Are Preferred Stock ETFs Worth the Risk ETF News And Commentary

Post on: 13 Июль, 2015 No Comment

Share | Subscribe

In the current environment of ultra-low interest rates, the yield-hungry investors seek higher income from non-traditional asset classes or instruments. One such asset class that has attracted the investors’ interest recently is the preferred stock.

Preferred shares not only offer substantial yields (often exceeding 6%) but also the opportunity for capital appreciation. Investors have the option of investing in individual companies’ preferred stock or buying preferred stock ETFs which provide a very convenient way to invest in a basket of diversified companies at a low cost. (Read: Invest like Mitt Romney with These Three ETFs )

The investors should however remember that the high payout from this asset class does not come without risks and they should analyze the risk-reward characteristics of the various options available in the space and then decide which ones suit their investment objectives.

Below we analyze the characteristics of this asset class, the potential risks and some of the investment options in this space. (Read: Three Excellent Dividend ETFs for Safety and Income )

What is Preferred Stock?

Preferred stock is a hybrid security that has the characteristics of both debt and equity. Preferred stock does not have voting rights but has a higher claim on the assets and earnings than common stock. That means that the dividends to preferred stock holders must be paid before any dividends are paid to the common stock holders and in the event of bankruptcy, the preferred stock holders’ claims are senior to common stockholders’ claims but junior to the claims of the bondholders.

Preferred stocks are either perpetual (without any maturity date) or have long-term maturity (30 to 50 years). Like bonds, preferred stocks are usually rated by rating agencies. (Read: Complete Guide to Preferred Stock ETF Investing)

The preferred stocks pay the stockholders a fixed, agreed-upon dividend at regular intervals, like bonds. Most preferred dividends have the same tax advantage that the common stock dividends currently have. However while the companies have the obligation to pay interest on the bonds that they issue, the dividends on preferred stock can be suspended or deferred by the vote of the board.

Trust Preferred Stock (TRUPS)

Trust preferred securities are issued mostly by the banks, which create trusts to hold and service these securities. According to the Federal Reserve, the trust preferred could be treated as ‘Tier 1′ capital by the bank holding companies. ‘Tier 1′ capital is one of the most important measures of assessing the capital adequacy of the banks by the regulators.  By issuing Trups the banks can raise their Tier 1 capital per regulatory requirements, while deducting the interest payments for tax purposes. Further, these shares do not have a dilutive effect on the company’s common shareholders and financial results.

Like fixed income securities, preferred securities are sensitive to changes in the interest rates. In the event of rising interest rate, the value of these securities will fall as these securities behave like bonds as far as interest rate risk is concerned.

Many preferred securities have call provision, i.e. the issuer has the right to redeem its preferred stock or convert it to common stock.  (Read: Global X Joins Preferred Stock ETF Race with SPFF )

The preferred securities also face credit risk as the issuer may not be able to meet the claims of the investors. We may add that most of the preferred shares do not enjoy a high rating and not all preferred securities are rated.

Banks have been active issuers of preferred shares due to the tax and capital advantage mentioned above. As a result, most of the ETFs in this asset class have high exposure to the financial sector, which has been very volatile in recent years.

In addition to high volatility, some of the recent regulatory changes are also unfavorable for the preferred shares issued by the banks.

Dodd-Frank Act seeks to restrict the ability of the banks to recognize Trups as part of the core capital. Initially the smaller banks had managed to get an exemption from the rule.  However, according to the latest capital rules proposed by the Federal Reserve, all banks will be required to phase-out from Tier 1 capital of trust preferred securities and cumulative preferred stock over a 10-year time period beginning on January 1, 2013, in order to comply with the Basel III requirements.

We may add that while the banks are not required to call their trust preferred securities, it is likely that the banks may call some of these securities and replace them with new form of capital in view of the current low-rate environment.

While keeping the above risks in mind, the investors can look at the investment options in this space.

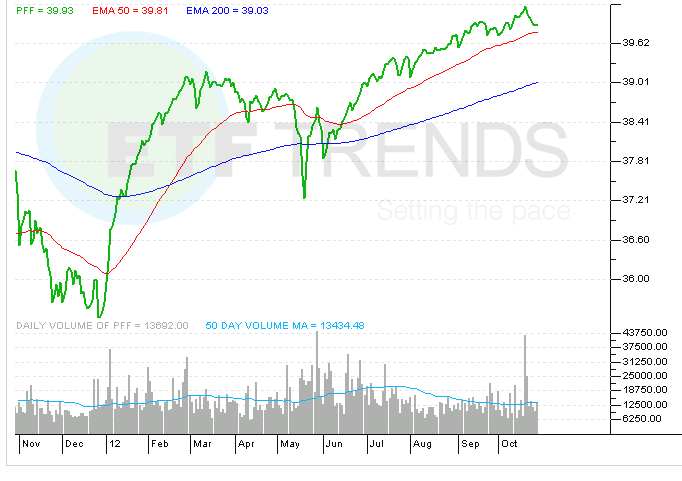

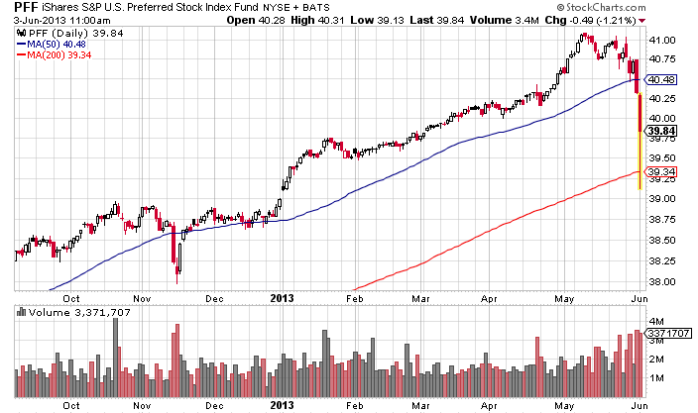

iShares S&P U.S. Preferred Stock Index ( PFF) remains the most popular and liquid preferred stock ETF, with assets exceeding $9.9 billion and daily volume exceeding 200,000 shares. The fund charges 48 basis points in expenses and has returned 12.8% year-to-date. Additionally, the fund has a very attractive payout, with the current 30 day SEC yield at 6.07%.

While the ETF is well diversified with 268 holdings, almost 80% of the holdings are in financial sector (mainly US banks and some European banks).

For investors looking to avoid exposure to the big US and European banks, Global X Canada Preferred ETF ( CNPF ) is an option. Canada’s banks are well managed, well regulated and well capitalized. The World Economic Forum has ranked Canada’s banking system as the most sound in the world, four years in a row. As a result of stringent regulatory norms and conservative lending practices, the Canadian banks had emerged largely unscathed from the global financial crisis.

The fund charges 58 basis points for annual expenses and has gone up 5.34% year-to-date. Current 30-days SEC yield is 3.65%, much lower compared with PFF.  Further with just about $14 million in assets and daily volume of about 1,400 shares, the trading costs for this fund are much higher.

If the investors want to avoid the exposure to financial sector completely, they may consider the recently launched Market Vectors Preferred Securities ex-Financials ETF ( PFXF ), which leaves out the financial sector.  The expense ratio for the ETF at 40 basis points is the lowest in this space. In terms of sector exposure REITs and Electric occupy the top spots. (Read: Market Vectors Debuts Preferred ex Financials ETF )

Current yield for the index is 6.78% and thus this ETF may be an excellent option for investors looking for substantial income while aiming to avoid banking sector specific risks . (see more in the  Zacks ETF Center ).