Assessing REIT funds in terms of Risk versus Reward

Post on: 16 Май, 2015 No Comment

A version of this post has been submitted to Seeking Alpha

Real Estate Investment Trusts

Historically, Real Estate Investment Trusts (REITs) have been a favorite asset class for income oriented investors. REITs were hit hard in the 2008 bear market but have rebounded strongly along with other equities since the 2009 low. However, REITs stumbled again in May 2013 when the Fed hinted that they would begin to unwind quantitative easing. REITs are still substantially off their May highs as apprehension still remains.

Are REITs a bargain?

Has the pullback in REITs created a buying opportunity? To be honest, I’m not sure. The fundamentals associated with the REIT sector are strong but the fears of rising rates are generating significant headwinds. However, as a retiree and income investor, I wanted some exposure to REITs in my portfolio. Rather than investing in individual REITs, I prefer REIT funds. This article analyzes REIT funds to see which have offered the best relative performance in terms of risk versus reward.

Tutorial

Before jumping into the analysis, it will be useful to review some of the characteristics of this asset class. In 1960, Congress created a new type of security call REITs that allowed real estate investments to be traded as a stock. The objective of this landmark legislation was to provide a way for small investors to participate in the income from large scale real estate projects. A REIT is a company that specializes in real estate, either through properties or mortgages. There are two major types of REITs

- Equity REITs purchase and operate real estate properties. Income usually comes through the collection of rents. About 90% of REITs are equity REITS.

- Mortgage REITs invest in mortgages or mortgage backed securities. Income is generated primarily from the interest that is earned on mortgage loans.

The risks and rewards associated with mortgage REITs are very different than those associated with equity REITs. This article will only consider equity REITs.

One of the reasons REITs are so popular is that they receive special tax treatment and as a result, are required to distribute at least 90% of their taxable income each year. This usually translates into relatively large yields. But because REITs must pay out 90% of their income, they rely on debt for growth. This means that REITs are sensitive to interest rates. If the interest rates rise, the cost of debt increases and the REIT has less money for business investment. However, on the plus side, rising rates usually implies increased economic activity and as the economy expands, there is a higher demand for real estate, which bodes well for REITs.

REITS can be purchased as individual stocks or through Closed End Funds (CEFs), ETFs, or mutual funds. As an income investor, my preferred investment vehicle is the Closed End Funds (CEFs) due to their generally large distributions. However, with CEFs, you need to be careful that the large distributions are not funded by destructive Return of Capital (ROC).

Assessing Return of Capital

Return of capital is an important concept when investing in Closed End Funds. The cash available for distributions comes from interest, dividends, and realized capital gains made in the current period. If a fund distributes more than this cash, it is considered return of capital. However, not all ROC is considered “bad”. For example, if fund assets have appreciated but have not been sold, then the Net Assess Value (NAV) has increased by “unrealized capital gains”. When it comes time for a distribution, a fund manager may decide not to sell some of his best performing assets because he believes they will appreciate even more. If he had sold the asset, he would have had plenty of cash for the distribution. However, since he decided not to sell, he may have a shortfall and not enough “immediate” cash flow to pay the distribution. He therefore has to delve into savings and this results in a tax event that is termed “return of capital”. This type of ROC is not destructive. My rule of thumb is that ROC is not destructive as long as the NAV continues to increase. If the fund NAV has decreased over time, it is more difficult to assess if the decrease is due to declines in the basic asset or destructive ROC.

UNII

Another metric that can aid in evaluating the quality of a fund’s distribution is “undistributed net investment income” (UNII). There are many nuances associated with UNII but if UNII is positive, that means that the fund has not distributed all the income, which is generally viewed as favorable. Conversely, negative UNII typically means that the fund has distributed more cash than it received from investment income. A small negative UNII is not a cause for concern but consistently large negative UNII may be a red flag, especially if the amount of negative UNII is more than a regular distribution payment.

REIT CEFs

There are currently 11 CEF funds focused on REITs. To narrow the analysis space, I used the following selection criteria:

- A history that goes back to 2007 (to see how the fund reacted during the 2008 bear market)

- A market cap of at least $200M

- An average daily trading volume of at least 50,000 shares

The following 6 CEFs met all of my selection criteria.

