Asset Allocation Funds Modern Portfolio Theory

Post on: 24 Май, 2015 No Comment

Asset allocation is simply your portfolios exposure to different types of investments. But the benefits of proper asset allocation are much more exciting and complicated than ordinary diversification. Each asset affects your other investments as well as your overall risk and return. In order to determine the asset allocation best suited for you, several factors must be taken into consideration:

- Age

- Risk tolerance (your willingness to lose money in exchange for greater potential returns)

- Income needs

- Tax situation

- Holding period (how long you will remain invested)

- Retirement goals

Your asset allocation should be customized to fit your needs and goals, and your portfolio should include a mix of different types of investments. Choosing this mixture can get a little tricky. While it is important to have a balanced diversification, it is also wise to consider how each investment affects the others and whether their risks are worth the reward.

Allocation and Modern Portfolio Theory

A chef knows the importance of mixing appropriate ingredients. While hot cheesy artichoke dip may be delicious and a fresh bowl of sliced fruit is refreshing, putting them together equals disaster. Just because two things are good doesnt mean they are good together. Asset allocation can be equally as delicate and requires a good advisor to prepare a winning entre.

Lets assume that after an in-depth study of economic conditions, it is decided that technology may outperform everything else. So, we take a heavy position in a big tech stock. Our potential reward just skyrocketed. Unfortunately, so did our potential loss. Generally speaking, risk and reward move together; greater risk means greater reward. Is it possible to increase reward without adding an equal portion of risk? This is where modern portfolio theory (MPT) comes in.

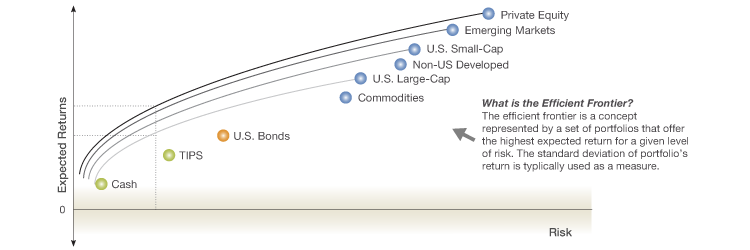

The objective of MPT is to find the greatest possible return for any given amount of risk. To greatly simplify the concept, MPT looks at the volatility of each investment in comparison with its current pricing and actual value, and carefully considers how each asset affects the portfolio as a whole. Each addition to a portfolio is analyzed and calculated to determine whether the portfolios risk and return is positively affected.

Adjusting your asset allocation

Finding the right asset mix is not as simple as choosing the right investment categories. Economic and investment research can determine what types of investments look to be the most promising going forward. Based on this research, adjusting your allocation to those investments can give you the best chance of performing well in the future. Additionally, making changes to your asset allocation as your personal circumstances change should keep your investments on track. For example, reassess your asset allocation and make appropriate changes to it as you age, if your income needs change, or if your retirement goals or plans change.

Protecting your portfolio

According to modern portfolio theory, appropriate asset allocation should help smooth your portfolios return as well as help protect it from significant losses that you may experience from one or more asset classes. Lets take, for example, a $1,000 portfolio with an allocation of 50 percent U.S. stocks and 50 percent U.S. bonds. Well use the S&P 500 Index as our proxy for U.S. stocks and the Barclays Capital U.S. Aggregate Bond Index as our proxy for U.S. bonds. The S&P 500 Index returned a strong +21.0 percent in 1999, then declined by -9.1 percent in 2000. Conversely, the Barclays Aggregate U.S. Bond Index returned -0.8 percent in 1999 and +11.6 percent in 2000. While a 100 percent stock portfolio would have performed much better in 1999, allocating 50 percent of the portfolio to bonds protected the portfolio during the stock markets decline in 2000. The table below shows the value of a 100 percent stock portfolio versus the 50 percent stock and 50 percent bond portfolio at the end of 1999 and 2000. The 50/50 portfolio (with rebalancing back to a 50/50 mix at the end of 1999) resulted in smoother and greater growth than the 100 percent stock portfolio.