Asset diversification isn t a free lunch anymore as high fees eat into profits

Post on: 2 Май, 2015 No Comment

Promotions

Just as in the taverns where free lunches began, investors hoping to get something for nothing by diversifying are drinking much of the profits up in the form of fees paid out to managers.

Or more properly, losing most of the free on rounds investors buy for the house.

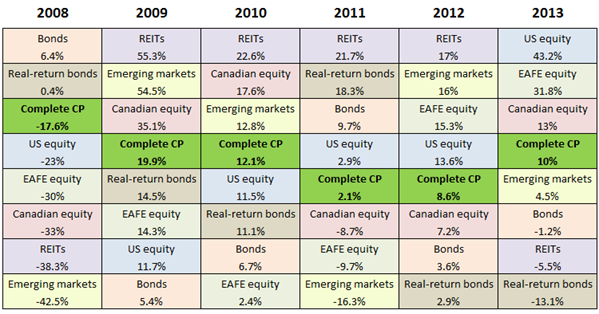

Since Nobel Prize winner Harry Markowitz first coined the phrase in 1952, diversification, with its ability to enhance portfolio returns while suppressing volatility, has been acknowledged as the only free lunch in investing. Though the benefits of diversification in theory are not in question, the actual gain depends on how much an investor pays to access a given asset class.

When it comes to paying for active management, even large institutions often give up half or more, William Jennings and Brian Payne, of the US Air Force Academy, say in a new study.

The fees on diversifying asset classes are astonishingly high relative to their diversification benefit, Jennings and Payne write. Diversification is often spoken of as the only free lunch in investing, yet we show that it is not free and is properly considered only in light of its costs. More exotic asset classes typically come with higher investment management fees, which offset their diversification benefits.

The study looks at the alpha, or outperformance, generated by the various asset classes into which investors can diversify and then compares that to the fees charged by actively managed products or managers in those asset classes.

To make these calculations the study uses data from a JP Morgan long-term capital markets return study as well as fees reported by institutions.

The institutions covered have more than US$2 trillion under management and are divided into three buckets: small endowments, with an average of US$100 million and achieving average fees for their class; state pension plans with US$11 billion, also getting 50th percentile fees for their group; and high-quality foundations with US$2 billion which negotiate advantageous fees in the 90th percentile.

Larger or cannier funds might do better; individuals will almost certainly do worse.

Of the 45 asset classes covered in the JP Morgan study, the authors found nine charged more in fees than they generated in asset-class-specific alpha.

Part of the underpinning of the study is the idea, argued in other studies, that the asset classes into which US investors diversify have as their prime driver of returns the embedded exposure to US equities, to which other assets are varyingly but highly correlated. That allows for the calculation of an incremental alpha for a given asset class, this being the amount of extra return over and above the risk-free and US equity returns each asset class offers. This is an asset-class alpha rather than an active management alpha, an important distinction.

Subtract the fees from that asset class alpha figure and you have a reading on how much investors actually benefit from the diversification.

Take, for example, hedge funds, which the authors calculate produce an alpha of 1.65 percentage points in extra annual returns over and above that explained by exposure to US equities. That is quite good, compared with the less than 50 basis points generated by international stocks. Citing survey data, they show that small institutions pay 14 basis points annually for passive exposure to international stocks but 50 basis points for active management. Or the entirety of the extra alpha generated by the asset class.

Looking at hedge funds, the same small institution pays 91 per cent of the structural benefit of diversifying into hedge funds out in fees. This implies that diversifying into international funds passively produces more diversification alpha than hedge funds, at least for small institutions.

Remember too that past returns are not guarantees of future experience. Fees are for certain while returns are a matter of speculation.

Another way to look at it is to consider the percentage of that allocation alpha eaten up by fees.

Our big quality foundation pays out 46 per cent of the allocation alpha generated by private equity in fees, and state pension funds dole out 86 per cent in the same asset class. Macro hedge funds are a particularly bad bargain, charging state funds 141 per cent of the allocation alpha in fees and even getting 95 per cent from quality foundations.

US Treasury inflation-protected securities, US high-yield and emerging equity are better deals. While diversification can still represent a nutritious lunch, investors need to work and bargain hard to get a fair deal.