Basics of Stock Option Valuation for the NonValuation Professional

Post on: 1 Июнь, 2015 No Comment

This article discusses the nature of stock options; examines the factors affecting their value; and explores the methods available for valuing these instruments, including options for stock that has no established market price (i.e. those for private, nonpublic companies). The discussion of the strengths and weaknesses of the various option-valuation models is in general terms, without reference to the intricate statistical formulas underlying each model. For purposes of this article, stock option and option will be used interchangeably.

Before discussing the accounting treatment and valuation of options, a few terms must be defined. First, an option gives the holder the right to purchase or sell a stated number of shares of stock at a fixed price within a predetermined period. The holder of the option, however, is not obligated to exercise the option. The fixed price at which the option is exercisable is called the exercise price. or sometimes the strike price .

There are two types of options: call options and put options. Call options provide the holder the right to buy a security. Put options. on the other hand, provide the holder the right to sell a security. For simplicity, this article will focus on call options, only using put options to present and highlight differences between the option rights.

The value of a stock option can be broken down into two components called intrinsic value and time value. Intrinsic value is the difference between the value of the stock and the exercise price, or price at which the stock can be purchased by the holder of the option. For example, if the share price is $95 and the exercise price of the option is $100, the intrinsic value is zero ($95 minus $100 produces a negative number). However, if the figures were reversed and the exercise price of the option was $95 and the share price was $100, the intrinsic value of the option would be $5 ($100 minus $95). The intrinsic value of a stock option may be either positive or zero, but it can never be negative, since the contract involves no liability on the part of the option holder; the option holder can walk away without exercising the option. In our first example, where the value of the stock was less than the option exercise price, the option is referred to as being out of the money. In our second example, where the value of the stock was greater than the option exercise price, the option is referred to as being in the money. Where the value of the stock is equal to the option exercise price, the option is referred to as being at the money .

Options are often used in lieu of cash compensation for start-up companies or to retain key executives and employees. Options can be granted to purchase stock of either a publicly traded or a privately held (nonpublic) company. In the former, the option may or may not have a public trading market; in the latter, neither the stock nor the options are publicly traded. As appraisers, we are often asked how a privately held, nonpublic company can issue options because the stock associated with the option does not have a current public market and, therefore, a published market price. Many privately held start-up companies issue options to their employees to compensate them for the current inability to pay a market wage, hoping this added incentive will reduce turnover of key employees and thereby spur growth and profitability. Executives of privately held companies may receive options as an added incentive for reaching certain financial objectives. Owners of privately held companies may also issue options to key employees as a way of broadening the business ownership. From a valuation standpoint, before we can determine a value for the option, we must first value the privately held company and determine its stock value. Once the value of the underlying stock has been determined, the appropriate option valuation models may be used.

ACCOUNTING TREATMENT OF STOCK OPTIONS PURSUANT TO ASC 718

Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718, Compensation Stock Compensation (ASC 718), establishes a method of accounting for stock-based compensation that is based on the fair value of stock options and similar instruments. When applying this general principle to stock compensation, equity instruments must be measured and recognized at their fair value, and the compensation cost is recognized over the vesting period of each option grant.

The objective of the measurement process in ASC 718 is to recognize in the financial statements the employee services received in exchange for equity instruments issued or liabilities incurred and the related cost to the entity as those services are consumed. This Topic uses the terms compensation and payment in their broadest senses to refer to the consideration paid for employee services (please refer to ASC 718-10-10-1). The fair value of a stock option granted by an entity shall be estimated in accordance with ASC 718 by an option-pricing model that takes into consideration, as of the grant date, the following factors:

- Exercise price of the option

- Expected life or term of the option, taking into account both the contractual term of the option and the effects of employees expected exercise and post-vesting employment termination behavior

- Current price of the underlying stock

- Expected volatility of the underlying stock

- Expected dividends on the stock

- The risk-free interest rate for the expected term of the option

ASC 718 suggests use of a closed-form model/Black-Scholes or a lattice model/binomial, which may include Monte Carlo simulation (discussed later in this article) for valuation of options relating to employee share-based compensation. An entity should change the valuation technique it uses to estimate fair value if it concludes that a different technique is likely to result in a better estimate of fair value. A change in either the valuation technique or the method of determining appropriate assumptions used in a valuation technique is a change in accounting estimate for purposes of applying APB Opinion No. 20, Accounting Changes. and should be applied prospectively to new awards.

