Atlas Capital Advisors Concentrated Equity Risk

Post on: 3 Май, 2015 No Comment

Concentrated Equity Risk

More than a few motivational speakers and self-help authors have expounded on the maxim that “success breeds success.” Many of their successful pupils could also add that “success breeds concentrated equity positions.” All too often, financial advisors and accountants find highly successful, established clients with massive stakes in single stocks. This is the natural result of closely-held businesses going public, corporate executives receiving stock-based compensation, family fortunes being handed down to heirs, and good old-fashioned “buy and hold” investment strategies.

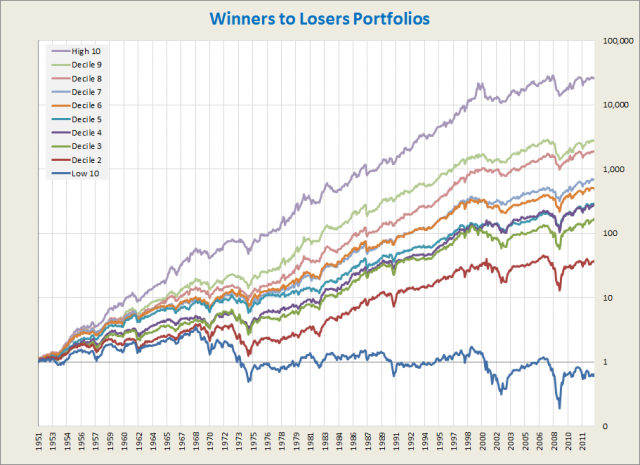

It is somewhat ironic that the strategy used to create this wealth, namely equity concentration, must be turned on its head in order to maintain the wealth. Maintenance of wealth, as most financial advisors would agree, is accomplished through diversifying portfolio holdings.

Nevertheless, that’s sometimes easier said than done. Investors may hold onto risky, concentrated equity positions out of emotional attachment. Also, the outright sale and reinvestment of stock holdings may not be the optimal tax strategy. Regardless of an investor’s decision to hold a concentrated position or to liquidate, an array of risk management strategies can be employed to protect the investor’s wealth.

Letting Go of a Winner

A host of psychological attachments often prevent investors from taking the necessary actions to diversify their portfolios. Loyalty to the company can often trump financial sensibilities. Take, for example, a retiree who built his company from the ground up and managed it until its IPO. The retiree may have no intention of liquidating his holdings, but instead may plan to hand down the stock to his children and grandchildren as a legacy. His descendants may then feel compelled to hold the stock because it’s so closely tied with the family’s identity.

Then, there’s the fear of missing out on future stock appreciation. Often, the fear of losing out on future gains trumps the wisdom of taking defensive measures through diversification. After all, why shouldn’t a historically successful stock continue to grow for years to come? Unfortunately, there are enough cases of prominent companies losing significant stock value to answer this question. For example, while Apple thrived during the recent Great Recession, General Electric did not fare so well:

Further, individuals who have been involved with a company for many years may have developed a comfort zone with the operations of the business and its industry. An investor may feel her deep expertise in her company is sufficient to predict future earnings and stock values. However, the larger economic picture is not so predictable, especially in our global economic environment.

Tax Considerations of Concentrated Positions

The most direct way to diversify a concentrated stock position is to simply sell the stock on the open market and reinvest proceeds into a variety of stocks and other asset classes. Most concentrated equity positions are held with a low cost basis and such sales trigger capital gains. In 2010, investors can still take advantage of the low, 15% capital gains tax rate enacted under President George W. Bush in 2003. If President Barack Obama chooses not to extend the Bush tax cuts, this low rate will expire at the end of 2010. Capital gains tax rates will return to the pre-2003 level of 20% starting January 1, 2011. Thus, an investor incurring a $20 million capital gain would have a $3,000,000 tax bill in 2010, but pay $4,000,000 for the same transaction in 2011.

Fortunately for investors, the tax code allows capital gains to be offset by capital losses. Thus, any capital loss carried over from prior years can become very important to reducing the tax bill in a year where large capital gains are realized. Periodically, investors may even choose to proactively create capital losses to offset large capital gains.

This strategy, known as “tax loss harvesting,” identifies stocks currently trading below cost basis that also are unlikely to recover in the near future. Atlas Capital Advisors can help investors identify equities that are good candidates for tax loss harvesting, and cull the losses on a regular or as-needed basis to offset capital gains. As an alternative to selling a large block of appreciated stock in a given year, the investor may follow a staged-selling strategy to spread the tax bill over several years. It simply involves selling smaller blocks of stock over a number of years. Of course, the investor takes the risk of increases in capital gains rates or future market price falls by employing this strategy. But this technique protects the investor from the potential price-depressing effect of selling large blocks of stock. For some corporate insiders, staged selling may be the only viable strategy due to restrictions imposed by the SEC. The SEC sets predetermined blocks of time when corporate insiders can sell company stock.

