Asset Allocation Strategies Do They Work

Post on: 3 Апрель, 2015 No Comment

What the heck are asset allocation strategies?

Lets recap what weve covered already. We started by discussing investment strategies in general. Then, we looked at market timing. And yesterday, we covered buy and hold .

Think of asset allocation as an investment stew made up of buy and hold with a pinch of market timing. A typical asset allocator buys a variety of mutual funds. Then, periodically, she sells some funds and buys others in order to keep the overall balance in place. Ill explain.

The concept of asset allocation is really nothing more than keeping your eggs in more than one basket. This way, if one type of investment does poorly, another will (hopefully) do better. In theory, it reduces the risk of investment losses .

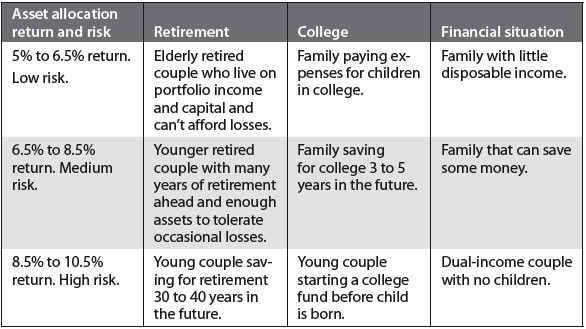

Since equity funds have been historically more volatile than bond funds, you first decide how much risk you are willing to take. If you want a higher return and are willing to take more risk, you use an allocation that is more heavily weighted towards equity funds. If you are risk-averse, you weight your portfolio toward bonds and lighten up the stock funds.

Asset allocators use all kinds of funds. The investments span from equity to bond funds, from large to small company funds and from domestic to international and global.

Even though you probably have better things to do with your time, if you are an asset allocator and wondering what to do with savings. you have to rebalance your portfolio at least once each year.

Ill explain why by way of example.

Lets say you start with $100,000 and you decide to put 50% in bonds and 50% in stocks. At the end of the first year your portfolio is worth only $80,000. The stocks are worth $35,000 and your bonds are worth $45,000. You no longer have the 50-50 split you wanteddo you? Nope. So you must sell off $5,000 in bond funds and buy $5,000 in stock funds. This will give you $40,000 in each and a beautiful 50-50 split.

You might be asking yourself why on earth youd buy more equity funds when they lost more money than bonds. Have those asset allocators gone crazy?

No, they havent gone crazy. The reason you sell off the higher-performing asset (or at least the one that has done the least damage) to buy more of the lower-performing asset is to reduce risk. The theory is that no asset class (bonds or stocks) does well forever. By moving money into the lower-performers, youll be taking advantage of lower prices and, hopefully, those lower-performers will start doing better soon. Thats the theory and many people rely on this method to help provide greater security when it comes to withdrawal strategies .

How has it worked out? It depends what timeframe you consider. Heres how different asset allocation models performed according to Wikipedia:

Cumulative return after inflation from 2000-to-2002 bear market

80% stock / 20% bond -34.35%

70% stock / 30% bond -25.81%

60% stock / 40% bond -19.99%

50% stock / 50% bond -13.87%

40% stock / 60% bond -7.46%

30% stock / 70% bond -0.74%

20% stock / 80% bond +6.29%

So in the bear market of 2000-2002, a very conservative investor earned 6.29% while the aggressive investor lost 34.35%. So far so good.

But remember, we cant have our cake and eat it too. Heres what Wikipedia said about expected returns from various asset allocation models going forward:

Projected 10-year cumulative return after inflation

(stock return 8% yearly, bond return 4.5% yearly, inflation 3% yearly

80% stock / 20% bond 52%

70% stock / 30% bond 47%

60% stock / 40% bond 42%

50% stock / 50% bond 38%

40% stock / 60% bond 33%

30% stock / 70% bond 29%

20% stock / 80% bond 24%

So you could have avoided large losses by having a risk-averse allocation in the bear market of 2000-2002. But your expected returns going forward would have been lower. Nothing wrong with that. Its simply a trade-off between risk and return. If you are an asset allocator, you make the decision based on your financial needs and risk tolerance and you (are supposed to) stick to that decision.

But lets consider how asset allocation funds did last year:

Not so well. Asset allocation could have helped you curtail some of your losses in 2008, but it wouldnt have saved from having some pretty deep wounds to lick. The best fund still cost investors north of 25% of their money. Ouch!

So once again, we see an investment approach that has some historical support but still doesnt deliver the goods 100% of the time.

Are you seeing a pattern yet? Weve seen that in market timing, buy and hold, and now here with asset allocation. All these strategies are structured to provide certain benefits at certain costs. There really is no free lunch. Invest knowing what these costs are and understand that even with the best plan, things can and do go wrong.

Having gone through this, I must say that for the right investor, asset allocation is great. It is a rigid system that keeps your emotions out of the equation. Also, since the assets are diversified, it should help reduce painful losses.

Tomorrow well wrap up and discuss which approach might be best for you. But let me ask you this: from what youve seen so far, which model fits you best? Why?