Art of investment

Post on: 16 Март, 2015 No Comment

The Indian Express 08-02-2015

Dhritabrata Bhattacharjya Tato

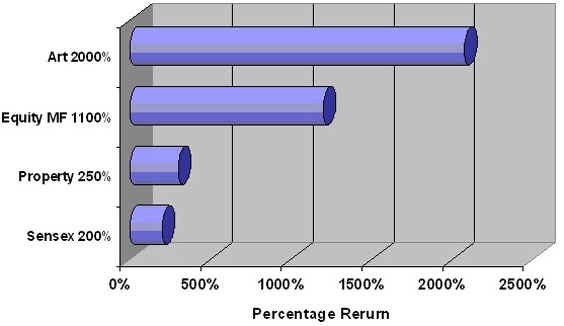

The just-concluded India Art Fair showcased modern and contemporary art from India and abroad. Interestingly, after the 2008 recession, Indian art investment funds are slowly picking up momentum. A Christie’s auction in Mumbai in December 2014 inspired new confidence in the market. It fetched Rs 75,27,45,000/ $12,092,289 by selling 90 per cent by lot and 97 per cent by value. This result was in line with ArtTactic’s Indian art market confidence indicator, which rose 42 per cent in the first half of last year.

Indian art is slowly being recognised as an asset class. According to Deloitte Luxembourg, in 2013, auction sales of Indian modern and contemporary art were up by 62 per cent from 2012 at $49.5 million. In addition, India is now proud host of an international art biennale in Kochi, Kerala.

Worldwide, investing in art is gaining pace. The Deloitte study shows that in 2014, 76 per cent of art buyers acquired art and collectibles as investments, compared to 53 per cent in 2012. This in turn has resulted in 36 per cent of the banks that were surveyed offering art-secured lending. However, there are several potential Indian investors who are yet to discover the magic of art and collectibles. The dynamics of the art market, which is reaching out to new clients online and in auction rooms, are slowly changing. However, many potential investors shy away due to lack of exposure and understanding of market practices.

According to BMW’s head of cultural engagement, Thomas Girst, today, the Indian contemporary art scene is being fuelled by increasing international recognition and visibility — in fact, several museums all over the world are hosting India-themed exhibitions. Further, “keeping up with Jones” is a motivating factor for several collectors and bodes well for Indian art. But Girst also points out that a vibrant art movement in India will not be possible in the absence of a deep and strong sense of national pride. In fact, “there can be no economic growth without taking into account the role of culture in creating identity.”

There is a clear role that large corporations and firms could play here. In fact, Girst points out that in order to build a strong reputation and increase their visibility, companies should give back to society, not just excel in their core business areas. This is where promoting the arts could come in. Buying art and enabling Indian artists could be potential brand-enhancement practices. In fact, this is particularly true for companies that one doesn’t associate with “visually”, such as service-sector firms and banks. Further, art could also become a “business tool for global-scale banks”.

While the media typically focuses only on objects of national importance that are going under the hammer — especially to save significant artefacts — the collectibles market is immensely promising for potential investors. Take, for example, the antiquarian map market, which is yet to be discovered by many Indian art fund investors. Prshant Lahoti, a pioneer of the segment and who perhaps possesses one of the largest collections, has a passion for maps, which is why he collects them. But he also believes that they are excellent “long-term bets”.

Provided by Indian Express The Deloitte study shows that in 2014, 76 per cent of art buyers acquired art and collectibles as investments, compared to 53 per cent in 2012. (Source: Oinam Anand)

In India, there are several hindrances that the art and finance industry needs to overcome. The key challenges have to do with liquidity, transparency and valuation. There is a need and demand for professional art wealth management services that can properly leverage and enhance collections.

Globally, art and collectibles are being seen as important components of well-balanced portfolios and asset-diversification strategies. According to a 2012 Barclays report, although holdings vary between region and type of asset, on an average, art and collectibles represent 9 per cent of the net assets of wealthy individuals. Banks are now contemplating art-related tax, estate and succession planning.

But with the number of ultra high net worth individuals expected to double in India over the next decade, and the social cachet associated with buying art and collectibles increasing, Indian art investment funds are bound to attract new investors. Art fairs are now gateways, not just to a world of beauty, but also to financial benefit — for those who have the patience to reap the long-run rewards.

Tato is a Delhi-based writer

express@expressindia.com