Are liquid alternative mutual funds right for you

Post on: 13 Апрель, 2015 No Comment

Alternative mutual funds use investments and strategies that are beyond traditional long stock and bond holdings in an attempt to produce returns that are uncorrelated to the overall market. They have become an increasingly popular way to diversify portfolios.

At the end of September, alternative mutual funds had more than $280 billion in total assets. At the end of 2013, they represented only 2.3 percent of the mutual fund market but accounted for 32 percent of mutual fund inflows for that year. According to Morningstar, there are more than 460 alternative mutual funds, many of which are only 2 years old.

New research by Societe Generale, a unit of SG Securities, found that adding a bit of alternative strategies to a typical portfolio of stocks and bonds would have boosted returns going back to the mid-1990s. They also lowered volatility in the portfolio. They were able to produce returns uncorrelated with stocks and bonds.

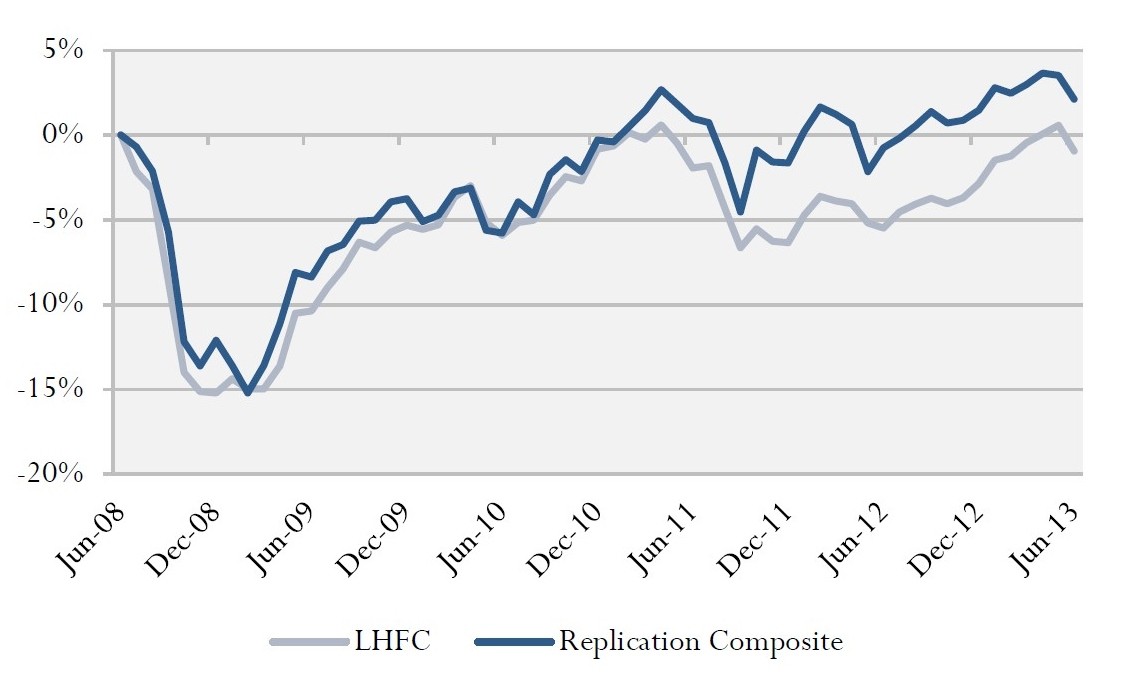

Producing returns that are uncorrelated with the typical stock and bond market are considered the Holy Grail of investing. Many uncorrelated items tend to correlate completely in severe downturns as we experienced in 2008.

The biggest item I would like to bring to the reader’s attention is whenever one reads a report with en

couraging statistics, as the one by Societe Generale, it is important to understand that the study reflects institutional investors. It does not necessarily directly pertain to the individual investor. If you are reading this, you are the individual investor.

These liquid alternative funds are called liquid because they are now in the form of the mutual fund. There are no lock ups, no large minimums’ required and they are available to all of us, where as once they were only available to institutional investors and the ultra-wealthy.

So, are we now to assume that by the generous nature of Wall Street, this is an LOL moment, that they have decided to make these here-before unavailable products available to us?

I propose not. Here’s why. I believe the advantage of some of these strategies is not as profitable as they once were. Calpers, the very large California pension fund, is now exiting the alternative investment universe. Poor performance and high fees are stated as the reason. There was a time when some of these alternatives produced outsized returns compared to the general market. The conditions that made these alternatives profitable have disappeared in many cases. A lack of market volatility is one of the reasons.

So, what’s a manager to do? Of course, take that alternative strategy to the masses in the form of a mutual fund. So, buyer beware!

There are many liquid alternative funds that seem to be charging a premium for doing nothing other than stocks and bonds, said Marc Roland, an investment adviser in San Diego.

According to Lipper’s index of these mutual funds, the index has produced annualized returns of 3 percent over the past five years, compared with 16 percent for the S&P 500.

Recent market conditions have given us some interesting statistics regarding how well these strategies perform in down markets. Of the 81 alternative funds followed by Goldman Sachs, 70 finished higher than the S&P 500 but only 21 had positive returns. Overall, the decline as a group was negative 4.1 percent vs, negative 6 percent for the S&P. There was also a large disparity between the best and worst performers. As with all mutual funds, identifying the winners before investing is difficult. Chasing the high performers often leads to buying high and selling low.

They also analyzed the performance of that group against a traditional benchmark portfolio of 60 percent stock and 40 percent bonds, which was down 0.01 percent during the worst of our recent market correction. The bad news is that only 16 of the funds beat the 60/40 portfolio.

I would approach these liquid alternatives with caution.

Michael T. Doll, an investment adviser with the Longboat Key Financial Group, can be reached at 941-383-2300, ext. 6, or Michaeltdoll@longboatkeyfinancial.com.