Are Bonds Better Than Stocks Right Now

Post on: 16 Март, 2015 No Comment

Over the last month, investors have still been flocking to bonds despite record low interest rates. In fact the average yield on bonds issued by Group of Seven countries (United States, Canada, Germany, U.K. France, Italy, Japan) has fallen to 1.23% as of June 12, from around 3% back in 2007. And for several countries (Germany and Switzerland), their yield on 2 years bonds went negative. This essentially means that investors dont expect growth for at least two years, and are willing to accept earning nothing on their money to not lose any money.

The Case for Safety

This brings us to the number one reason people invest in bonds: safety. Bonds are backed by the governments which issue them, so the chances of them losing value are extremely rare. People value this protection for their money, and in turn, are willing to pay a premium to keep their money from losing value.

This is why you should look into building a diversified bond portfolio. By mixing different bond types and bond lengths, you could still get the safety of bonds while boosting your returns.

The Risk of Investing in Bonds Right Now

However, with interest rates so low, the chance of making any profit on bonds is slim. With bond yields being so low, it means the cost to own the bond is very high. And since they have been historically low for the past several years, the chances of them continuing to remain this low for another few years is rare.

As bond yields start creeping up, the prices of the bonds will fall, causing two things to occur:

- Investors will start exiting bonds in pursuit of other investments

- The sell-off will perpetuate the bond price collapse

As prices fall, bond funds will take a beating in price, causing significant loss in value. Investors will see longer term bonds lose significantly more value than short term bonds as rates rise. To hedge against this a bit, keep maturities short while interest rates are low, so that you can easily take advantage of rising rates without losing too much in price.

Invest in Stocks

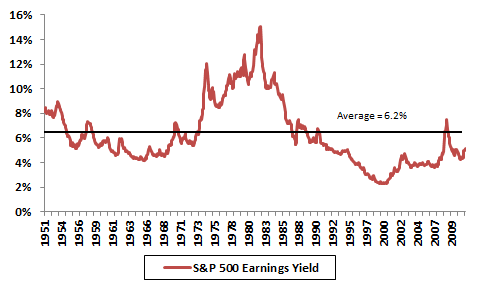

Because of the risky bond situation, many investors, including Warren Buffett, have said investors should avoid bonds and invest in stocks. The reason is that as the economy improves and bond yields rise, stocks will most likely gain a lot of value because companies will be performing better.

And if there is inflationary pressure during the economic recovery (due to the Federal Reserve stimulus programs), stocks usually outperform during inflationary periods.

Either way, stocks are most likely a better bet going forward. Get in on lower valuations now, during economic uncertainty, and enjoy the gains later!

Readers, what are your thoughts on investing in stocks vs. bonds?