Bank of England on Housing s Impact on Consumer Spending

Post on: 27 Апрель, 2015 No Comment

(August 24, 2006)

Dear Subscribers and Readers,

I imagine that most of our subscribers must be getting tired of the talk about the “housing bubble” already, especially since this author himself had been discussing this on and off for the past couple of years. But in light of the most recent “recession talk” that has sprung up over the last few days (including recessionary forecasts both from Merrill Lynch and Charles Schwab – with one of the major reasons being the slowing housing market), this author would like to put in his two cents as well. Comments are definitely welcome. In fact, I would love nothing more than to get some feedback from our subscribers, as we are all in a continual learning process here!

I would first like to bring up the following chart courtesy of a poster on our discussion forum. dknoester. The following chart actually came from Merrill Lynch’s North American Chief Economist, David Rosenberg (Birinyi Associates did the research), and shows the NAHB Housing Index (left axis) vs. the S&P 500 with a lag of 12 months (right axis):

According to the National Association of Home Builders (NAHB), the NAHB Housing is “a weighted average of separate diffusion indices, calculated for three key single family series in the survey: Present Sales of New Homes, Sale of New Homes Expected in the Next 6 Months and Traffic of Prospective Buyers in New Homes ,” and is designed as a monthly survey in order to “take the pulse” of the housing industry, especially the industry for single-family homes. Readers who wish to learn more can go to the following NAHB webpage .

In the above chart, Birinyi Associates claims that the movement in the NAHB Index has a 79% correlation to the movement in the S&P 500 12 months into the future. In other words – over the last ten years or so – Birinyi Associates claims that the NAHB Index had been a very good leading indicator of the stock market, and given the above, there is now a good chance that the stock market will suffer a significant correction over the next six to 12 months.

However, this author believes that the above “analysis” and conclusions are questionable, given the following:

1) As I have mentioned many times before, the stock market is the ultimate leading indicator. To suggest that one can rely on an indicator to lead the stock market – especially an indicator that does not consist of individual stocks (such as the RTH or the SOX) is not only dangerous, but also ludicrous. In fact, if takes a look at the history of the NAHB Index going back until 1985, then one can clearly see that the NAHB Index has not always been a leading indicator of the stock market. Following is a monthly chart showing the NAHB Housing Market Index vs. the annual rate of change in the Dow Industrials:

As can be seen on the above chart, the NAHB Housing Market Index has generally not acted as a leading indicator of the stock market. Sure, there has been a lot of correlation over the years, and sometimes, the stock market has actually led the NAHB HMI (e.g. 1990 when the stock market bottomed two months before the NAHB HMI bottomed). During the last economic slowdown in 1994 to 1995, the stock market and the NAHB HMI actually bottomed out at the same time.

2) To suggest that the topping out of the NAHB HMI in early 1999 foretold the end of the technology and telecom bubble a year later is nave – as the latter was mostly driven by easy credit, unprecedented optimism and greed, and a mass bullish psychology that have never been seen since the late 1920s. The bubble ended once it exhausted itself. The fact that the NAHB HMI topped out a year early was accidental – and it should not be given more weight than say, the NYSE A/D line which actually topped out in April 1998 (the latter of which is infinitely more useful as a leading indicator of the stock market).

3) Go back to the first chart created by Birinyi Associates, and one can see that there was a significant divergence between the NAHB HMI and the S&P 500 12-month future performance during 1996 and the early parts of 1997. Both the NAHB and consumer spending was weak in 1996 (retail stocks such as WMT and HD remained stagnant in 1996), but that did not prevent the stock market from rising during both 1996 and 1997. In fact, the 21-month period from January 1996 to September 1997 represented one of the best performances in stock market history.

In summary, this author would not put too much weight on the above “analysis” by either Birinyi Associates or Merrill Lynch. To this author, there seems to be no good explanation for a direct correlation between the NAHB HMI and the subsequent 12-month performance of the S&P 500. In fact, I would go as far to say that whatever factor that had a positive influence on the NAHB HMI (such as rising real income and lower interest rates) most probably had a positive influence on the stock market at the same time as well. Hence, the supposed direct correlation or relationship.

This is also the view taken up by the Bank of England in their latest Summer 2006 Quarterly Bulletin – part of which discusses the “relationship” between house prices and consumer spending. I will now quote from the Bank of England:

In a famous experiment, Pavlov showed how a past association between two events could be mistaken for a causal link between the two. In his experiment, a bell was rung as his dogs were provided with food. Over time, the dogs learned to associate the two, believing that the ringing of a bell would be accompanied by the arrival of food. Of course, that was not necessarily the case. It is an example of the fact that correlation is not causation.

