Are FloatingRate Funds Safe

Post on: 26 Апрель, 2015 No Comment

SarahMorgan

The hottest-selling funds on the market have drawn plenty of praise and billions of dollars in the last year. Now they’ve also inspired a warning from regulators, who say the investments may be riskier than buyers realize.

‘Floating-rate’ funds, which investors like for their high yields and protection against rising rates, have gathered $22 billion in net inflows so far this year — more than any other fund category, according to fund tracker Morningstar. But in July, the Financial Industry Regulatory Authority issued an investor alert warning that the funds earn those yields by investing in bank loans, which carry higher risk of default than investment-grade bonds. They’re also traded over the counter, as opposed to on an exchange, so they’re less liquid. The total effect, says Finra, is that investors may be chasing the promise of higher returns without fully understanding the higher risk involved in these funds.

Despite the risks, investors have flocked to the funds, which offer yields that can top 6% — better than most stock dividend funds, real estate investment trusts and bond funds. The category has quadrupled in size since 2008 and now claims more than $63 billion in assets. Eight new funds have launched in the first eight months of this year alone. It’s all about yield, says Jeff Tjornehoj, a senior analyst for fund research company Lipper. They’re spinning off income at a level much higher than investment-grade products are capable of, and that gets attention.

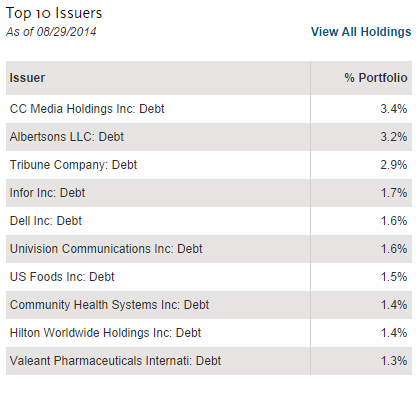

The problem, says Finra, is that some investors are desperate for returns in an environment where traditional bonds aren’t yielding much and stocks have been extremely volatile. But floating-rate funds, Finra says, offer higher yields for a simple reason: they’re riskier. The funds essentially buy loans that banks make to companies, and those loans aren’t securities that can be traded on a regulated exchange. That means it’s more difficult to figure out how much each loan is worth, because investors can’t refer to a market price set by the activity of thousands of other investors. The companies taking out the loans have below-investment-grade credit ratings, so they’re agreeing to pay higher interest rates because they’ve been shut out of cheaper options. These are equivalent to junk bonds in terms of their credit rating, says Sarah Bush, a fund analyst with Morningstar. Talking about higher yields sounds warm and fuzzy, Tjornehoj notes, but when you use that ‘junk’ term instead, people become a bit more cautious.

Fund Resources

Managers of floating-rate funds agree that they’re risky, but say they still have plenty to recommend them. For one, they are more conservative than high-yield bond funds, says Paul Massaro, the co-manager of the T. Rowe Price Floating Rate fund (PRFRX ), one of 15 new funds to launch in the category since 2008. If an underlying issue defaults, the long-term recovery prospects are better than for other high-yield bonds, because banks have priority over other bondholders in the event of a default, he adds, and Scott Page, co-manager of the Eaton Vance Floating Rate fund (EVBLX ) says the securities are no less liquid than municipal bonds or mortgage-backed securities.

Even without Finra’s warning, some of these funds may lose their luster in the coming months. The secondary appeal of the funds is their promise to protect investors from rising interest rates. Fixed-rate bonds would lose value in a rising rate environment because new bonds would offer more attractive yield; floating-rate funds invest in variable-rate loans, so their yield will rise when rates rise. For some investors, that sounded like a better pitch before the Federal Reserve announced its intention to keep rates low for the next two years, says Greg Neer, the head of research at Relative Value Partners. Clearly when Bernanke said that, it scared people, Neer says, and some floating-rate funds saw redemptions the week of Aug. 8. People who bought them for that reason said, ‘Man, we don’t need these anymore,’ he says.

Investment professionals say floating-rate funds should be used sparingly in a portfolio, even for investors who are comfortable with the risks. The funds are more volatile than typical fixed-income investments, Bush says. Consider: In 2008, the average floating rate fund lost about 30%, then rebounded with a 42% gain the next year.