies with value characteristics have outperformed the broad market averages over the decades. Historically, adding a small-cap value index fund to a diversified equity portfolio has lowered portfolio risk and increased returns.

A long list of successful value managers quickly come to mind: Benjamin Graham, Warren Buffett, John Neff, John Templton and Mario Gabelli to name a few. Their secret to success was value investing and particularly small-cap value when they were just starting out.

The academic research supporting small-cap value exposure is robust. Gene Fama and Ken French popularized this methodology for investors during the 1990s by introducing the Fama-French Three-Factor Model. Their elegant formula quantified portfolio returns as having three main risks and returns; market (beta), firm size (size), and book-to-market (BtM). Investors who choose to take extra risks in small-cap and value stocks should expect to earn higher returns.

With model in hand, the question becomes how much of a position should one take in a small-cap value index fund? To find that answer, I ran a few numbers and wrote a short report on the results. See Winning with Small Value Stocks on my research website for details and figures. The data suggests that about 33 percent in small-cap value has worked well in the past.

Winning with small value stocks isn’t a short-term market play – it’s a long-term investment philosophy. There were periods when the strategy didn’t produce higher returns or less risk.

If you’re prone to being impatient during times when small value is having a tough go, don’t invest in small value because you won’t succeed with the strategy.

On the other hand, if you’re a patent investor – one who understands and appreciates the long-term relationship between risk and return – having a position in a small-cap index fund has always worked in the long-term, both in the US and abroad.

No one can say for certain that there will be a portfolio benefit from small-cap value investing in the near future or even in the long-term. I believe the probability is high that there will be benefit, so I’m in for the long-term.

For more information on small-cap index fund investing, including a list of funds and ETFs that cover this style, read All About Index Funds and All About Asset Allocation .