ARMOUR Needs To Quit Defensive Approach ARMOUR Residential REIT Inc (NYSE ARR)

Post on: 16 Март, 2015 No Comment

Summary

- If company persists with current defensive strategy, there is a further downside risk to its book value.

- Company needs to increase its exposure to long duration assets like 30-year MBS, which will improve asset yield.

- ARMOUR needs to reduce the size of its hedge book, which will augur well for its book value and core EPS.

A low interest rate environment will support mortgage REITs’ performance in 2015. The Fed will not increase interest rates, contrary to market expectations, due to weak global economic conditions. In the low interest rate environment, mREITs should increase their exposure to long term high yield assets and reduce their hedge portfolio. ARMOUR Residential (NYSE:ARR ) has positioned its portfolio defensively to maintain its book value in case of an increase in interest rates. Also, the company is targeting short duration assets and significant hedge book. In the prevailing low rate environment, the company’s current portfolio composition strategy is too defensive and not correct, and will result in book value decline. The company needs to aggressively change its portfolio composition strategy, otherwise its future earnings could come under pressure and potentially result in another dividend cut.

Portfolio Composition

ARMOUR has been consistently experiencing a decline in its book value due to its wrong and defensive portfolio composition strategy. The company has positioned itself to protect against a rise in interest rate. In my opinion, interest rates in the U.S. will stay constant. Slacks in the labor market, low inflation. weak global economic conditions and appreciation of the U.S. Dollar will encourage the Fed to maintain its zero interest rate policy in 2015. And because of the divergence of portfolio composition strategies in the mREIT space, return deviation will rise in 2015.

The company has positioned its portfolio to maintain its book value if interest rates increase. The company has been favoring exposure to 15-year MBS over 30-year MBS, and continues to maintain a large hedge book. Currently, almost 50% of the company’s investment portfolio comprises of 15-year MBS and 32% of the portfolio comprises of 20-year MBS, in comparison to only 8.7% invested in 30-year MBS. The company needs to increase its exposure to long duration MBS, as 30-year MBS offer a weighted average net coupon of 4.01%, higher than the 15-year MBS weighted average net coupon of 3.33%. An increase in 30-year MBS will augur well for the company’s asset yield and core EPS in upcoming quarters. The table below displays the company’s portfolio composition.

Source: Investors Presentation

In addition to high short duration securities exposure, the company has maintained a large hedge book, which is weighing on its core EPS and book value. ARMOUR has hedged 84.5% of its assets and 91% of its net repo balance. The company has maintained a hedge book of $13 billion. The significant hedge positioned has kept its funding cost high, which has been weighing on its core EPS. In 4Q’14, due to its large hedge book, the company gained only $0.67 per share and lost almost $1.25 per share in value on its hedge positions, which has resulted in book value decline of almost $0.60 per share to $3.98. The consistent drop in book value is a result of its large hedge book, which is designed to guard against a rise in interest rates, which is not the case these days. The following table displays the hedge book of the company.

Source: Investors Presentation

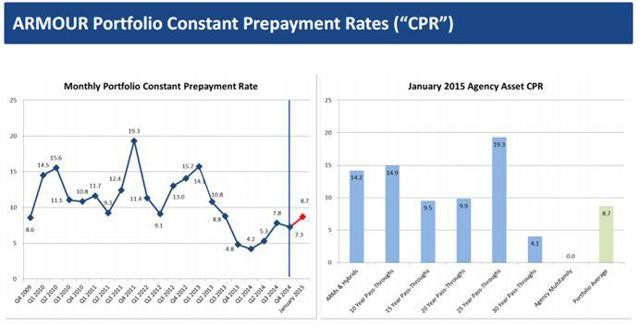

As I expect interest rates to stay low longer than expected, the company is exposed to acceleration in prepayment speed. Higher prepayments will shorten assets duration and result in premium amortization premium, which will weigh on core EPS in upcoming quarters. The company has been consistently experiencing an increase in prepayment rate since the first quarter of 2014. Monthly agency assets CPR for January 2015 stood at 8.7, as reflected below.

Source: Investors Presentation

Dividends and Valuation

The company announced a 20% dividend cut in December 2014. The stock now offers a quarterly dividend of $0.12 per share, down from the previous quarterly dividend of $0.15 per share. The company’s current defensive portfolio composition strategy even poses a risk to its revised dividends. The company is likely to experience further book value decline in upcoming quarters, which will weigh on its core EPS and challenge its dividends. Also, the company could possibly opt to reduce its portfolio worth by selling some assets to maintain healthy liquidity and maintain its book value. Therefore, the company could face earnings pressure and another possible dividend cut in upcoming quarters.

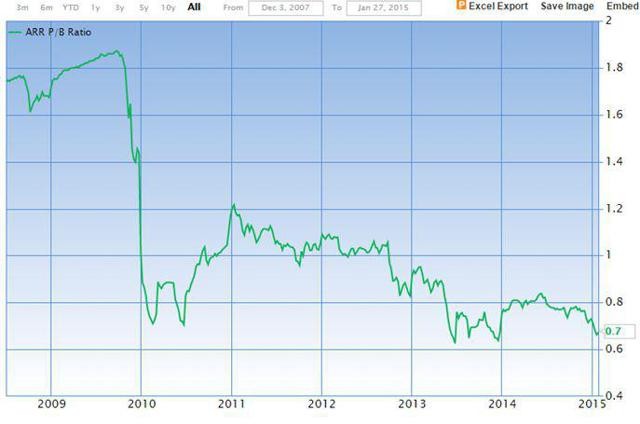

The stock is currently trading at a price-to-book value of 0.70x. lower than its historic price-to-book value of 0.90x. The discount to its book-value is justified, given the company’s defensive portfolio strategy, which could result in further book value loss. Until the company changes its portfolio composition strategy, I do not foresee any valuation expansion for the stock. The following graph reflects ARMOUR’s historical price-to-book value.

Source: Gurufocus.com

Summation

The company’s current portfolio composition strategy is too defensive, which has negatively affected its book value and core EPS. If the company persists with its current defensive strategy, there is a further downside risk to its book value, and core EPS could come under pressure, which will challenge its quarterly dividends. The company needs to increase its exposure to long duration assets like 30-year MBS, which will improve its asset yield. Also, the company needs to reduce the size of its hedge book, which will augur well for its book value and core EPS, and hence result in dividend stability.