Are sugar stocks a sweet deal for investors

Post on: 10 Август, 2015 No Comment

Are sugar stocks a sweet deal for investors?

The growing demand for relief to boost the ailing sugar industry has finally been addressed.

The import duty hike on sugar from 15 to 40 per cent, subsidy on raw sugar exports till September and the subsequent rise in domestic prices have given the much-needed lifeline to the industry.

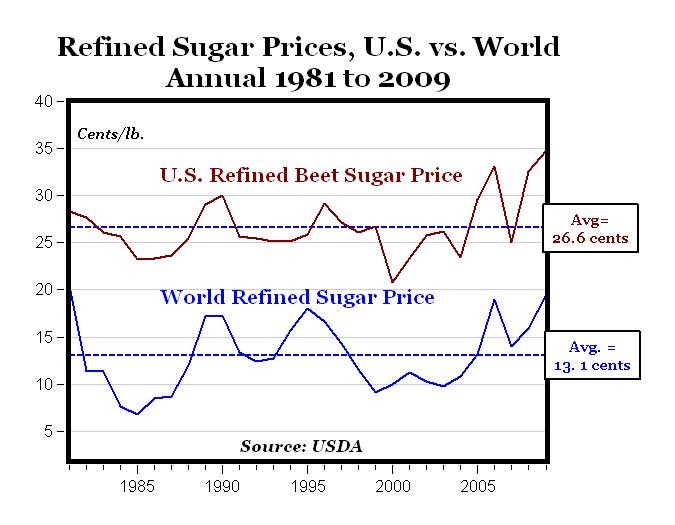

Experts believe this could augur well for sugar company stocks. Investors can also take heart from the fact that global sugar prices are expected to firm up in the 2014-15 season (October-September) following an adverse sugar-producing climate in Brazil.

In a recent report, Jonathan Kingsman from Platts increased the global deficit for 2014-15 from 0.4 million tonnes to 2.1 million tonnes.

Uttar Pradesh-based sugar mills, including Balrampur Chini Mills and Bajaj Hindusthan, which have had a huge inventory since the crushing season ended in April, stand to benefit from the price increase as the realisations will go straight to their bottom lines.

Are sugar stocks a sweet deal for investors?

Disclaimer. Information presented on this site is a guide only. It may not necessarily be correct and is not intended to be taken as financial advice nor has it been prepared with regard to the individual investment needs and objectives or financial situation of any particular person. Stock quotes are believed to be accurate and correctly dated, but www.stockmarketindian.com does not warrant or guarantee their accuracy or date.

www.stockmarketindian.com takes no responsibility for any investment decisions based on recommendations provided on website.

Financial contents like Technical charts, historical charts and quotes are taken from NSE and Yahoo sites.

Note — All quotes are delayed by 15 minutes and unless specified.

Google Adsense Ads are posted on every page of the website so visitors clicking on Ads and going to those links and carrying any financial deal is not at all related to www.stockmarketindian.com and any financial deal should be done on their own sole responsibility.

Please read at www.stockmarketindian.com/disclaimer.php before using any material or advice given at www.stockmarketindian.com

While demand is on the rise following an increase in consumption, a delayed monsoon will lower the domestic production compared to last year.

If the monsoon does not pick up, sugar production for the coming year may be impacted, says, analyst. Non-payment of dues to the tune of Rs 11,000 crore by sugar mills has also contributed to lower sugarcane production as farmers were forced to grow other crops.

However, the government’s move to give interest-free loan of Rs 4,400 crore to mill owners, provided they clear all dues to farmers, is being seen as a major relief as most companies have been reeling under a debt burden.

The government’s decision to increase the limit of blending ethanol in petrol from the current 5 to 10 per cent is also expected to benefit the industry.

However, the impact will be visible over the long term. The other initiative to link sugarcane prices to those of sugar is going to be a game changer. Among the major sugar-producing states, Karnataka and Maharashtra have passed the legislation, while Uttar Pradesh is expected to do so soon.

Though the outlook seems positive, there is no need to rush to sugar counters because most companies are still struggling to keep up with the huge losses.

Shree Renuka Mills and Bajaj Hindusthan have reported a net loss of Rs 466 crore and Rs 1,533 crore, respectively, while Balrampur Chini Mills reported a net profit of Rs 3.64 crore in 2013-14.

Investors can, however, hold on to other large-cap sugar stocks, such as Shree Renuka Sugars and Bajaj Hindusthan, because once the rally starts, it may lift all companies.

Shree Renuka Sugar got into financial trouble because of its leveraged buyout of mills in Brazil. In addition to raising capital through a rights issue, it is using value unlocking opportunities in Brazil and India.

Investors are also warming up to Bajaj Hindusthan after it successfully repaid FCCBs worth $17.7 million recently.

(Posted date — 21 July 2014)

Welcome to Investment House. your way to earn