Are Financial Advisors Abandoning Alternatives American Hard Assets

Post on: 25 Май, 2015 No Comment

Dec 17 (Investopedia) — Who needs alternatives?

As the stock market surges on to new highs, it appears that financial advisers — and probably their wealthy clients, are starting to ask that question.

According to a benchmarking survey by Wealthmanagement.com, fewer financial advisers (70%) are recommending alternative investments — anything other than stocks and bonds — to their clients this year than last (75%). The percentage of advisers that said they would be unlikely to recommend alternatives to any of their clients rose to 24% this year from 17%.

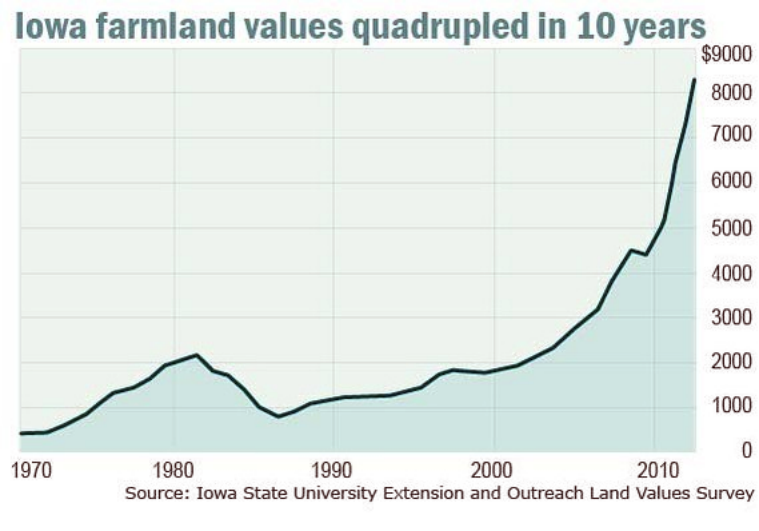

The demand for assets with returns not closely correlated to stocks exploded after 2008, when the S&P 500 index fell 38.5% on the year. Broadly defined, alternative assets are anything that isn’t a stock or a bond that might be expected to hold or increase its value over time. That includes real estate, precious metals, commodities, private equity investments, even collectible art and memorabilia or fine wine. (For more, see: Alternative Investments: Financial Adviser Client Guide .)

The fastest growing class of alternative assets, however, are the so-called 40 Actfunds — commonly called liquid alts, that operate as mutual funds or trade on exchanges (ETFs). They employ hedge fund-like trading strategies usually intending to reduce equity risk or even aiming to perform well when stocks don’t. The big selling point of the funds is diversification: their returns are typically not closely correlated with either the stock or bond markets.

Since the end of 2008, the number of such funds tracked by investment research firm Morningstar Inc. (MORN) has increased to 1,519 from 455 through the end of October, and assets in those funds have swelled to $304.9 billion from $40.6 billion. Despite what have generally been lousy returns in liquid alt funds, the money has poured in.

MASSIVE UNDERPERFORMANCE

The performance of the seven categories of liquid alt funds tracked by Morningstar have massively underperformed stocks over the past five years. Only two of them — long/short equity, which buy some stocks and sell others short, and multi-alternatives, which employ various alternative strategies, have had a double-digit annual gain in any year since 2008. In 2011, all seven categories had negative returns.

The S&P 500 index, meanwhile, has had double-digit annual returns in every year but 2011 since the financial crisis. Last year, it returned 29.6%, while the top-performing alt category — long/short funds, was up 14.6%. Multi-alternatives, the next best category, returned 4.2%, and three categories posted negative average returns. The “bear market” funds — which had a 30% return in 2008, were down by an average of 34.4%. (For more, see: Should you Offer Alternative Investments? )

NOT BEST WHEN STOCKS ARE RISING

The relevant benchmark for alternative investments is, of course, not the S&P 500 index. It’s not even the return on the 10-year Treasury bond, which despite numerous calls of an end to the 30-year bull market in bonds, has remained the favorite safe-haven for investors in a still-jittery investment environment. Alternatives can be expected to underperform equities when the stock market is doing well. It’s in times of volatility and crisis-like atmosphere that they prove their value. In 2008, when stocks cratered, all seven categories of alt funds beat the S&P 500 index by wide margins, though three of them did post double-digit negative returns. (For more, see: How Financial Advisers Can Help Clients Stomach Volatility .)

Keeping up with the Joneses, however, is a strong motivation for financial advisors. They are measured against their peers and the low returns on alt funds, combined with their high management fees, are probably getting harder to justify to clients. Many advisors believe that the talent pool of portfolio managers running the alt funds is thin, and they have not yet proven themselves through a bear market. They also worry that the funds are having difficulties replicating strategies employed by hedge funds that have fewer restrictions on what they can do.

The real rub, however, is the dismal returns. The theoretical diversification and downside protection that alternatives offer is cold comfort when stocks are as hot as they are now. Ironically, this may be the time when alternatives make the most sense. The S&P 500 index has now almost tripled from its bottom below 700 in May 2009. In its march upwards since then it has yet to have a correction of 20% or more — something that usually happens every three to five years. The last time it fell more than 10% was in 2011 when the stalemate between Republicans and Democrats over the debt ceiling spooked the markets. (For related reading, see: Stock Market Risk: Wagging the Tails .)

THE BOTTOM LINE

Financial advisors’ enthusiasm for alternatives may be waning, but the fund flows for five of the seven alt fund categories are still positive if significantly lower than last year. Only the bear funds and multi-currency funds have experienced outflows of money this year. Trees don’t grow to the sky, as advisers are fond of pointing out. The stock market is overdue for a major correction, and when it happens, investors are likely to be glad for any allocations they have to alternatives.

For more market updates, follow American Hard Assets on twitter: @hardassetsmag. Receive the latest news by joining us on Facebook. And be sure to give us plus one on Google Plus. Grab also a copy of our latest magazine issue .