OPTION VALUATION VARIABLES

The valuation of an option encompasses many variables. Following is a discussion of some of the key option-valuation model inputs and how they impact the valuation process for both put and call options. All of the exhibits that follow are based on our previous example of an option with a $100 exercise price, an initial risk-free interest rate of 5%, one month until expiration, and volatility of 22%. By using the Black-Scholes method of valuing options, we ran varying scenarios that are summarized in the following graphics.

Stock Price

In general, as the value of the underlying stock increases, the value of the call option also increases. Referring to the blue solid line in Figure 1 below, if the exercise price is $100 and the underlying stock price is $95 and all other variables remain constant, the option will have a greater value than if the underlying stock price was less than $95.

Figure 1. General Relationship Between Price of the Stock and Value of the Option

Exercise Price

Figure 4. Relationship of Option Value to Time to Expiration

Potential Dilution from Exercise of Options

The more options that are outstanding in relation to the existing number of shares of underlying stock outstanding, the greater the common stock dilution if all the options are exercised. Potential dilution has a negative impact on the value of an option.

COMMONLY USED OPTION-VALUATION MODELS

Now that some of the key variables to the various option-valuation models have been defined and discussed, the remainder of this article addresses the most commonly used valuation methods and their unique strengths and weaknesses.

Black-Scholes Model

The Black-Scholes model is probably the most widely used and best-known theoretical option-valuation model. A theoretical model is a forward-looking model that attempts to determine what the option should sell for in the market given the option terms and the underlying stocks salient points. This option pricing model is a partial differential equation that computes an option price based on the difference between the adjusted stock price and the adjusted present value exercise price. Adjustments in stock price and exercise price are based on a lognormal distribution relationship between the change in option price relative to the change in stock price. The relationship is called the hedge ratio, which is used to compute the number of options necessary to equate the return on a portfolio for risk-free securities to the return of a portfolio of options and stocks.

The Black-Scholes model is appropriate for options with expiration dates that are relatively short term in nature, largely due the underlying assumptions of the model. However, it is important to note that the Black-Scholes model is often inappropriately used to value options that have a fairly long time until expiration. It is important to be aware of the underlying assumptions of the Black-Scholes model to avoid misapplication. The assumptions are as follows:

- The short-term interest rate is known and is constant through time.

- The stock price follows a random walk in continuous time with a rate of variance in proportion to the square of the stock price.

- The distribution of possible stock prices at the end of any finite interval is lognormal.

- The variance of the rate of return on the stock is constant.

- The stock pays no dividends and makes no other distributions.

- The option can be exercised only at maturity.

- No commissions or other transaction costs are incurred in buying or selling the stock or the option.

- It is possible to borrow any fraction of the price of a security, or to buy or hold a security, at the short-term interest rate.

- A seller who does not own a security (a short seller) will simply accept the price of the security from the buyer and agree to settle with the buyer on some future date by paying him or her an amount equal to the price of the security on that date. While this short sale is outstanding, the short seller will have the use of, or interest on, the proceeds of the sale.

- The tax rate, if any, is identical for all transactions and all market participants.

It may be difficult to apply the Black-Scholes model on a 10-year option, for example, since it may be improbable that the short-term interest rate will remain constant for a 10-year period. In addition, the assumption that the option can be exercised only at maturity may not hold true, especially for a long-term option on a highly volatile stock. For example, the stock price may exceed the exercise price in Year 5, and the holder may exercise his or her right to purchase stock. However, the price of the option developed under the Black-Scholes model assumes the option will not be exercised until expiration, which would be a full 10 years rather than five years. Given the above assumptions, the Black-Scholes model must be very carefully applied on a situation-by-situation basis.

