Bearer bonds (Business) Definition Online Encyclopedia

Post on: 17 Апрель, 2015 No Comment

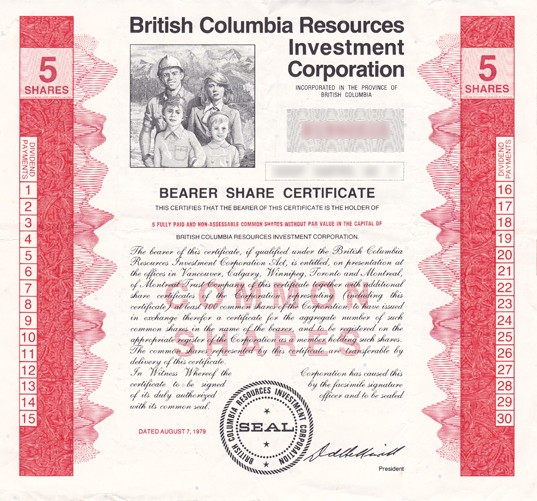

Bearer bonds are issued as an engraved certificate. The issuer maintains no records of who owns the bonds. Ownership is transferred by transferring the certificate. Whoever can produce the certificate is presumed to own the bond.

BEARER BONDS OR STOCKS — Securities owned by and payable to whomever holds the physical certificate. Se.

BEARER CHECK — a check payable to cash or to the bearer rather than to a specific party.

Bearer bonds are legal certificates that entitles the bondholder to receive coupon interest payments and the entire original principle upon maturity. However, they are different in the sense that no record of the original bondholder is kept.

Bearer bonds are bonds that are made payable to whoever holds them (called the bearer); these bonds are not registered.

Benchmarking.

In the case of Bearer Bonds the coupon is the warrant attached to the certificate, i.e. a physically detachable coupon, which you are required to present to a paying agent in order to receive the interest payment due. The coupon will state the amount of interest due at each payment date.

Bearer share s or bearer bonds are securities in which ownership is conferred merely by possession of the bond or share certificate as there is no central register of owners. Dividends or interest payments are claimed from a paying agent by presenting coupons clipped from the certificate.

Bearer bonds are unregistered and negotiable, and are payable via coupons to the person who has physical possession of the bond document. The owner’s name is not registered on the issuer’s books.

Usually outside the issuer’s home country as bearer bonds. Eurocurrency Bank deposits in a country other than the issuer of the currency. Eurodollar US dollar bank deposits outside the US. European embedded value A standardised calculation of embedded value and related numbers.

All bonds issued prior to June 1983 were bearer bonds ; since then, they have been issued in Registered Bond form. Before July 1983, municipal securities were issued for the most part in certificate form with coupons attached.

However, note that in the United States it has not been legal to issue bearer bonds in the municipal or corporate markets since 1982. As a result, bearer bonds available in the secondary market are long-dated maturities issued before this date and are becoming increasingly scarce.

An unregistered, negotiable, bearer bonds on which interest and principal are payable to the holder, regardless of whom it was originally issued to. The coupons are attached to the bond, and each coupon represents a single interest payment.

As such, bearer bonds pay interest and principal to whomever bears the bond itself, much in the way cash in your wallet is a bearer certificate. Bearer bonds are rarely issued any more by U.S.

In the past, bearer bonds came with detachable coupons that had to be presented to the issuer to receive the interest payments. That practice explains why a bonds interest rate is often referred to as its coupon rate.

One that is not registered is called a bearer bond ; one issued with detachable coupons for presentation to the issuer or a paying agent when interest or principal payments are due is termed a coupon bond. Bearer bonds are negotiable instrument s payable to the holder and therefore do not legally.

Coupon bonds are sometimes referred to as bearer bonds , since payment may be made to any bearer of the bond or coupon, rather than to a particular registered owner.

Coupon bonds

Coupon Bonds or bearer bonds are bonds with attached coupons that are detached and presented for interest payments on certain dates.

Getting To Know The Money Market

Bearer Bonds. From Popular To Prohibited

Should You Pay In Cash?

Money Market: Banker’s Acceptance.

Bonds with coupons are also known as bearer bonds because the bearer of the coupon is entitled to the interest.Although most new bonds are electronically registered rather than issued in certificate form, the term coupon has stuck as a synonym for interest in phrases like the coupon rate.

A bond issued with detachable coupons that must be presented to the paying agent or the issuer for interest payments. Coupon bonds are bearer bonds. so whoever presents the coupon is entitled to the payment.

Court Appointment.

loans from foreign countries, international FINANCIAL INSTITUTIONS, etc. and internal debt that includes market loans, TREASURY BILLS. special bearer BONDS and special loans and securities outstanding. A very large portion of the internal debt obligations is held by the Reserve Bank of India.

Bonds issued in any currency and are commonly listed in Luxembourg. They cannot be traded in the USA. Eurobonds are often Bearer Bonds .

Stripped Bond s: Bonds issued by investment bankers against coupons or the maturity portion of original bearer bonds. where the original bonds are held in trust by the investment banker. A stripped bond is essentially a zero coupon bond manufacture d by an investment banker.

Some municipal bonds are still sold in bearer form ; that is, possession of the bond itself constitutes proof of ownership. Historically in the United States, most public bonds (government, corporate, and municipal) were bearer bonds.

Also called a coupon bond, it is not registered in anyone’s name. Rather, whoever holds the bond (the bearer) is entitled to collect interest payments merely by cutting off and mailing in the attached coupons at the proper time. Bearer bonds are no longer being issued.

Bearish.

A stock or bond not registered in the name of an owner and that therefore belongs to whoever holds the bearer certificate. Dividends or interest payments are claimed using coupons attached to the certificate, which is transferable and negotiable without endorsement. Bearer bonds are also called.

A bond that is (1) underwritten by an international syndicate, (2) issued simultaneously to investors in a number of countries, and (3) issued outside the jurisdiction of any single country. Eurobonds are often bearer bonds.

It provides evidence of the debt, and the holder of the instrument acquires legal title to the goods or property regardless of whether the previous holder had a defect in his title. Negotiable instrument s include bank notes. bearer bonds. cheque s, certificates of deposit, etc.

The interest on a bearer bond is received by clipping one of the dated interest coupons which are attached to the bond and presenting it to a bank for collection. This is the reason a bearer bond is also referred to as a coupon bond. Today, bearer bonds are almost nonexistent.

Bonds may be secured or unsecured, which refers to whether or not the bondholder has a specific claim against the assets of the bond issuer. Bonds also vary in terms of principal and interest payments, and they may be registered or unregistered. Unregistered bonds are also known as bearer bonds.

BEARER BONDS See coupon bonds. BEIGE BOOK This report summarizes the information compiled by the Federal Reserve Bank regarding current economic conditions in its twelve districts through reports from bank and branch directors.

Eurobonds are often bearer bonds. EuroclearThe Euroclear group is the world’s largest settlement system for domestic and international securities transaction s, covering both bonds and equities for financial institutions located in over 80 countries.