BARL Stocks and Oil Contango Problems Together In A Single Leveraged Product

Post on: 23 Май, 2015 No Comment

June 30, 2011 by Ron Rowland

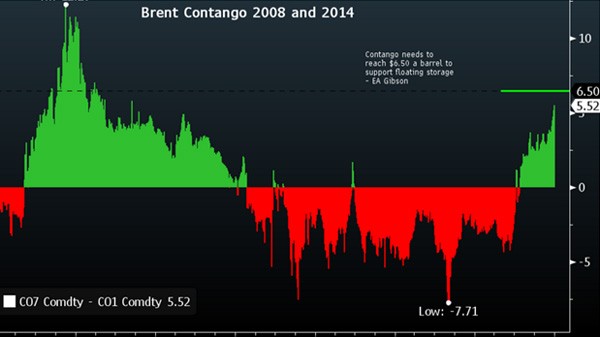

If you want 100% exposure to crude oil contracts and their associated contango problems, plus you want to leverage up for another 100% exposure to large cap US stocks, then Morgan Stanley has just the product for you.

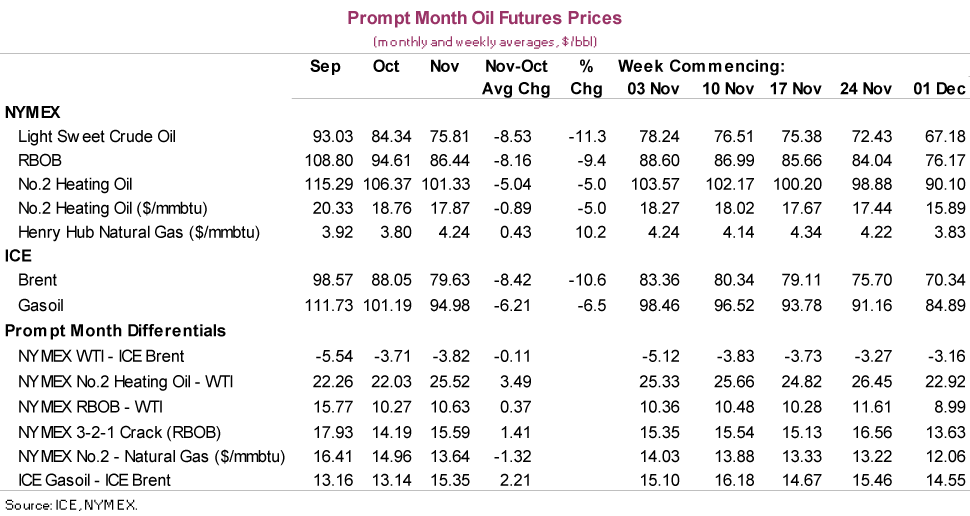

It was just a few months ago (3/17/11) that Morgan Stanley became an ETN issuer with the launch of the Morgan Stanley Cushing MLP High Income ETN (MLPY). Yesterday (6/29/11), the company added to its product list with the introduction of the Morgan Stanley S&P 500 Crude Oil ETN (BARL). It will track the performance of the S&P 500 Oil Hedged Index, which provides 100% exposure to the S&P 500 Total Return Index, 50% to near-term NYMEX West Texas Intermediate (WTI) Light Sweet Crude futures contracts, and 50% to ICE Brent (Brent) Crude Oil futures contracts (200% exposure in all). The index is rebalanced monthly.

I’m not sure to whom Morgan Stanley is marketing this, or who might even be interested. BARL’s overview page is located in the “institutional” area of the firm’s website. However, I believe that any institutional investor that wanted to pursue a strategy along these lines would want to control the individual components themselves. As for retail investors, the only benefits I see are the monthly rebalancing and achieving leverage for a relatively low fee. The downsides of eating the monthly contango in two crude oil contracts, the fixed exposure to stocks and oil, and the ETN structure seem to overwhelm any perceived benefits.

It appears the underlying index was invented in March of this year. However, Morgan Stanley was kind enough to include the hypothetical performance of the index as part of the prospectus (pdf), and the graph is reprinted below.

Eyeballing the chart, it appears the index peaked at about 21,000 in mid-2008 and hit a low of around 3,000 in early 2009. That constitutes more than an 85% drop, which of course does not include fees.

The fact sheet (pdf) provides a 10-year performance of 98% for the index. I guess no one told the Morgan Stanley marketing department that the SEC frowns on using cumulative performance figures for periods greater than a year. This equates to 7.07% per year. However, the tracking fee is expressed as an annualized number of 0.79%. Over those same ten years, that would have clipped the 98% cumulative return down to about 84%.

I’ll try to conclude on a positive note. Morgan Stanley does provide one of the most straightforward and clearest risk disclosures I have seen:

“Because each dollar invested in the ETNs results in one dollar of notional exposure to the S&P 500 Total Return Index and one dollar of notional exposure to the crude oil futures contracts, the ETNs provide leveraged exposure and you should be aware that any percentage declines in the S&P 500 Total Return Index and crude oil futures prices are additive, such that, for example, a 40% decline in the S&P 500 Total Return Index and a 60% decline in the crude oil futures prices would result in a total loss of your investment in the ETNs. Depending on the index closing level on the applicable valuation date, you could lose a substantial portion or even all of your investment.”

Disclosure covering writer, editor, and publisher: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.