Asset Location where investments are placed can reduce taxes Granite Hill Capital Management

Post on: 1 Июль, 2015 No Comment

Friday, January 31st, 2014 at 3:48 pm

2C440 /%

Asset Location: Tax-Smart Portfolio Decisions

It is often said that the three most important factors in a home’s price are: location, location, location. With your investment accounts, asset location can play a somewhat similar role. Arranging your investments among your accounts may boost long-term, after-tax performance, with estimates of improved performance ranging from 0.2% to 0.5% annually 1. That’s $2,000 to $5,000 per year for every $1,000,000 invested and a nice enhancement when interest rates are low and expected stock returns appear depressed.

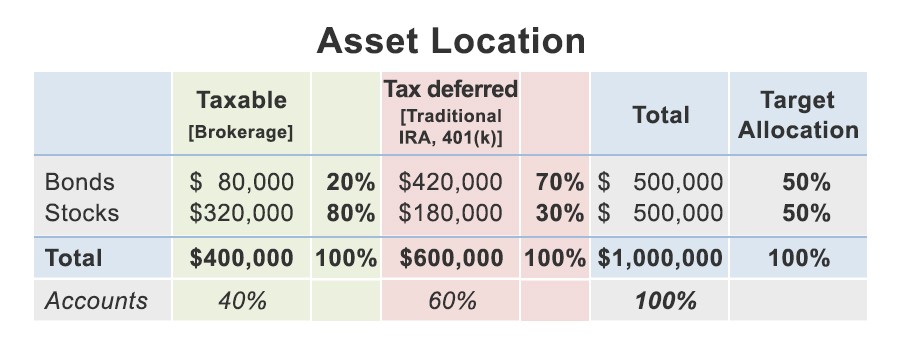

Asset Location vs. Asset Allocation . Asset location is separate and distinct from asset allocation. Asset allocation divides your money among different groups of investments while recognizing their risks and “expected” future returns in your portfolio. For example, a top-level asset target allocation might be 50% stocks and 50% bonds. This is highlighted in yellow below for a hypothetical $1 million portfolio.

2C300 /%

Asset location is deciding where to place, or “locate,” your money among your taxable (e.g. brokerage) and tax-sheltered (e.g. 401(k), 403(b), IRA) accounts. Instead of retaining the basic “50/50” allocation for each account, you could strategically split the location of your investments to enhance long-term, after-tax performance.

Taking the above example, the investments could be located differently for each account. As highlighted in green below, the taxable account is 80% stocks and 20% bonds, while the tax-deferred accounts are 30% stocks and 70% bonds. Overall, the 50/50 stock/bond allocation remains the same. This example assumes your taxable account comprises 40% of your investments, your tax-sheltered accounts comprise 60%, and you do not have tax-exempt Roth IRAs or Roth 401(k)s.

What to Put Where . The general intuition is to place tax-inefficient investments in tax-deferred accounts and tax-efficient investments in taxable accounts.

Tax-inefficient investments include actively managed funds generating short-term capital gains, Real Estate Investment Trusts (REITS), and high yield bonds, because they produce short-term capital gains or income taxed at your marginal income tax rate. Depending on your income, that tax bite can be big—up to 39.6% for those at the top income bracket. These investments are best held in your tax-deferred accounts.

In contrast, tax-efficient investments—tax-managed funds, stocks held for the long-term, and most exchange traded funds (ETFs)—generate “qualified” stock dividends taxed at 15% (20% for the top income tax bracket) and distribute minimal, if any, short-term or long-term capital gains. Only the sale of the investments triggers long-term capital gains. Such funds are best held in your taxable account for the long term.

With long-term stock returns expected to be higher than bonds, it might seem best to allow stocks to compound in a tax-deferred account. However, upon withdrawal, those long-term gains are taxed at ordinary income tax rates instead the 15% long-term capital gain rate (20% for the highest tax bracket and 0% for those in the bottom brackets). Passing them on to your beneficiaries or charity through a step up in basis may eliminate capital gain taxes altogether.

Broad View of Various Investments’ Tax Efficiency .

2C660 /%

Practical Implementation . Holding some tax-efficient investments in your tax-deferred accounts makes sense even if you have enough taxable account space to house all your tax-efficient investments. Leaving some in your 401(k)/IRA allows tax-free “rebalancing .” Over time, market fluctuations cause your investments to drift from their target allocation (50/50 in the above example). Getting back on target requires selling (buying) the overweight (underweight) asset. This may trigger capital gain taxes on appreciated stocks in a taxable account, a scenario which can be avoided when the transactions take place in a tax-deferred account.

Implementation Challenges . Locating your investments for tax efficiency is complicated.

First. arriving at—and maintaining—the best formula for you and your unique circumstances involves many moving parts, as indicated above.

Second. it’s not just about tax-sheltering your assets; it’s about doing so within the larger context of how and when you need those assets available for achieving your personal goals.

Finally. it requires that you look at your total portfolio and not compartmentalize accounts. A stock-heavy taxable account will be more volatile than the bond-heavy tax-deferred account. The disparity in account performance can be alarming if you are not prepared.

Never Heard of Asset Location? Asset location is a rare topic for the popular financial press. Why? In part, because a large swath of the financial industry ignores the need. Moreover, it is not sound-bite material. By granting attention to asset location you’ll find:

- Missing Pieces. Over time, you may have accumulated multiple accounts and financial service providers. Organizing them into a cohesive whole requires a solid framework.

- Missing Expertise. Even if you have a handle on your varied accounts and holdings, asset location does not lend itself to a turnkey formula. Complex tradeoffs and assumptions need to be examined.

- Missing Oversight. As your own goals, investment performance, and tax laws evolve, your portfolio requires ongoing coordination to retain the desired tax efficiencies.

While most investors may not be aware when they are missing out on effective asset location, the money they may unnecessarily lose to taxes is very real. As a tax-conscious advisor, Granite Hill Capital is well positioned to incorporate asset location in our client’s overall investment and financial planning. Can we answer additional questions? We’ll be happy to help!

[1] Gobind Daryanani, and Chris Cordaro, “Asset Location:A Generic Framework for Maximizing After-Tax Wealth,” Journal of Financial Planning. January 2005; and Morningstar Tries to Quantify The Value of Financial Planning ,” November 12, 2012.

Links to third-party websites are provided as a convenience and do not imply an affiliation, endorsement, approval, verification or monitoring by Granite Hill Capital Management, LLC of any information contained therein. The terms, conditions and privacy policy of linked third-party sites may differ from those of this website.