Lattice Model

A more integrated and complex model used to value options is called the lattice model. This model is a theoretical model like the Black-Scholes model; however, it uses either a binomial or a trinomial distribution process to derive value by separating the total maturity period of the option into discrete periods. When progressing from one time period, or node, to another, the underlying common stock price is assumed to have an equal probability of increasing and/or decreasing by upward and downward price movements. Visually, a binomial lattice model would appear as follows:

As each node of the binomial lattice represents the value of the option, the model considers the probabilities of various triggering events and early exercise and incorporates the value of the option if such an event occurs. If none of the triggering events occurs, the value of the option at each node will be calculated as the expected value of the two successive nodes using the discount factor.

The lattice model is a more flexible valuation technique that can account for early exercise behavior and various market and performance conditions.

Monte Carlo Simulation

Monte Carlo simulation methods are often used to value complex derivative instruments including stock options by simulating various path-dependent conditions. This approach simulates share price movements using assumptions of lognormally distributed prices, averages the payoff values over the range of resultant outcomes, and then discounts the expected payoff at the risk-free rate to get an estimate of the value of the option.

The advantage of Monte Carlo simulation is that it can be used when the payoff depends on the path followed by the underlying common stock value as well as when it depends only on the final value of common stock. Payoffs can occur at several times during the life of the derivative rather than all at the end.

CONCLUSION

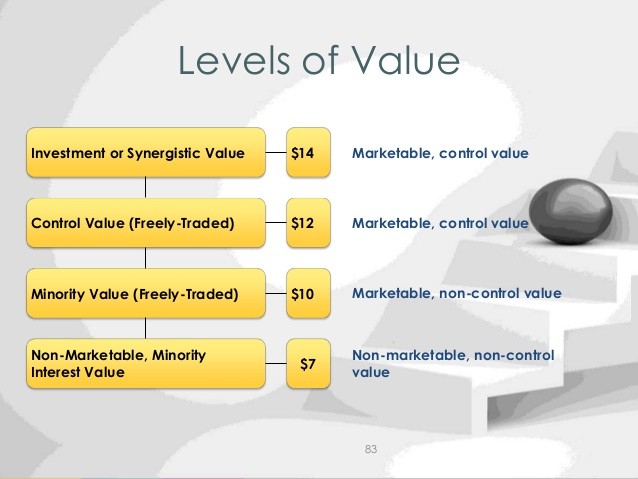

Valuations are needed for stock options issued by both public and nonpublic companies. As the preceding indicates, the issuance and valuation of stock options is very complex. Option values can fluctuate depending upon the volatility of the underlying stock and the level of interest rates, among other factors. In addition, the type of valuation model utilized will depend upon the complexity of the underlying option and the level of model flexibility required. An added level of valuation is required when the option is issued by a nonpublic company, as the value of the underlying stock must first be determined before the option can be valued (especially for Section 409A compliance purposes).

Significant thought and input from legal, tax and qualified independent valuation advisors is required as to establishment of a stock option plan, the tax ramifications of the option to the individual and to the company and selection of the appropriate option-valuation model.

REFERENCES AND SUGGESTED READINGS

Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718, Compensation Stock Compensation

Pratt, Shannon P. with Alina V. Niculita, Introduction to Valuing Stock Options. in Valuing a Business. 5th ed. ch. 25 (The McGraw Hill Companies, Inc. 2008)

American Institute of Certified Public Accountants Audit and Accounting Practice Aid, Valuation of Privately-Held-Company Equity Securities Issued as Compensation

Internal Revenue Code Sections 83, 409A, 421, and 422

Beaton, Neil J. BVRs Practice Guide to Valuations for IRC 409A Compliance (Business Valuation Resources, 2009)