Apple Google Tesla Which Will Be The First To Reach A $1 Trillion Market Cap (AAPL GOOGL AMZN

Post on: 13 Апрель, 2015 No Comment

When equity markets reach historic highs, talk generally turns to the most valuable companies on the planet (as measured by market capitalization or market cap). In June 2014, as global market capitalization – propelled by the surging U.S. stock market – exceeded $65 trillion for the first time in history, speculation about which company would be the first to get to the trillion-dollar level no longer seemed particularly far-fetched. Naysayers point to the avid interest in this subject as signs of unhealthy optimism and perhaps an impending market top.

However, it remains indisputable that getting in on the ground floor with a stock that over time goes on to become one of the most valuable in the world can work wonders for your portfolio returns and financial situation. While identifying such stocks is no easy task, your odds of success are greatly improved by adopting a long-term approach to investing – rather than short term or day trading – since trillion-dollar companies are not built overnight. Although a few obvious contenders are favored to win the race, some dark horses could potentially pip the front-runners to the post. Read on to learn who they are.

Putting a Trillion Dollars in Context

$1 trillion is quite a bit of coin. It amounts to 1.5% of the value of every public company traded around the world. Only 15 economies in the world had gross domestic product exceeding $1 trillion in 2012. A single company with a $1 trillion market cap would therefore be bigger than major economies such as Indonesia, Turkey, Saudi Arabia, Netherlands and Switzerland.

$500 billion is no trifling matter either. A company with a $500 billion market cap would be equal to the size of Norway – which was ranked No. 23 in terms of 2012 GDP – and would be larger than economies like Poland, Belgium, Argentina, Austria and South Africa.

The Most Valuable Companies – a Brief History

In the context of those mind-boggling numbers, it should come as no surprise that only a handful of companies have ever exceeded $500 billion in market capitalization, and of that select group, only one company briefly exceeded $1 trillion in market value.

Six U.S. companies have had market caps above $500 billion – Apple (Nasdaq:AAPL ), Cisco Systems (Nasdaq:CSCO ), ExxonMobil (NYSE:XOM ), General Electric (NYSE:GE ), Intel (Nasdaq:INTC ) and Microsoft (Nasdaq:MSFT ). Microsoft, Cisco and Intel topped that level between 1999 and 2000, when valuations for technology companies reached astronomical levels. General Electric also benefited from the booming U.S. economy to break the $500 billion barrier during that period. Microsoft was the biggest company by market cap for much of this time, as it briefly surpassed $600 billion in market value. The leadership baton was periodically passed to Cisco and Intel before the “tech wreck” crushed these stocks and put General Electric in the top position.

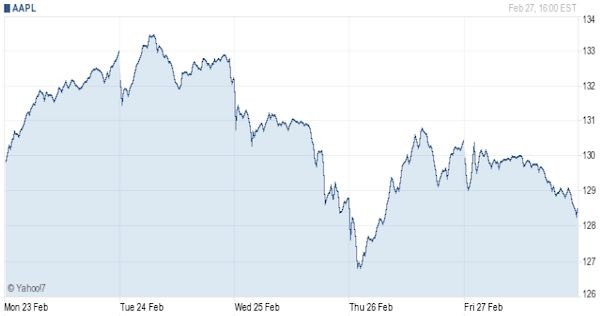

Apple is the most recent entrant to the $500 billion club, having done so in 2012. The stock entered a tumultuous phase after its market value peaked at more than $700 billion in September 2012, declining 40% by April 2013, before ascending steadily to regain the half-trillion summit a year later.

ExxonMobil’s market value topped $500 billion in late 2007 amid surging energy and commodity prices. It was during this energy boom that a relatively lesser-known entity – and a non-U.S. company at that – achieved the distinction of becoming the first-ever company to be valued at $1 trillion. PetroChina (PTR ), China’s biggest energy producer, achieved this feat on Nov. 5, 2007, when its shares almost tripled on the first day of trading following its IPO on the Shanghai exchange. But the stock could not stay at those lofty levels for long, and by June 2014, it had a market cap of less than $250 billion, which was still enough to make it the world’s 15th-biggest company.

(Sources: Bloomberg, Company filings)