A similar point applies to the interpretation of correlations among many macroeconomic time series. The link between consumer spending and house prices is a good example. The two series have tended to move together in the past. In part, that is because house price movements can cause changes in spending. But the correlation also reflects the influence of common factors, like expectations of future income, that affect both house prices and consumption.

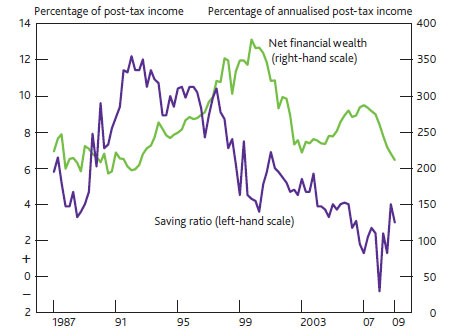

In other words, the common factors that caused a rise in housing prices may have simultaneously caused the increase in consumer spending (or a rise in the stock market), rather than the rise in housing prices being the primary driver behind the increase in consumer spending. More importantly, however, the Bank of England also stated that the housing price/consumer spending relationship has broken down over the last few years – suggesting that 1) The general rise in UK housing prices did not cause a significant increase in consumer spending, 2) The recent “popping” of the UK housing bubble has not diminished UK consumer spending, and nor the UK economy. Following is the chart courtesy of the Bank of England showing the annual change in real housing prices vs. the annual change in consumer spending over the last 35 years. Notice that the spike in housing prices (blue line) from 2002 onwards did not cause a dramatic increase in consumer spending (red line):

Similar to the experience in the US, many UK homeowners also took the opportunity of lower interest rates to increase their mortgage equity withdrawals (MEWs). Surprisingly (for the bears), UK homeowners did not use this “excess money” to go on a spending binge. On the contrary, the evidence suggests that the bulk of the mortgage equity withdrawal either was directed to paying down debt or to savings accounts or for other investment purposes. Following is a chart courtesy of the Bank of England showing the relationship between MEW and consumer spending over the last 35 years:

Again, readers please notice that despite a spike in MEW since 2000, consumer spending has stayed relatively flat (at approximately 94% to 96% of after-tax income) over the last ten years. Both logic and evidence suggests that the American experience is very similar – as I have already discussed in the past. This is also evident in the U.S. consumer credit growth numbers, as consumer credit growth has been lower than the nominal GDP growth since late 2002 – suggesting that U.S. homeowners have been using MEW as a mean to paying off some of their higher-carry debt.

But Henry, what about the ARM resets that so many folks have discussed over the last few months?

Yes, I realize that. According to many reliable sources, approximately $500 billion in mortgages are due to be reset by the end of this year, with $1.5 trillion more by the end of 2007. However, aside from the following white paper. this author really has not seen any comprehensive study done discussing the breakdown of that $500 billion in mortgages, such as the amount of equity those folks hold in their houses and the “before and after” interest rates that those mortgages will be subjected to. However, assuming a 400 basis point jump in carrying cost (similar to the cumulative amount of the Fed rate hikes from June 2004 to the present), this would “only” mean an additional annual carrying cost of $20 billion (4% x $500 billion), or approximately 0.25% of total consumer spending in any given year (equivalent to approximately a $2.50 rise in crude oil prices). Suddenly, $500 billion does not seem so big anymore. And by the time year-end 2007 comes around, there is a good chance that the Fed will have already lowered short-tem rates sufficiently to ease the pain of the $1.5 trillion adjustable-rate mortgage reset.

Conclusion. Readers are encouraged to read the Summer 2006 quarterly bulletin on housing prices vs. consumer spending in order to make up their own minds. Hopefully, this author has successfully cleared up some superficial “gloom and doom” arguments which many bearish commentators have been regurgitating over the last couple of months. While the popping of the housing bubble may ultimately have some severe repercussions for both the U.S. and global economy, it is important to know that there are many holes” in the bear’s argument. For now, I urge our readers to think independently and study this situation for yourselves. Again, plant your feet firmly on the ground. Keep a close eye on valuations and current sentiment. Both Merrill Lynch and Charles Schwab are now stating publicly we will have a recession outright (where is Henry Blodget when you need him?). Can these firms both be right? Where were they in the days before the 2001 recession? Did they successfully predict the end of the technology and telecom bubble? How good are their track records? Answer: Their track records are not very good.