BDC Market Update Q4 2014 Introduction

Post on: 11 Апрель, 2015 No Comment

Summary

- This is a new series of articles to update BDC investors with general industry trends.

- Over the last two months BDC investors have sold what I consider to be ‘lower quality’ BDCs.

- I believe this trend will continue through 2015.

BDCs fell an average of around 12% for six straight weeks but have rebounded an average of 4% last week.

Small Cap Stocks

As I have mentioned in previous articles, BDCs have fallen with in line with other smaller cap stocks. However BDCs have not rebounded as quickly as shown in the following chart.

I have consistently mentioned that investors should use general market volatility as an opportunity to buy ‘higher quality’ BDCs. As discussed in my BDC Risk Profile articles, some of the things that I look for in a higher quality BDC are:

- Adequate dividend coverage and less need to reach for yield

- Portfolio credit quality vs. portfolio growth

- NAV growth

The following table shows the stock performance for BDCs over the last two months along with the current price compared to recent lows.

TCP Capital (NASDAQ:TCPC ) is the only outlier as a higher quality BDC that slightly underperformed the average. This is most likely because the stock was trading much higher after the May 15 lows and was up 14% compared to the average BDC of around 7%. Many of the other higher quality BDCs such as Hercules Technology Growth Capital (NYSE:HTGC ), FS Investment Corp (NYSE:FSIC ), Golub Capital BDC (NASDAQ:GBDC ), PennantPark Floating Rate Capital (NASDAQ:PFLT ), Main Street Capital (NYSE:MAIN ) and New Mountain Finance (NYSE:NMFC ) have performed better than average over the last two months.

At this point I would urge investors to use caution when considering BDC investments. Most inexperienced investors use dividend yield and price-to-book multiples as key decision criteria for their investments. This has clearly been a mistake over the last two months and I believe will continue through 2015.

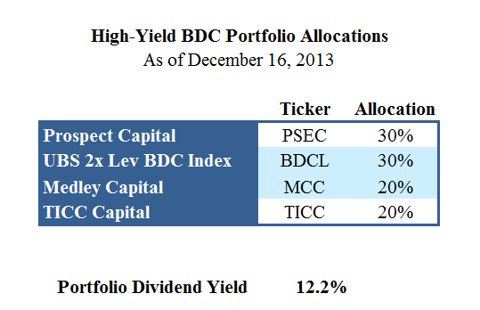

Many of the higher yield and/or lower priced BDCs such as Full Circle Capital (NASDAQ:FULL ), TICC Capital (NASDAQ:TICC ), Prospect Capital (NASDAQ:PSEC ), Fifth Street Finance (NASDAQ:FSC ), PennantPark Investment (NASDAQ:PNNT ), Medley Capital (NYSE:MCC ), Apollo Investment (NASDAQ:AINV ), BlackRock Kelso Capital (NASDAQ:BKCC ), KCAP Financial (NASDAQ:KCAP ) and THL Credit (NASDAQ:TCRD ) could potentially have some or all of the following issues:

- Inability to raise equity capital at a premium to NAV

- Reliance on fee income to cover dividends

- The need to reach for yield

It is important for investors to identify which BDCs are more at risk of having these issues that are directly tied to future dividend coverage and portfolio credit quality. Other BDCs, with lower or average yields, that could also have some of these issues in 2015 include Ares Capital (NASDAQ:ARCC ) and Fidus Investment (NASDAQ:FDUS ).

The rest of this series will cover general BDC market trends related to why I believe some companies have fallen more than others and continue to trade at lower multiples of net asset value (NAV) per share contributing to their higher yields and updating my BDC Research Page . For more information on specific BDCs please visit my Index to BDC Articles .

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Disclosure: The author is long HTGC, FSIC, PFLT, MAIN, NMFC, ARCC, TCPC. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.