- Nuveen Real Estate Income (JRS). This CEF sells for a small discount of 0.5%, which is unusual since, on average, this fund sells at a 7% premium. The fund has 75 holdings spread over all types of REITs (residential, commercial, retail). It utilizes 30% leverage and has an expense ratio of 1.9%, including interest payments. This distribution is a high 9.4%, but a large percentage is from ROC. The NAV of JRS has fallen over the past year and the amount of negative UNII exceeds a quarterly distribution so I would consider at least part of the distribution as destructive ROC.

- Neuberger Berman Real Estate Securities Income (NRO). This CEF sells for a discount of 14.3%, which is slightly below its average discount of 12.8%. The fund consists of 65 holdings with 75% in diversified REITs and 30% in the preferred shares. The fund uses leverage of 16% and has a relatively high expense ratio of 2.1%, including interest payments. The yield is a relatively low 5.5% but comes directly from income with no ROC.

- Cohen Steers Quality Income Realty (RQI). This CEF sells for a 9.9% discount, which is lower than its average discount of 6.6%. The fund has 117 holdings consisting of REITs (82%) and preferred stock issued by REITs (16%). The fund utilizes 27% leverage and has an expense ratio of 1.8%, including interest payments. The distribution is 7.6%, consisting primarily of income and long term gains with very little ROC.

- Cohen and Steers REIT and Preferred (RNP). This CEF sells for discount of 12.2%, which is lower than its average discount of 9.5%. The portfolio consists of 183 holding with 52% in REITs and 47% in preferred shares. Only about 10% of the preferred securities are in real estate with the rest being spread across multiple sectors, including banking and insurance. The fund uses 28% leverage and has an expense ratio of 1.6%, including interest payments. The distribution is 7.6%, consisting primarily of income with about 30% ROC. However, since the NAV has stayed relative flat year-over-year, I would consider the ROC portion of the distribution as being non-destructive.

- CBRE Clarion Global Real Estate I (IGR). This CEF sells for a discount of 11.7%, which is well below its average discount of 7.8%. The portfolio consists of 66 securities with 95% in REITs and the rest in preferred shares. About 47% of the holdings are from the United States with the rest spread over Asia, Europe, Australia, and Canada. This fund does not use leverage and has a relatively small expense ratio of 1%. The distribution is 6.8%, consisting of income and ROC in roughly equal parts. Since the NAV has fallen year over year and the amount of negative UNII is very high, I would consider the ROC to be destructive.

- Alpine Global Premier Property (AWP). This CEF sells for a discount of 11.3%, which is substantially less than its average discount of 7.1%. The portfolio consists of 106 holdings with almost all (98%) in REITs. Only 36% of the holdings are domiciled in the United States. The next largest geographical weightings are Japan at 12% followed by Brazil at 11%. The UK and Singapore each make up about 8% of the holdings. The fund uses only a small amount (8%) of leverage and has an expense ratio of 1.2%, including interest payments. The distribution is 8.4% consisting primarily of income and ROC. The NAV has been flat year-over-year so I would not consider the ROC to be destructive.

For comparison, I will use the following Exchange Traded Funds (ETFs).

- Vanguard REIT Index (VNQ). This ETF tracks the MSCI US REIT Index, which is a pure equity REIT index. The index is diversified across real estate sectors with retail being the largest constituent at 27% followed by Office (15%), residential (15%), and health care (15%) REITs. The fund charges a miniscule 0.10%, which is substantially less than most of its competitors. The fund yields 4.3%.

- Note that the following ETFs are all about 99% correlated with VNQ so were not included in the analysis

- iShares US Real Estate (IYR)

- iShares Cohen& Steers REIT (ICF)

- SPDR Dow Jones REIT (RWR)

Risk vs Reward over bear-bull cycle

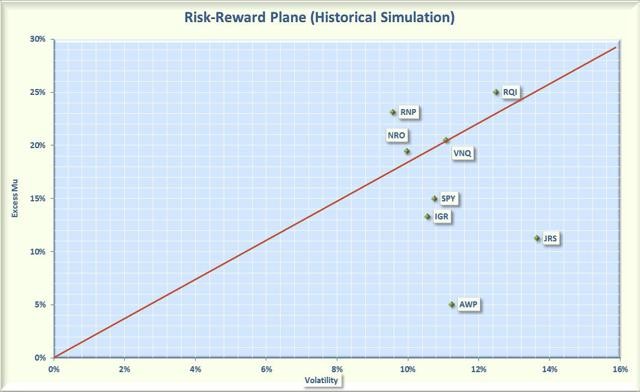

To assess this class over a complete market cycle, I plotted the annualized rate of return in excess of the risk free rate (called Excess Mu in the charts) versus the volatility of each of the CEFs. To capture the entire bear-bull cycle, I used data from October 12, 2007 (the market high before the collapse) until today. The Smartfolio 3 program (www.smartfolio.com ) was used to generate this plot. The data is shown in Figure 1.

