Arguing for Cash Flow Stock Picking

Post on: 18 Май, 2015 No Comment

After a recent post about the debated idea of trying to time the market, I had a conversation with Hamamjian, who runs an investment advisory firm called GeaSphere .

Hamamjian argued for market timing but not in isolation. When combined with portfolio diversification and smart stock picking, he says it is the best way to get market-beating numbers.

Smart stock picking is no easy order, but his criteria are not that complicated. Hamamjians focus is on free cash flow, and his argument is simple: Any main street business has to be cash flow positive to keep its doors open. Public companies should be judged on the same basis.

“Would this business survive if you shut off their access to capital tomorrow?” he says. “If you apply that very simple [test] it’s scary how many would close their doors within a week. It’s a lot. “

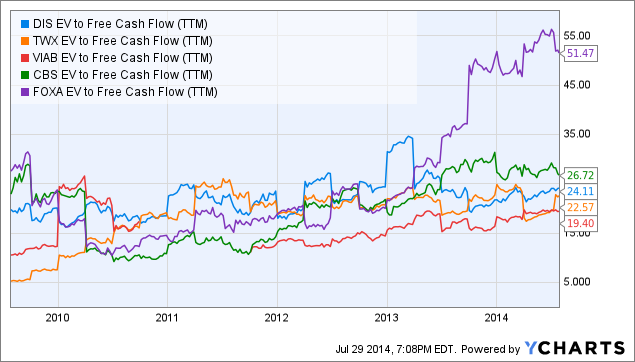

He compares the free cash flow to the price of the stock to see if it’s overvalued. Naturally this changes over time.

In 2000, Hamamjian says, Microsoft was “a screaming sell” with its shares selling at something like 60 times its cash flow. The stock has fallen since then, but won’t be a buy he says until it gets to about $18 a share.

Not many companies have been showing up as buys recently, he says, but most of the ones that have are smaller, emerging technology companies. He also sees value in some of the integrated oil companies. Their exposure to emerging markets throughout the world is a plus, and “once a rig is in place, the upfront cost is done, and the price-to-free cash flow should improve.”

According to back testing done by GeaSphere, if you were to have bought only the stock of companies in the Dow Jones Industrial Average selling for 15 times or less their price to free cash flow on January 1, of each year, from 1993 through 2009, you would have only had three down years. And a $100,000 investment would have grown to $1.3 million.

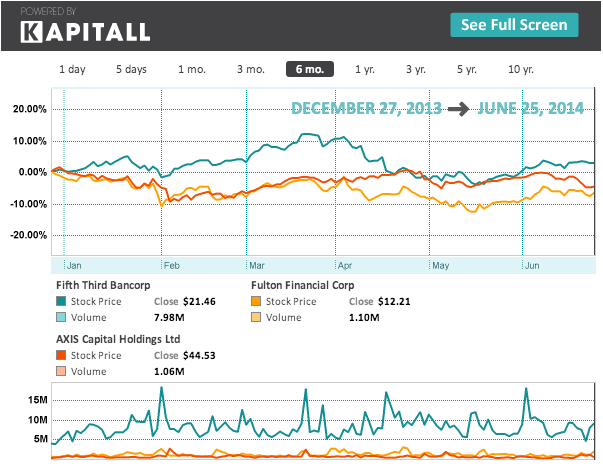

In addition to stock picking, Hamamjian also looks at investor sentiment to help him do some marketing timing (when it goes up too high he starts shorting the market). And he constructs a diversified portfolio of assets tested to make sure they don’t move in the same direction. Many stocks that fit the cash flow analysis never make the portfolio because they don’t help its diversification.

Warren Buffett has historically been another big believer in trying to dig down to a company’s true cash flow, what he calls “owner earnings.” In his 1986 letter to Berkshire Hathaway shareholders. Buffett defines “owners earning” as:

(a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges… less (c) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume. (If the business requires additional working capital to maintain its competitive position and unit volume, the increment also should be included in (c) . However, businesses following the LIFO inventory method usually do not require additional working capital if unit volume does not change.)

Our owner-earnings equation does not yield the deceptively precise figures provided by GAAP, since(c) since must be a guess – and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes – both for investors in buying stocks and for managers in buying entire businesses. We agree with Keynes’s observation: “I would rather be vaguely right than precisely wrong.”

In a nutshell, A+B = Net Income + Depreciation – C or Capital Expenditures = Owners Earnings. (All of those component numbers are usually readily available through Value Line and other sources.)

Coca-Cola is one of the largest bets Buffett has ever placed. He built that position in the two years after this annual report, when Coke was selling at some of the lowest price to free cash flow figures it has in the past 35 years.

For more on Buffett’s approach take a look at the Buffett-Hagstrom screen at the American Association of Individual Investors. It’s based on author Robert Hagstrom’s books including “The Essential Buffett ,” and it’s consistently beat the market.

Is there a place for stock picking? Please add your thoughts and experiences.