Are Shipping Stocks Due For A Rally (DRYS NAT FRO SEA)

Post on: 14 Апрель, 2015 No Comment

With the overall stock market up big over the last few years, investors looking for bargains need to go into the sectors that are the most hated in order to find good deals. And one of the most hated has to be shipping stocks. As the global economy stalled and the commodity boom fizzled, the various owners of shipping vessels have struggled to keep up.

But it’s that underperformance that makes them attractive to value-hounds right now.

With improving economic conditions, day rates and rising import/export demand, the time could be finally at hand for investors to realize some of the value left in the sector — and there is plenty. (For more, see: Sectors: Shipping .)

Five Years of Zero Profits

It’s easy to see why the shippers have had a tough time the last few years. During the good times, the global shipping industry expanded capacity across the board. Everything sub-sector, from dry bulk cargo ships to oil tankers, saw new orders/ships hitting the high seas. Then the recession happened and the bottom fell out.

Excess capacity wreaked havoc on the industry’s profits. Many firms within the container shipping sector haven’t been profitable in over five years, while earnings in the other sub-sectors have been extremely volatile. Moving from hefty profits one quarter to complete washouts in the next. That wonkiness has kept the vast majority of investors — sans private players like Blackstone Group LP (BX ) — away from the shipping names.

That’s made stocks with the sector awfully cheap. The Delta Global Shipping Index currently trades for just a P/E of 11 and several dry-bulk names are selling for less than their book values. (For a historical look, see: The Shipping News Isn’t Good .)

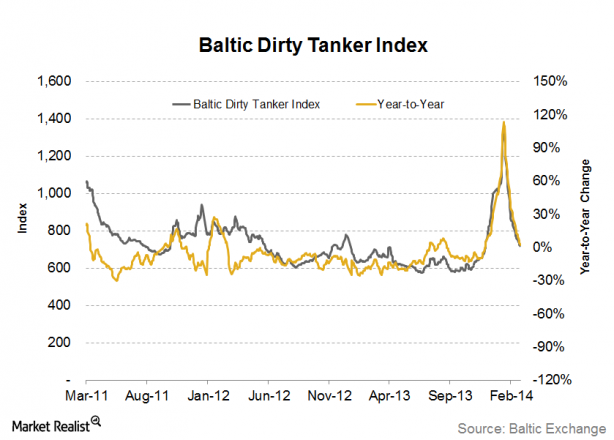

This cheap P/E is even perhaps a better value considering that sector is once again seeing some signs of life. Shipping is a lagging indicator when it comes to the global economy and should benefit as the world’s economy expands. Analysts are predicting that global economy should grow by about 3% in 2015. That would be the fastest annual pace since the recession. An expanding economy should help drive day-rates for all sorts of ships. Already, we’ve seen some components of the Baltic Dry Index rise as supply of new ships, chartered before 2008, have finally been eclipsed by demand.

Meanwhile, one of the sectors biggest costs continues to drop. Fuel remains one of the highest expenses for the shippers at around 40% of the total. Brent crude oil prices have dropped by about 20% this year. That lower cost of fuel should take some pressure off the shippers’ overhead. In fact, analysts McKinsey & Company estimate that fuel savings should boost earnings by as much as 10-20%. That will move many shipping firms from the red into the black with regards to earnings. (For related reading, see: Size Matters in Shipping .)

Betting on Seaborne Trade

Cheap share prices, rising demand and lower input costs are a match made in heaven. For investors, that means taking a shot at the shippers. The easiest way to do it is via the Guggenheim/Delta Global Shipping (SEA ).

SEA tracks the previously mentioned Delta Global Shipping Index, which tracks shipping stocks across the various tanker, dry-bulk and cargo sub-sectors. Currently SEA holds 26 names. Top holdings include Teekay Corp. (TK ) and Matson Inc. (MATX ). That broad exposure to all the corners of the shipping market makes it a prime choice for investors looking for an all-in-one investment in the sector. The exchange-traded fund ‘s 3.86% dividend yield and relatively low expense ratio of 0.66% help as well.

International Shipholding Corp. (ISH ) could be an interesting play in the sector. The shipper owns a fleet of 54 vessels. That includes container ships, auto carriers, tug boats and even coal barges. However, the real win for ISH is that several of its ships are Jones Act -compliant. The 93-year-old law restricts shipping in U.S. waterways to American owned and flagged ships. That gives the firm a big edge as the U.S. economy continues to take-off and export/import more goods. Also benefiting from its Jones Act status is barge operator Kirby Corp. (KEX ) with regards to shipping crude oil.

Finally, the biggest bargains could be in some of shipping’s elder statesmen. The trio of DryShips Inc. (DRYS ), Nordic American Tankers Ltd. (NAT ) and Frontline Ltd. (FRO ) are basically trading for peanuts. In the case of DRYS and FRO, both are under $2 per share. Now they do have warts, and much of their stock declines are self-inflicted, but any marginal increases to day-rates or demand should help boost their depressed share prices. That could make the trio an interesting trade on the sector. (For a historical look, see: 3 Shipping Stocks that Are Cruising .)

The Bottom Line

In today’s market, investors looking for value need to search among the most beaten-down sectors. That leads us towards the shippers. However, that cheapness may not last for long. Several bullish catalysts are lining up in the sectors favor. That could propel stocks with in the sector higher over the next few months. (For a historical look, see: Rough Seas Ahead for Shipping Stocks .)