Asset allocation_1

Post on: 24 Май, 2015 No Comment

10 Smart Ways to Boost Your Investing Results

Alamy

You don’t have to be an investing genius to improve your returns. Just follow a few simple steps.

Recent research shows that people who know their way around investing and finance racked up higher annual returns (9.5% vs. 8.2%) than those who dont. Here are 10 tips that will help make you a savvier investor and better able to achieve your financial goals.

1. Slash investing fees. You cant control the gains the financial markets deliver. But by sticking to investments like low-cost index funds and ETFs that charge as little as 0.05% a year, you can keep a bigger portion of the returns you earn. And the advantage to doing so can be substantial. Over the course of a career, reducing annual fees by just one percentage point can boost the size of your nest egg more than 25%. Another less commonly cited benefit of lowering investment costs: downsizing fees effectively allows you to save more for retirement without actually putting aside another cent.

2. Beware conflicted advice. Many investors end up in poor-performing investments not because of outright cons and scams but because they fall for a pitch from an adviser whos really a glorified salesman. The current push by the White House, Department of Labor and Securities and Exchange Commission to hold advisers to a more rigorous standard may do away with some abuses. But the onus is still on you to gauge the competence and trustworthiness of any adviser you deal with. Asking these five questions can help you do that.

3. Gauge your risk tolerance. Before you can invest properly, youve got to know your true appetite for risk. Otherwise, you could end up bailing out of investments during market downturns, turning paper losses into real ones. Completing a risk tolerance questionnaire like this one from RealDealRetirements Retirement Toolbox can help you assess how much risk you can reasonably handle.

4. Dont be a bull market genius. When the market is doing well and stock prices are surging, its understandable if you assume your incredible investing acumen is responsible for those outsize returns. Guess what? Its not. Youre really just along for the ride. Unfortunately, many investors lose sight of this basic fact, become overconfident. take on too much riskand then pay dearly when the market inevitably takes a dive. You can avoid such a come-down, and the losses that accompany it, by leavening your investing strategy with a little humility .

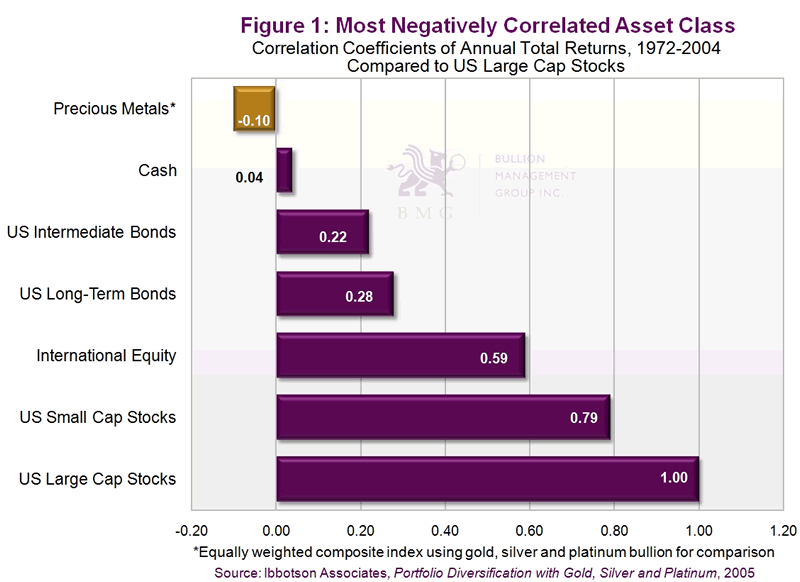

5. Focus on asset allocation. not fund picking. Many people think savvy investing consists of trying to identify in advance the investments that will top the performance charts in the coming year. But thats a fools errand. Its virtually impossible to predict which stocks or funds will outperform year to year, and trying to do so often means youll end up chasing hot investments that may be more prone to fizzle than sizzle in the year ahead. The better strategy: create a diversified mix of stock and bond funds that jibes with your risk tolerance and makes sense given the length of time you plan to keep your money invested. That will give you a better shot at getting the long-term returns you need to achieve a secure retirement and reach other goals while maintaining reasonable protection against market downturns.

6. Limit the IRSs take. You should never let the desire to avoid taxes drive your investing strategy. That policy has led many investors to plow their savings into all sorts of dubious investments ranging from cattle-breeding operations to jojoba-bean plantations. That said, there are reasonable steps you can take to prevent Uncle Sam from claiming too big a share of your investment gains. One is doing as much of your saving as possible in tax-advantaged accounts like traditional and Roth 401(k)s and IRAs. You may also be able to lower the tab on gains from investments held in taxable accounts by investing in stock index funds and tax-managed funds that that generate much of their return in the form of unrealized long-term capital gains, which go untaxed until you sell and then are taxed at generally lower long-term capital gains rates.

7. Go broad, not narrow. In search of bigger gains, many investors tend to look for niches to exploit. Instead of investing in a broad selection of energy or technology firms, theyll drill down into solar producers, wind power, robotics, or cloud-computing firms. That approach might work, but it can also leave you vulnerable to being in the wrong place at the wrong timeor the right place but the wrong company. Going broader is better for two reasons: its less of a guessing game, and the broader you go the lower your investing costs are likely to be. So if youre buying energy, tech or whatever, buy the entire sector. Better get, go even broader still. By investing in a total U.S. stock market and total U.S. bond market index fund. youll own a piece of virtually all publicly traded U.S. companies and a share of the entire investment-grade bond market. Throw in a total international stock index fund and youll have foreign exposure as well. In short, youll tie your portfolios success to that of the broad market, not just a slice of it.

8. Consider the downside. Investors are by and large an optimistic lot, otherwise they wouldnt put their money where their convictions are. But a little skepticism is good too. So before putting your money into an investment or embarking on a strategy, challenge yourself. Come up with reasons your view might be all wrong. Think about what might happen if you are. Crash-test your investing strategy to see how youll do if your investments dont perform as well as you hope. Better to know the potential downside before it occurs than after.

9. Keep it simple. You can easily get the impression that youre some kind of slacker if youre not filling your portfolio with every new fund or ETF that comes out. In fact, youre better off exercising restraint. By loading up on every Next Big Thing investment the Wall Street marketing machine churns out you run the risk of di-worse-ifying rather than diversifying. All you really need is a portfolio that mirrors the broad U.S. stock and bond markets, and maybe some international exposure. If you want to go for more investing gusto, you can consider some inflation protection, say, a real estate, natural resources, or TIPS fund. But Id be wary about adding much more than that.

10. Tune out the noise. With so many investing pundits weighing in on virtually every aspect of the financial markets nearly 24/7, its easy to get overwhelmed with advice. It might make sense to sift through this cacophony if it were full of investing gems, but much of the advice, predictions, and observations are trite, if not downright harmful. If you want to watch or listen to the parade of pundits just to keep abreast of the investing scuttlebutt, fine. Just dont let the hype, the hoopla, and the hyperbole distract you from your investing strategy.

Walter Updegrave is the editor of RealDealRetirement.com . If you have a question on retirement or investing that you would like Walter to answer online, send it to him at walter@realdealretirement.com .