Asset Bubble Definition Causes Examples Protection

Post on: 7 Июль, 2015 No Comment

Definition, Causes, Examples, and How to Protect Yourself

Definition: An asset bubble is formed when the prices of asset, such as housing, stocks or gold. become over-inflated. Prices rise quickly over a short period of time, and are not supported by underlying demand for the product itself. It’s a bubble when investors bid up the price beyond any real sustainable value. This price spikes often occur when investors all flock to a particular asset class. such as the stock market, real estate or commodities.

Causes

A sset bubbles are often initially caused by low interest rates. Low rates create an over-expansion of the money supply. Investors can get borrow cheaply, but can’t receive much return on bonds, so they look for another asset class.

An asset bubble can be also aggravated by a supply shortage, if investors think there isn’t enough of the stuff to go around. Most modern asset bubbles are primarily a result of demand-pull inflation .However, it’s a form of inflation that is not always accurately captured in the Consumer Price Index (CPI). Therefore, it’s overlooked by policy-makers, who can keep blowing up the bubble until it bursts. Here’s some examples.

2014 — U.S. Dollar

Forex traders stampeded into the dollar, which rose 15% starting in July. That’s when the Fed announced that Quantitative Easing would end in October, the European Central Bank stated it would start QE, and U.S. GDP dramatically improved. This all signaled American economic strength combined with weakness in the EU and emerging markets, especially China. For more, see U.S. Dollar Index and Euro to Dollar Conversion History .

2013 — Stock Market

The stock market took off in 2013, and by July it had gained more points than any year on record. On March 11, the Dow Jones Industrial Average closed at 14,254.38, breaking its previous all-time record of 14,164.43 set on October 9, 2007. On May 7, it broke the 15,000 barrier, closing at 15,056.20, and broke the 16,000 barrier on November 21, closing at 16,009.99. The Dow set its high for the year at 16,576.55 on December 31. 2013. For details, see Dow Closing History.

Price gains rose faster than corporate earnings, which is the value underpinning stock prices. Companies achieved earnings gains by cutting costs, not by increasing revenue. Demand for many consumer products was weak, since unemployment was still high (around 7%) and average income levels were low. Investors were more concerned about whether the Fed would taper off QE, than they were about the real economic growth.

2012 — Treasury Notes

On June 1, 2012, Treasury yields hit a 200-year low. The yield on the 10-year Treasury note briefly hit 1.442% during the day, closing at 1.47%. First, the Federal Reserve had been buying $85 billion a month in Treasuries since September 2011, boosting demand (which keeps rates low). See more about Quantitative Easing.

Second, investors were worried by high unemployment. and a seeming worsening of the eurozone debt crisis. They sold off stocks, driving the Dow down 275 points, and bought the safe-haven U.S. Treasury notes. As a result, mortgage rates also dropped. This helped revive the housing market. For more, see Relationship Between Treasury Notes and Mortgage Interest Rates.

However, by 2013 interest rates started to rise as the Fed hinted it would begin winding down its purchases of Treasury notes in September. Between May and July, Treasury yields rose 75%. However, that was postponed when the government shut down in October. Therefore, the yield on the 10-year Treasury remained between 2.5% — 2.8%.

2011 — Gold

An asset bubble occurred in 2011 with gold prices. which reached an all-time high of $1,895 an ounce in September of that year. Gold prices started rising in 2009, reaching a record high of $1,081 in November. Gold was bought as a hedge against the global financial crisis, not for its value in producing jewelry or dental fillings. Many thought the global economy would recover quickly. When it didn’t, gold prices just kept rising for two more years. For more, see Gold, the Ultimate Bubble, Has Burst .

2008 — Oil

An asset bubble also occurred in another commodity. oil. It started in the summer of 2008 with oil prices. Investors got out of the stock market in 2007, and started investing in oil futures. At first, they thought that demand from China would outstrip supply due to a mild shortage in Nigeria. However, demand actually fell that year, thanks to the recession. and supply actually increased. This didn’t stop the asset bubble from creating high oil prices. which set a record of $143.68 a barrel in July 2008. For more, see Gas Prices in 2008 .

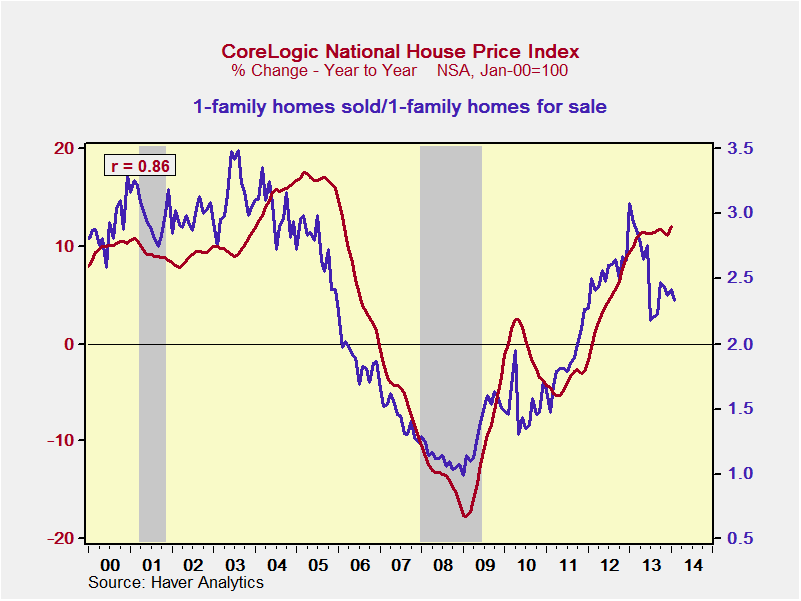

2005 — Housing

An asset bubble occurred in 2005 with real estate. Derivatives such as mortgage-backed securities were insured by credit default swaps — or so investors thought. Hedge fund managers created a huge demand for these supposedly risk-free securities, and therefore the mortgages that backed them. To meet this demand for mortgages. banks and mortgage brokers offered home loans to just about anyone. This drove up demand for housing, which homebuilders tried to meet. Many people bought homes, not to live in them or even rent them, but just as investments to sell as prices kept rising. When the homebuilders finally caught up with demand, housing prices started to fall in 2006. This burst the asset bubble, and subsequently led to the subprime mortgage crisis in 2006, the banking credit crisis in 2007 and finally the global financial crisis in 2008.

How to Protect Yourself from an Asset Bubble

The hallmark of an asset bubble is irrational exuberance. Nearly everyone is buying that asset! And, for a long time, buying that asset seems profitable. Often the price just keeps going up for years.

The problem is that it is very difficult to time a bubble. Therefore, follow the advice of most financial planners. which is to have a well-diversified portfolio of investments. Diversification means a balanced mix of stocks. bonds, commodities and even equity in your home. Revisit your asset allocation over time to make sure that it is still balanced. If there is an asset bubble in gold or even housing, it will drive up the percentage you have in that asset class. That’s the time to sell. Work with a qualified financial planner. and you won’t get caught up in irrational exuberance and fall prey to an asset bubble. Article updated January 29, 2015