As an Investor Do You Want a Stock to Have a High or Low PE Ratio

Post on: 15 Июль, 2015 No Comment

Definition

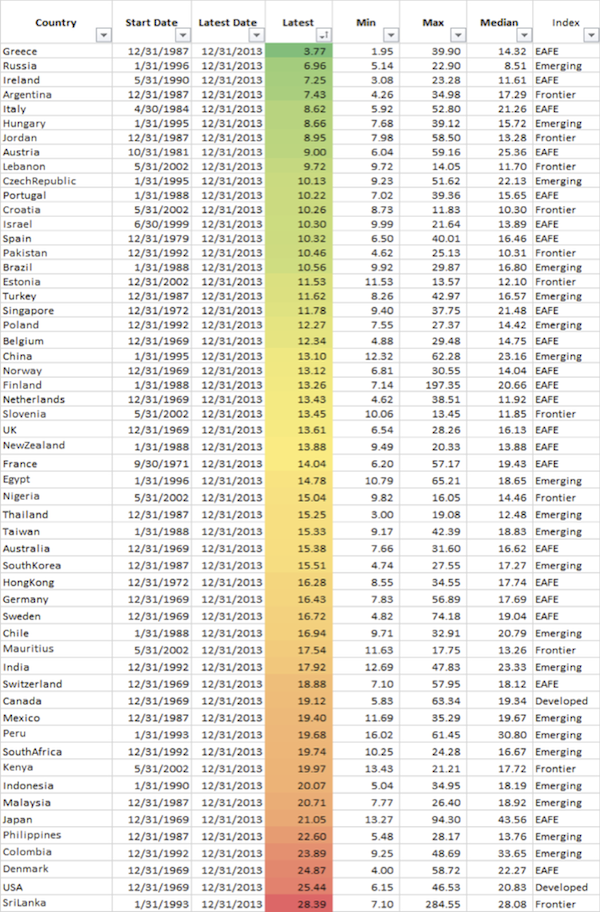

The price to earnings ratio is the ratio comparing a stock price to a company’s earnings per share. For example, if a stock is trading at $50 per share and the company earnings are $5 per share, the PE ratio is $50 to $5 or 10. PE ratios are commonly expressed as a single number rather than the two separate numbers used to compute the ratio.

High PE Ratio

A high PE ratio signifies that investors are paying a premium for a stock in relation to company earnings. A stock with a high PE ratio is said to be overvalued by some market analysts. However, the high PE ratio can also be a sign of strength, as it means that investors are willing to pay a premium for a stock. For instance, if investors are optimistic about a company’s future growth, demand for the stock will increase and consequently the PE ratio will also rise.

Considerations

References

More Like This

How Does a P/E Ratio Determine the Value of a Stock?

What Is a Good P/E Ratio for Stocks?

What Is the Difference Between a Dividend Rate & Dividend Yield?

You May Also Like

Investors in the stock market are always looking for opportunities for making profit in the market. These investors aim to buy stocks.

Positive & Negative Effects of a Wind Farm on a Community. Wind turbines, as a source of energy, are vastly expanding in.

P/E stands for price to earnings ratio. The P/E ratio is one of the one of the most widely used measurements of.

PE ratio refers to the ratio between the share price of a company and the company's earnings. Investors and analysts use the.

A P/E ratio, or price-earnings ratio, is the market price of a share of stock in a company divided by how much.

The dividends per share ratio is a useful tool for investors interested in buying and selling stocks. When investors buy a share.

Toning the waist area requires losing fat through cardiovascular exercise as well as building up abdominal muscles through crunches, sit-ups and core-strengthening.

When investors buy shares of stock they do so for one reason: they want to make money, either from growth in the.

The PE ratio is the ratio of price to earnings. It is calculated by dividing the closing price by the stock's earnings.

P/E is an acronym which is used to refer to a stock's price-earnings ratio, and is a valuation measure that describes the.

The prostate-specific antigen (PSA) test measures how much PSA is in the blood. PSA is a protein compound made by the male.

There are several ways to evaluate a stock's true value. While the share price is the first and most obvious indicator of.

Comments. Video Transcript. OK so how do we calculate a P/E ratio? The price to earnings ratio. It's very simple, you take.