Figure 1. Risk vs. reward for REIT funds over the bear-bull cycle (click to expand)

As is evident from the figure, there was a relatively large range of returns and volatilities. For example, RQI had a high rate of return but also had a high volatility. Was the increased return worth the increased volatility? To answer this question, I calculated the Sharpe Ratio.

Sharpe Ratio

The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. In Figure 1, I plotted a red line that represents the Sharpe Ratio associated with Vanguard’s REIT Index (VNQ). If an asset is above the line, it has a higher Sharpe Ratio than VNQ. Conversely, if an asset is below the line, the reward-to-risk is worse than VNQ.

Some interesting observations are apparent from Figure 1. Over the bear-bull cycle, REIT funds were more volatile than the S&P 500 and only a few (VNQ, REZ, and RNP) generated a return commensurate with the increased risk. On a risk-adjusted basis, SPY, REZ, VNQ, and RNP all had similar performance. The other CEFs lagged during this 6 year period. If you only look at CEFs, the best performers were RNP followed by RQI.

So for the most part, REITs did not outperform the general market. However, one of the reasons touted for owning REITs is the diversification they provide. To be diversified, you want to choose assets such that when some assets are down, others are up. In mathematical terms, you want to select assets that are uncorrelated (or at least not highly correlated) with each other. To assess the degree of diversification, I calculated the pairwise correlations associated with the REIT funds and the SPY. The results are provided as a correlation matrix in Figure 2.

Diversification

As is apparent from the matrix, REITs did provide a reasonable amount of portfolio diversification. The REIT CEFs were about 70% correlated with SPY. Somewhat surprising, the CEFs were also not highly correlated with each other (with correlations ranging from 60% to 80%). The Vanguard REIT ETF (VNQ) was slightly more correlated with SPY. The two ETFs, VNQ and REZ, were 92% correlated, so not much diversification is received by investing in multiple REIT ETFs.

Figure 2. Correlation matrix over bear-bull cycle (click to expand)

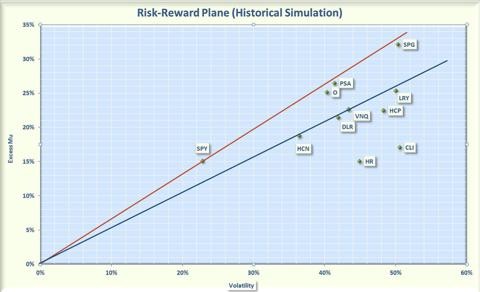

Next, I looked at the past 3 year period to see if the REIT performance had significantly changed. The results are shown in Figure 3. Over the past 3 years, the SPY has been in a rip-roaring bull market and easily outpaced all the REIT funds so we will focus on relative performance among the CEFs and ETFs.

Figure 3. Risk vs. Reward for REIT funds over past 3 years (click to expand)

Over this 3 year period, REIT performances were tightly grouped, with RNP leading the pack on a risk-adjusted basis. VNQ, AWP, NRO, and RQI had about the same risk-adjusted return, with a performance slightly less than RNP. In the figure, the symbol for AWP is shown to the right of VNQ but the actual performance was the same as VNQ. JRS lagged in terms of risk-adjusted performance.

As a final stress test, I re-ran the analysis over the past 12 months, when the S&P experienced a truly impressive bull run but REITs fell off the cliff. The results are shown in Figure 4. Over the past year, only VNQ and AWP were able to stay above water. The rest of the REIT funds registered negative returns with IGR lagging the most.

Figure 4. Risk vs. Reward for REIT funds previous 12 months (click to expand)

Bottom Line

I don’t know if REITs will return to their glory days in the near future. However, if you are risk tolerant and are willing to take a gamble, I believe that RNP, RQI, AWP, and VNQ offer good relative performance.