Are we reaching a tipping point in the stock market 4 million fewer jobs from peak but corporate

Post on: 28 Июнь, 2015 No Comment

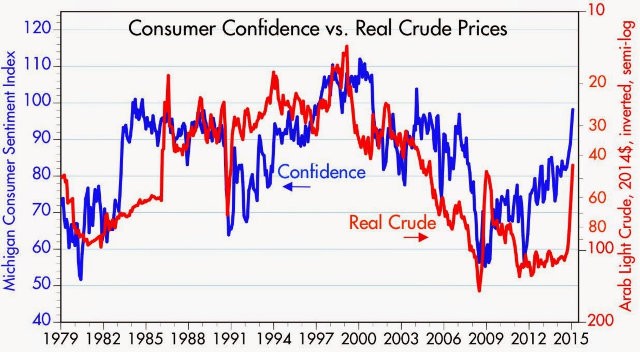

As the Dow flirted with 14,000 and the S&P 500 hit 1,500 the typical American is losing their confidence and also reflects a stock market that diverges from the interests of the Americans worker . Given that many of the S&P 500 companies earn a sizable portion of their profits abroad, it is hard to see a direct correlation to the health of the American worker. In fact, the middle class continues to face a difficult future. It was interesting to see consumer confidence fall while stock prices move up. But what we do see is a growing class of Americans stuck in poverty. The startling high number of Americans on food stamps does not seem to be inching lower (we are over 47 million). Yet corporate profits are at record levels. Goldman Sachs for example earned $2.8 billion in the fourth quarter of 2012. How is it feasible that stocks continue to move higher while real wealth gains to working and middle class Americans seem stagnant?

S&P 500 and Consumer Confidence

One very telling chart in regards to the frothiness of the market is the divergence between consumer confidence and the actual stock market:

Source: SoberLook

While consumer confidence and stock values usually follow a similar trend, since the fourth quarter of 2012 we have been moving in opposite directions. So some type of inflection point is occurring here. Obviously consumer confidence in an economy like the US is very important. The fact that stocks continue to move higher unabated with little retail investment is likely a sign that hot money from the Fed is being used by places like Goldman Sachs to speculate and make big money without any real tangible gains to Americans. The cost of course comes through inflation in multiple sources .

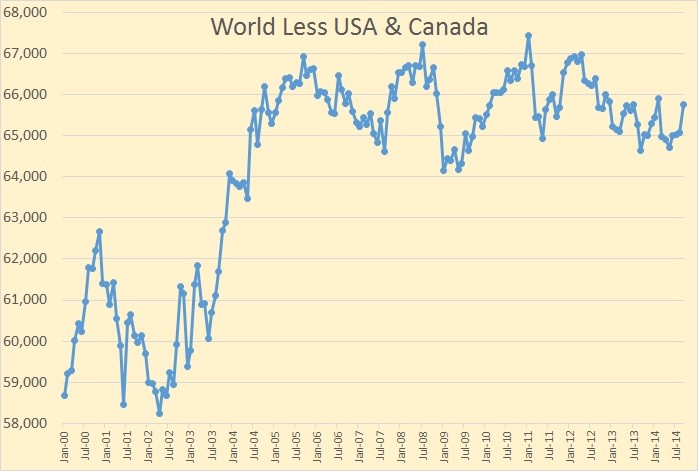

What is even more telling is that we are still over 4 million jobs short from where we were in 2008 yet stocks are now inching back to their previous peaks:

So obviously stocks cannot be used as a reliable barometer for the health of the employment market. Many corporations used the recession as a method of cutting wages and firing employees to boost their stock profits. This is seen when you examine the financial statements of many of these organizations. The above chart shows how far behind we are from our peak employment. It also helps to explain why today with a near record in stock values we also have a near record in food stamp usage . It would seem almost impossible to have both of these scenarios occurring at the same time but that is exactly what we have in our current economy.

Irrational Exuberance

One telling way to tell a top is usually when the herd begins diving into the stock market. We are well over 100+ percent up from the lows of 2009. However now, it does seem that some retail investors may be thinking about coming back in:

The signs? Trading volume is up in retail accounts. $11 trillion in stock wealth has been brought back. Net inflows of funds have picked up a bit. Optimism is very high. The VIX index shows almost no signs of fear. Forget about the record food stamp usage, our ever consistent debt ceiling breaches. or that we will deficit spend for most of our lifetimes. We have major challenges ahead yet the above almost signifies an economy that is booming. The recent GDP figures showed a contraction and most of the other gains had to do with artificial money flowing into the economy thanks to the Federal Reserve and Wall Street speculation. The big winners? Places like Goldman Sachs but not exactly an encompassing win for the overall US worker.

What about housing? Housing is the big wealth store for Americans. Even here, the gains are happening because of very low rates and banks controlling inventory:

While the stock market is nearing a peak. home values are still down by 30 percent from their peak. This makes sense given that Americans have seen their incomes head back to levels last seen in the 1990s. The stock market is actually a very poor indicator of the health of the overall US economy. When you have the Fed going into negative rate territory and eroding the value of money (i.e. banks giving you 0 percent interest) you have money put into member banks flowing into all sorts of speculative sectors. You even have hedge fund money now crowding out people in the housing market as they chase rental yields. In the end this doesn’t help your average investor or American worker . But that is sort of the point.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!