Avoid Premature Exercise On Employee Stock Options_1

Post on: 15 Апрель, 2015 No Comment

The first rule of managing your employee stock options is to avoid premature exercises. Why? Because it forfeits the remaining time premium back to your employer and incurs an early compensation income tax to you, the employee.

When employee stock options are granted, the entire value consists of time premium because there generally is no intrinsic value at the grant date since the exercise price is generally the market price on the day of the grant.

What Is Time Premium?

This time premium is a real value and not an illusion. The time premium is what the Financial Accounting Standards Board (FASB) and the Securities and Exchange Commission (SEC) require all the companies to value at the grant date and expense against their earnings over the option’s vesting period. The maximum contractual time to expiration is 10 years but evaluators use what is called the expected time to expiration as an input assumption into theoretical pricing models such as the Black Scholes model.

When a grantee receives an employee stock options grant, he receives a value and the employer takes on a contractual liability to perform in respect of the grantee’s contract. The value of the company’s liability should be equal to the value of the benefit to the employee. Some pundits speculate that the cost to the employer is greater than the real and perceived benefit to the employee/grantee. This may be the case when options are misunderstood by the employee/grantee. But in most cases, the values that companies expense are actually understated, with the value to informed grantees being greater than the assumed liability costs to the company. (For more insight, read our Employee Stock Option Tutorial .)

If the stock moves up and is in-the-money. then there is now an intrinsic value. But, there is also still a time premium; it doesn’t just disappear. Often the time premium is greater than the intrinsic value, especially with highly volatile stocks, even if there is substantial intrinsic value.

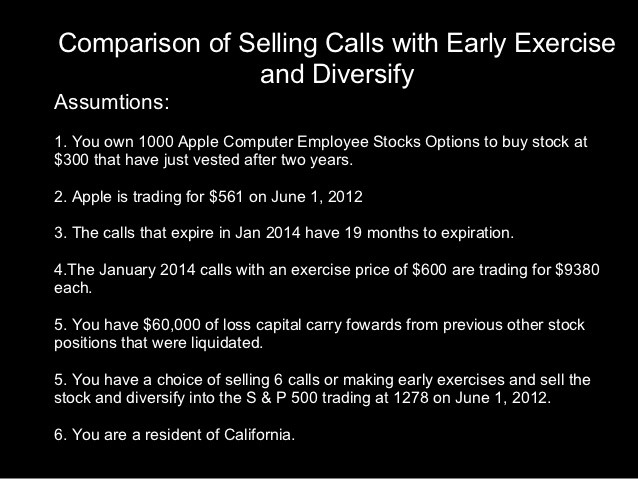

When a grantee exercises ESOs prior to expiration day. he gets penalized in two ways. First, he forfeits all of the remaining time premium, which essentially goes to the company. He then receives only the intrinsic value minus a compensation, tax which includes state and federal tax and Social Security charges. This total tax may be more than 50% in places like California, where many of the options grants take place. (These plans can be lucrative for employees — if they know how to avoid unnecessary taxes. Check out Get The Most Out Of Employee Stock Options .)