Balancing Risk and Reward Asset Allocation SprinkleBit Blog

Post on: 3 Апрель, 2015 No Comment

Home Guest Blog Balancing Risk and Reward: Asset Allocation

The Importance of Asset Allocation

Many portfolio managers believe that asset allocation is one of the most important decisions that investors make:

- From a portfolio design standpoint, portfolio theory asserts that in any given period, some investment styles will be outperformers and some will be underperformers, and market goes through cycles. The addition of investment styles that have a low correlation to the rest of the assets in the portfolio can reduce overall volatility, both on the upside and downside, thus producing a more efficient and stable return pattern.

- More often than not, investors believe that some way exists to predict which asset class will come in first place, and some investment managers indicate that they in fact can make such market-timing predictions accurately. With an appropriate asset allocation guideline in place, investors can keep a long-term perspective, as trying to time the market can have perverse consequence.

Asset allocation aims to balance risk and reward. The process determines which mix of asset classes to hold in the investor’s portfolio. The asset allocation that works best for the investor at any given point will depend largely on the investor’s financial situation, risk tolerance, and investment horizon.

A number of studies, including Brinson, Hood, and Beebower (1986), Ibbotson and Kaplan (2000), and Brinson, Singer, and Beebower (1991), showed that the strategic asset allocation of pension plans accounted for 91.5% 93.6% of the variance in fund returns. The remaining portion of the variance in fund returns, i.e. 6.4% to 8.5%, can be explained by security selection and market timing:

Performance attribution = Asset allocation effect + Security selection effect + Market timing/tactical allocation effect

Asset Allocation vs. Diversification

Although there are similar benefits, asset allocation and diversification are different so they should be addressed concurrently but thought of separately. Asset allocation in its most basic form is the decision of how to weigh stocks, bonds, and cash in a portfolio in a way that provides the potential for the best investment return given the amount of risk the investor is willing to take. In portfolio construction, expected return and acceptable risk must be viewed simultaneously, as an investor must feel comfortable with the downside risk associated with the higher upside potential.

Average 12-Month Return (%) Upside and Downside

Diversification, on the other hand, is to make sure that the portfolio has exposure to many different asset classes or investment styles. Similar to the benefits from asset allocation, a properly diversified portfolio can also achieve a higher expected return and a lower overall volatility. All other things being equal, the more dissimilarity there is among the patterns of returns of the asset classes within a portfolio, the stronger the diversification effect is in the long run. The beauty of diversification lies in the fact that its benefits are not dependent on the exercise of superior skill; rather, they arise from the policy decision to follow a multiple-asset-class investment approach.

Strategic Asset Allocation vs. Tactical Asset Allocation

- Strategic asset allocation is a buy-and-hold strategy. The allocation process establishes a target or policy mix based on the expected risk/return profile of each asset class, e.g. a 50% equity/20% fixed income/30% alternative investments portfolio. Strategic asset allocation requires periodically rebalancing the portfolio back to these targets as investment returns skew the original allocation percentages. The foundation of strategic asset allocation lies in the Modern Portfolio Theory (MPT).

- Tactical asset allocation is a moderately active portfolio management strategy that is utilized sometimes when investors find it necessary to occasionally engage in the short-term and tactical deviations from the mix to capitalize on exceptional investment opportunities, which adds a market-timing component to the portfolio. This asset allocation strategy allows a range of percentages in each asset class, and the goal is to improve the risk-adjusted returns. In addition, tactical asset allocation also provides a hedge against risk in a volatile market. When desired short-term profits are realized, the strategic mix shall be returned. Some investment managers use the term dynamic asset allocation interchangeably.

Other Asset Allocation Strategies

- Insured asset allocation is another active portfolio management strategy. Under this approach, typically, the asset class that experienced the largest relative decline would be underweighted. As a first step, the investor establishes a base portfolio value, e.g. 80% of total invested capital, and the total portfolio value is not allowed to drop below this base value. When the total portfolio value is above the base value, the investor would exercise active strategies, such as investing in high-risk instruments to maximize the portfolio value; when the total value approaches or drops below the base, the investor would move to a passive mode by investing in low-risk instruments and selling off risky assets. Portfolio insurance is a well-known application of this strategy.