As an alternative to selling concentrated equity positions, some investors find it more beneficial to gift the shares to charitable organizations or family members. When making a donation of appreciated stock to a qualified organization, the investor receives a deduction equal to the fair market value of the stock at the time of the donation, subject to certain income and deduction limitations. Gifts of appreciated stock to individuals of up to $13,000 per year ($26,000 for married filers) can also be made without incurring a gift tax.

More sophisticated strategies, such as utilizing charitable remainder trusts, can also be set up with the help of a tax specialist.

Hedging Strategies

Investors reluctant to diversify a concentrated equity position, for emotional or tax-based reasons, can use multiple hedging strategies to reduce the overall risk of the concentrated position. Most of these strategies can be efficiently implemented. However, the implicit assumption is that the shares in question are held “free and clear” by the individual and could be sold at anytime. Some corporate executives may own stock but are contractually unable to liquidate their positions (corporate governance restrictions, restricted stock, etc.) and thus limited in their hedging tactics.

Traditional Put Option Hedge

The most straightforward way to manage the risk of appreciated stock is to purchase put options. Buying put options grants the investor the right to sell the stock at a predetermined price, also known as the strike price. Thus, if the market value of the stock falls below the strike price of the option, the investor can still sell the stock at the higher strike price. The investor is limiting their downside while still being exposed to potential market price appreciation. The costs of this strategy are the premiums each investor must pay for the put options.

Correlation Option Hedge

An alternative to buying put options on the concentrated position is buying puts on a highly correlated investment. This technique is known as a proxy hedge or a correlation option hedge due to the similarity of the underlying secondary investment. The strategy is most useful for those executives that are contractually unable to sell their concentrated holdings. For example, an executive of Exxon Mobil could purchase puts on Chevron, which should move up or down in close correlation with the executive’s holdings.

Correlation Hedge

A tangential strategy to the correlation option hedge is the outright shorting of the similar company’s underlying stock. If the correlation remains constant, the net result is that the risk exposure has been eliminated. However, the investor will also lose any upside in their concentrated holding because of the offsetting loss in their short position.

Collar Hedge

Rather than spending money to hedge a concentrated position, an investor can also create an “equity collar” around the share price of the concentrated stock. In this case, the investor simultaneously purchases a put option while selling a call option, the premium earned from the call helps offset or cover the cost of the put (depending on the strike prices of both options). This technique is referred to as a “collar” because it creates a price floor and a price ceiling for the stock. The strategy is most effective in periods of low volatility in which the underlying stock trades within a particular price band.

Some investors may even be able to take out a loan against the stock since its value has been protected by the “collar.” While structured at a no out-of-pocket cost, the investor must agree to forgo some of the stock’s potential upside to offset the cost of the put option. And, if the range between the price floor and ceiling is not wide enough, the stock can be considered a constructive sale for tax purposes.

Establishing an equity collar can also create an opportunity for the investor to initiate a prepaid forward contract. This type of agreement provides immediate proceeds to the investor for a sale that will be fulfilled at some point in the future. The sales proceeds are discounted for a variety of variables including an imputed finance charge. The tax implications of this technique are complex and should be analyzed by a competent tax professional.

Covered Call Hedge

A different approach to managing the risk of the concentrated position is simply to sell call options on the underlying stock. Such a strategy is known as a “covered call”. The strategy doesn’t protect against a falling stock price but it does generate incremental income from the concentrated holding. Premiums earned can be invested elsewhere to diversify holdings. Of course if the stock price is above the strike price at option expiration, the underlying stock will be “called away”, or effectively sold at the strike price.

LP Exchange Fund

Finally, some investors may find it beneficial to participate in an exchange fund, in which the investor contributes shares to a limited partnership along with other investors holding appreciated stocks. In return, he receives partial ownership in the limited partnership, which now holds a portfolio of stocks contributed by different individuals. The clear benefit is diversification of risk. The downsides are the relatively high fees charged for the limited partnership, the illiquidity of the partnership interests, and exposures to stocks the investor may not desire.

Protecting the Wealth Created

Investors who find themselves with substantial positions in single stocks should first be congratulated on their successes. These situations often result from exceptional business and investment savvy. However, holding vast sums in a single stock is indeed a high-risk situation. When an investor is ready to move from a wealth creation to a wealth preservation strategy for a fortune being held, Atlas Capital Advisors LLC can help design and implement the ideal path to a well-diversified, risk-managed portfolio.