Asset Correlation Definition Examples and Problems

Post on: 30 Июнь, 2015 No Comment

Asset Correlation

Definition of Asset Correlation

Asset correlation is a measurement of the relationship between two or more assets and their dependency. This makes it an important part of asset allocation because the goal is to combine assets with a low correlation.

The correlation measurement is expressed as a number between +1 and -1. A zero correlation indicates there is no relationship between the assets. A +1 indicates an absolute positive correlation (they always move together in the same direction). A -1 indicates an absolute negative correlation (they always move together in opposite directions of each other).

Examples of Asset Correlation

Positive Correlation

When two or more assets move up and down together. Stocks in the same industry would have a high positive correlation. They would probably be affected similarly by events.

Zero Correlation

When two or more assets show no relationship to each other. Combining multiple assets with no correlation would be an ideal diversified portfolio because volatility (risk) of the whole portfolio would theoretically be minimized. In the real world most assets have some correlation; so a low asset correlation such as between gold and S&P stocks, would be a good example of near non-correlated assets.

Negative Correlation

When two or more investments move inversely to each other they have negative correlation. Two assets that were perfectly negatively correlated would eliminate risk of the combined assets.

Perfect negative correlation is mostly only found in synthetic instruments such as futures contracts or inverse ETFs. These instruments can provide near perfect negative correlation and therefore can be useful tools to reduce portfolio volatility. Of course these instruments, particularly futures contracts, can be very risky if not employed properly.

Problems with Asset Correlation

In the real world very few asset classes have a perfect positive correlation (+1), zero correlation (0), or perfect negative correlation (-1). The vast majority of investments will have some correlation (between 0 and +1). The goal is to have low asset correlation. The fact that most investments are positively correlated is a problem and means finding the right mixture of assets more challenging.

Another problem is correlations are dynamic. You know the saying “Past performance does not equal future returns”. This is especially true with correlations because they change. The world is becoming increasingly interconnected, so many investments that formerly had low correlations are now more correlated.

In recent years when we experienced turmoil in global markets almost everything suffered. In other words, because of globalization, asset classes are tending to be more correlated than in the past. This problem is making proper asset allocation more difficult.

Asset Correlation and Cash

The shrinking number of asset categories with low correlations should give cash and cash equivalents an increased and higher priority to asset allocation models. Cash has a zero correlation with most other investment assets and provides a means to preserve capital in bear markets.

Why is Asset Correlation Important?

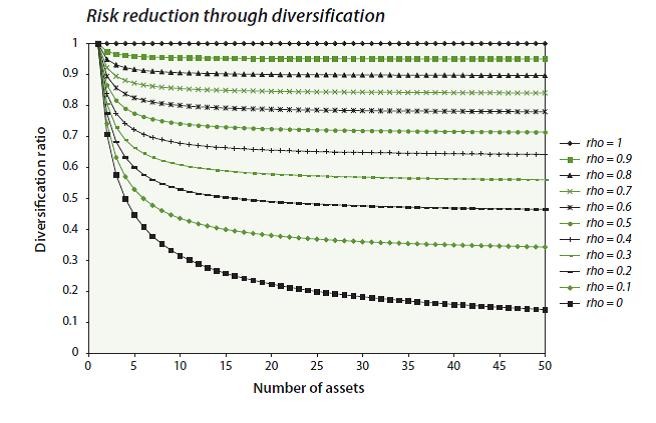

The financial concept of asset correlation is important because the goal of asset allocation is to combine assets with low correlation. The purpose of asset allocation is to lower portfolio volatility. By putting low correlation and/or negatively correlated investments in a portfolio, the overall volatility of the portfolio is lowered.

Combining asset categories that have a low correlation reduces the volatility of the portfolio as a whole and allows the portfolio manager to invest more aggressively. In other words, a portfolio manager willing to accept a given amount of volatility can invest in higher return/risk investments. This is because the volatility of the overall portfolio is lower due to combining non-correlated assets. This is called portfolio optimization.

Understanding asset correlation can reap huge rewards for your portfolio. Small differences in rate of return can make gigantic differences in portfolio value in the long run. If you can increase your returns by 1% annually a $100,000 portfolio will return you an extra $146,000 over a 30 year period.

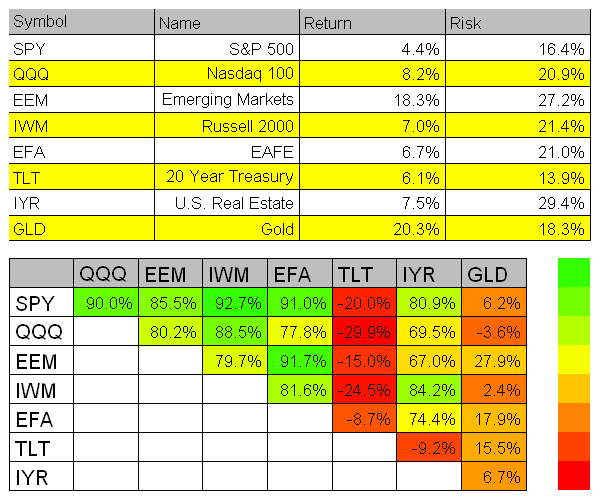

AssetCorrelation.com

AssetCorrelation.com is a website to learn more about asset correlation. In fact you can sign in (free) and set up an investment portfolio. It will produce a matrix where you can see the correlations between each of your assets.