Asset Allocation Revisited How Much International Stock Exposure For Your Portfolio

Post on: 29 Май, 2015 No Comment

In the post Foreign Stocks For The Long Run. author Rick Ferri recently revisited the topic of how much international stock exposure you should add to your portfolios asset allocation. I also have an older post about this Choosing An Asset Allocation: Deciding On The Domestic/International Ratio as part of my Rough Guide to Investing series.

One of the reasons to invest in international stocks is for the diversification benefit. While both have historical average returns of 8-10% annually before inflation, they dont always move in sync (not perfectly correlated). As a result, Markowitz showed us you can attain a higher risk-adjusted return by holding some of both as opposed to just one or the other. So how much of each should you hold?

In my 2007 post, I posted this chart taken from the then-current edition of the bestseller A Random Walk Down Wall Street by Burton Malkiel. It maps the risk/return for portfolios that range from 100% US stocks to 100% EAFA (Non-US Developed countries) for the period January 1970 to June 2006:

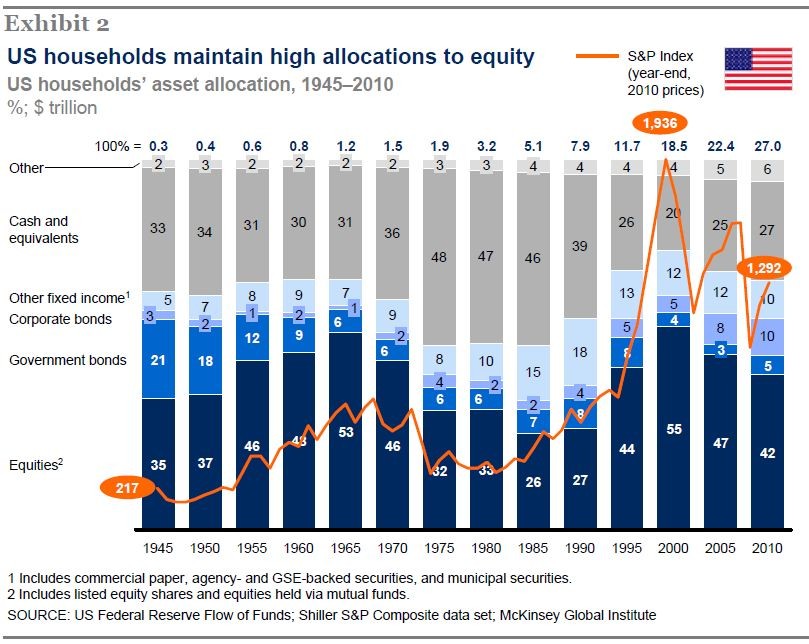

From 1970-2006, foreign stocks outperformed US stocks, while the point of optimal risk-adjusted returns was a split of 76% US and 24% Foreign (70% is a typo).

However, the updated data collected by Ferri shows a different yet similar story (see chart below). From 1970-2013, we see that now US stocks outperformed foreign stocks instead, with the point of optimal risk-adjusted returns at 70% US and 30% Foreign.

In both time periods, the overall return/risk ratio (Sharpe Ratio) didnt change dramatically if you varied from say 60% to 80% US stocks, or even further out. (I havent looked deeply but there are many other similar charts out there, this old NBER paper has one covering 1985-1990 .) I might also note that over time the optimal allocation went from 76% US to 70% US. Is this a trend?

Another point to consider is how the worlds publicly-traded markets are currently allocated by total market value (market capitalization). According the the holdings of the Vanguard Total World Stock ETF (VT ) which tracks the FTSE Global All Cap Index, as of 10/31/2013 the breakdown was 48% US and 52% World excluding-US.

My non-expert opinion is that for US residents, anywhere from 50% to 75% US exposure (25% to 50% International exposure) is fine. I dont think you can tell if US or International stocks will outperform from this point onward, but holding some of both will smooth out your returns as one can zig while the other zags. The important thing is to figure out what number works for you, write down the reason why, and stick with it even when one eventually outperforms the other for extended periods of time. My choice? Simple 50/50.