BALANCE AND DIVERSIFICATION ARE KEY TO INVESTING

Post on: 2 Май, 2015 No Comment

Balance and Diversification Key to Investing - By Megan Martin, Freelance February 10, 2011

Asset mix can be seen as the financial equivalent of a well-balanced meal

Emile Petroro, senior investment adviser at Dundee Securities, believes in diversification of investments.

Delving into the world of investing can be an intimidating prospect. But there are things investors can do to arm themselves in a climate of uncertainty. Analyzing needs and objectives and determining one’s tolerance to risk are the first things people should assess before investing.

That’s the starting point for any investor, said Emile Petroro, director, Private Client Group, Dundee Securities Corporation, Dundee Wealth Management. People should consider their income and growth needs, investment time horizon and how comfortable they are with risk.

Splitting your assets between stocks and bonds — among other investments -can help protect your portfolio in years when stocks lose ground. In fact, having a well-diversified portfolio is imperative to investing wisely; it can be thought of as the financial equivalent of a well-balanced meal.

Proper portfolio construction and good diversification are essential to reducing risk and better protecting portfolios from disastrous events and permanent loss, Petroro said. Many investors have become more conservative since the financial crisis and have turned to lower-risk investments.

Risk for most well diversified portfolios is measured more in terms of volatility than in terms of permanent loss of capital. The decision faced by many investors is whether to accept lower returns and, in turn, a lower standard of living or to target higher returns with more volatility.

It’s a trade-off, Petroro said. It’s never all or none, and risk tolerance is built into a portfolio in order to accommodate people’s individual needs as well as their emotions.

Many believe that accepting the risk of stocks rewards investors in the long term with higher returns. However, along with the potential for higher returns comes risk and volatility.

Between 1935 and Dec. 31, 2009, the average return from Canadian stocks, as measured by the TSX Total Return, was 9.9 per cent compared with 6.5 per cent for Canadian Bonds, 4.8 per cent for cash and 3.8 per cent for inflation.

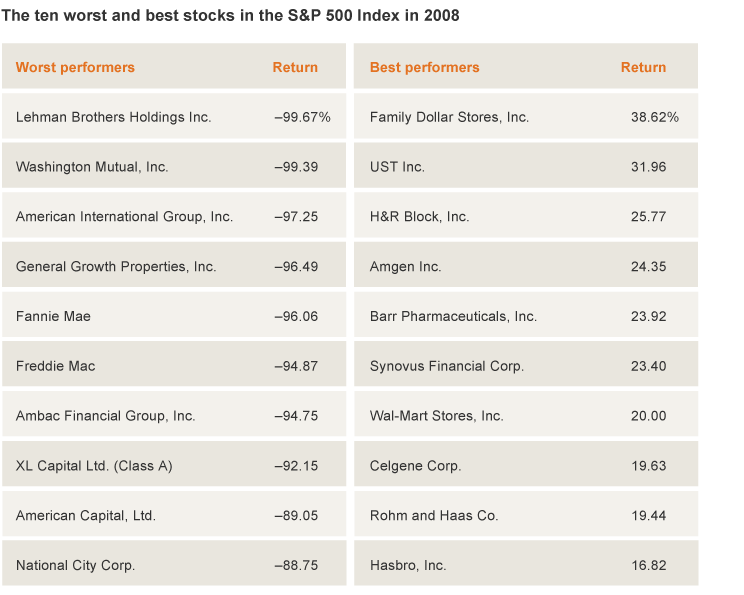

Despite this performance by stocks, their returns have also been more volatile with declines in excess of 12 per cent in four of the past 20 years: 1990, 2001, 2002 and 2008. The most severe drop came in 2008 with a decline of 33 per cent.

In those same four years where stocks lost ground, bonds partially offset the losses with gains in the mid to high single digits, Petroro said. It’s an example of how diversification can serve to counterbalance losses during times of market volatility.

Bonds are generally less volatile investments than stocks. As a bondholder, you’re lending your money to a government or corporation for a certain period of time and, in return, receive predetermined interest payments and a promise to repay your capital at maturity.

But it’s important to note that the interest payments, along with the capital repayments, are dependent on the issuer’s ability to pay, Petroro said. So it’s not impossible to lose money when investing in bonds.

The flood of money chasing secure investments in the past few years, coupled with Central Banks lowering interest rates, have driven government bond yields to all-time lows.

Defensive strategies and avoiding major disasters are the keys to investment success, Petroro said.

The asset mix is the primary decision in any investment portfolio and must be tailored to individual needs and adjusted periodically.

Doing proper research in selecting money managers specialized in the different asset types adds another layer of protection.