Asset Location What is Asset Location

Post on: 1 Июль, 2015 No Comment

Minimize Taxes & Maximize Returns

Don’t put your savings in the wrong account types. Getty Images

You’ve heard of asset allocation but what about asset location. The placement, in terms of which account, taxable or tax-advantaged, is an important investing decision that has significant impact on an investor’s taxes and thus the net return after taxes.

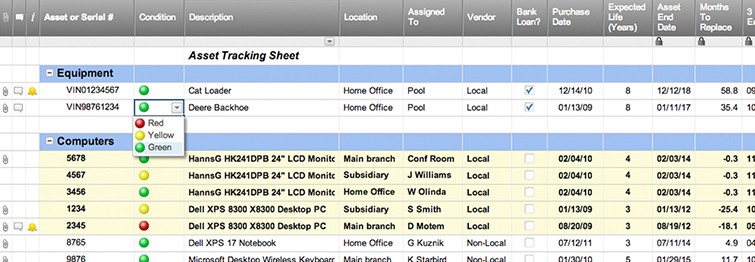

Many investors have two basic types of investment accounts: 1) A regular brokerage account that can either be individual or joint and 2) A tax-deferred account, such as an IRA or 401(k). Many of these same investors have never given any thought as to what investment types are best to place in these accounts.

Remember that investments held in a brokerage account are taxed on capital gains and on interest income (dividends). For example, if you sell a mutual fund at a price (NAV ) higher than the price you purchased it, you will have a capital gain for which you will owe a tax. Also, any interest income (dividends) earned on investments in a brokerage account is taxed as ordinary income, just as if are when receiving pay from an employer.

Taxation is significantly different in tax-deferred accounts than in brokerage accounts. Selling mutual funds in a tax-deferred account, such as an IRA or 401(k), will not generate capital gains taxes. In fact, selling funds generates no taxes at all (although other mutual fund fees may apply). Also income from dividends is not taxed in IRAs or 401(k)s until withdrawn at a later time, such as retirement.

Hopefully your investor and tax accounting minds have merged to make a logical connection: Funds that generate little to no taxes should be held in brokerage accounts and mutual funds that may generate taxes should be held in tax-deferred accounts. For example, in a brokerage account, you might consider using tax efficient funds, such as municipal bond funds or funds that generate little or no dividend income, such as certain Exchange Traded Funds (ETF). Index funds or growth stock funds.

Also remember that mutual funds state their objectives in a prospectus or you can find it by using Morningstar or directly from the particular fund company website. If the fund objective is Income or Value the holdings of the mutual fund are usually stocks that generate income (dividends) and you’ll have a tax bill if the fund is held in your brokerage account. Conversely, a growth mutual fund will typically hold stocks with growth objectives, which means that the companies use their profits to reinvest in the company rather than paying dividends to investors.

By now you should be thinking along the lines of keeping more of your hard earned savings and mutual fund earnings by keeping taxes low. To keep taxes low on mutual funds, be smart about asset location—the place (account type) where you hold your mutual funds can make a big difference in taxes, which happens to be one of the biggest drags on performance for investors.

Once again, keep funds that produce income (most bond funds, most stock funds with income objective) in a tax-deferred account, such as IRAs and 401(k)s. Keep tax-efficient funds (see tax-cost ratio ) in a taxable account, such as individual and joint brokerage accounts. Also, watch out for capital gains in brokerage accounts. If you anticipate trading often (buying, selling, exchanging several times per year) try to do this more in your IRA or 401(k) where there are no capital gains taxes generated.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.