- Integrated asset allocation is also an active portfolio management strategy. It is concerned with the optimization of an investor’s net worth, thus it deals with the expected net worth and the standard deviation of the future net worth, given the investor’s willingness to take on risk. Unlike other asset allocation strategies, integrated asset allocation gives nearly equal importance to future returns and risk tolerance. The process often starts just like strategic or tactical/dynamic asset allocation, and then the investing preferences will be changed to get desired short-term or long-term perspective.

- Core-satellite asset allocation belongs to the broad category of tactical asset allocation. It incorporates a “core” portfolio, which is comprised the bulk of the investor’s holdings, or the strategic segment, and a “satellite” portfolio, which gives the investor the opportunity to make short-term investment decisions driven by fundamental, technical, and other quantitative economic indicators. Therefore, under core-satellite asset allocation strategy, investors will have the flexibility to move in and out of investments based on what is happening today without sacrificing their basic investment strategy.

Conditions of a Good Asset Allocation Framework:

There are two basic conditions for an asset allocation strategy to work in the long term. First, economically, the asset allocation strategy should make good investment sense, which means, given the investor’s financial resources and reasonable capital market assumptions, the framework should enable the investor to realize his investment objectives. The second condition is related to investor behavior. The investor should feel comfortable following the strategy and not be tempted to change it, particularly during market extremes. To be specific, for a good asset allocation framework to be successful in practices:

- Be conceptually sound

- Be comprehensible to investors without requiring a huge amount of time commitment on their part

- Facilitate the development of appropriate individually tailored, all-weather strategies based on the investor’s unique needs and circumstances

- Be standardized with respect to the steps to be followed

- Continue to be relevant and effective in the future, throughout changing market environments

Rebalancing Your Portfolio

Different asset classes move in cycles over time, over the course of the period, the market value of each asset within the portfolio earns a different return, resulting in the percentage of the allocation change. This change may increase or decrease overall risk, so it is necessary to buy and sell portions of the portfolio in order to set the weight of each asset back to its original state. Portfolio rebalancing is the primary tool for preventing the market from commandeering investors’ asset allocation strategy and thereby undermining their investment objectives.

The inherent tradeoff of rebalancing is potentially earning lower returns in the short run compared with the unbalanced portfolio, however, if unadjusted, the portfolio will become too risky. Rebalancing is especially useful when one asset class is likely to dominate the portfolio with high performance relative to the rest of the portfolio. Below is an illustration showing the performance of two portfolios during the period 1987 to 2012. Each portfolio started out with a 60% stocks/40% bonds mix. One was rebalanced annually, and the other left un-rebalanced.

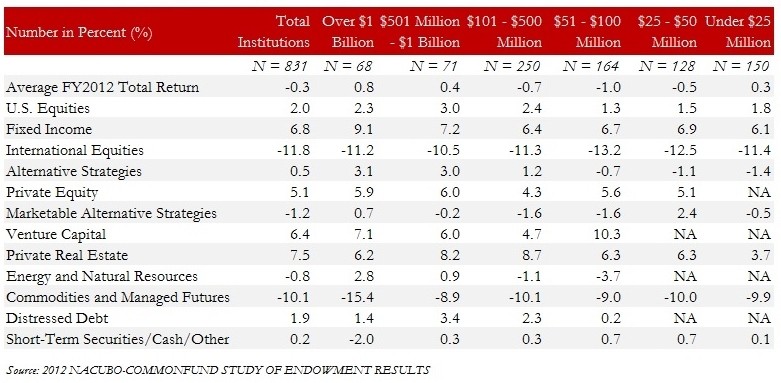

The rebalanced portfolio experienced lower volatility and higher risk-adjusted returns. For endowment portfolios, it is particularly important to tailor a rebalancing strategy to match their preferred level of risk tolerance, return expectations, investment horizon, and other objectives and constraints.

References :

- Ibbotson, Roger G. and Paul D. Kaplan. 2000. “Does Asset Allocation Policy Explain 40, 90, or 100 Percent of Performance?”

- Integrated Asset Allocation by William F. Sharpe, 1987

- Brinson, Gary P. L. Randolph Hood, and Gilbert L. Beebower. 1986. “Determinants of Portfolio Performance.” Financial Analysts Journal, vol. 42, no. 4 (July/August): 39–44