Annaly Understanding Interest Rates Annaly Capital Management Inc (NYSE NLY)

Post on: 26 Май, 2015 No Comment

Summary

- Annaly shares have performed solidly during the correction and yield an enticing 10.7%.

- Falling interest rates increase Annaly’s book value as the value of its MBS portfolio rises.

- Conversely, falling rates, and the potential for a flatter curve next year, could pressure Annaly’s net interest income and thereby its dividend.

- Still at 20% below estimated current book value, Annaly is already pricing in a cut, and is an interesting risk/reward buy.

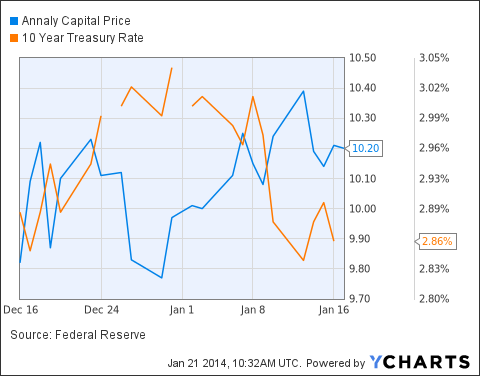

With the S&P 500 down over 5% in just the past month, investors are invariably looking for safe havens to weather further volatility, and it can often be useful to look at what sectors or companies have performed decently during the downturn. In particular, Annaly Capital Management (NYSE:NLY ) has withstood the selling pretty well. When factoring in its dividend, shares are up about 1% in the past month. With its 10.7% dividend yield, Annaly and other mREITs have long been favored by income-oriented investors. I believe a primary reason for Annaly’s outperformance has been declining interest rates (as lower rates increase book value), but investors must recognize that falling interest rates are both a positive and negative for NLY. Falling rates, which is another way to say bond prices are rallying, is good for Annaly’s book value, but bad for its dividend capacity, particularly if the curve flattens.

As an mREIT, Annaly mainly buys agency mortgage backed securities (MBS). Because they are guaranteed by an agency of the federal government (mainly Fannie Mae and Freddie Mac), Annaly is not taking any credit risk, though the mark to market value of the bonds can obviously vary depending on interest rates and pre-payment speeds. Annaly is a major owner of agency MBS with $82.4 billion in bonds in its portfolio at the end of last quarter (financial and operating data available here ). Since the end of the quarter and during the recent stock market pullback, we have seen a sizable rally in the treasury market with the 30-year treasury now hovering around 3%, while the 10-year sits at around 2.3%.

As bond yields fall, that pushes up the mark to market value of Annaly’s portfolio. Absent interest rate hedging, every 1% move in MBS prices would move NLY’s book value per share by about $0.87. Now, Annaly hedges out some of its interest rate risk to make book value a bit less volatile. Still at the end of last quarter, book value was $13.23, and with the 30 year at 3%, I expect current book value to be at least $14, meaning shares are about 20% below book value. If we see a continued decline in long yields, Annaly’s book value would continue to rise, which should theoretically translate to a higher stock price.

However, while that is the good news, lower rates are not a panacea for Annaly, which can afford a double-digit dividend because it uses leverage to increase cash flow. While it owns over $80 billion in bonds, its book equity position is less than $13 billion. The other $67 billion is funded through borrowings, mainly on the short-term repo market. In the most recent quarter, leverage was 5.3x, admittedly much less than the prior year’s 6.2x.

Now, like mortgages, an MBS amortizes, meaning there are constant principal pay-downs. With this cash, Annaly can then go and buy new MBS. With rates falling, these bonds likely carry lower interest rates than existing bonds in the portfolio that are amortizing. This is how lower interest rates cuts investment income, which can put pressure on the dividend payment. While lower rates increase the value of the portfolio, they diminish the income earning potential of that portfolio.

Further, Annaly is buying bonds that have a duration of several years while it often borrows on the overnight market. With overnight rates below 0.25%, this funding is very cheap. Short-term rates have nowhere left to fall, but long-term rates continue to fall (the yield curve is flattening), which cuts Annaly’s net interest income. Essentially, Annaly buys bonds at the long end of curve and borrows at the short end, meaning it makes the most money when the curve is at its steepest. With the 30-year yield falling, we are seeing the curve flatten, pressuring net interest income.

Now, this problem could get exacerbated if the Federal Reserve raises short-term interest rates, which is poised to happen between June and September of next year. In this situation, short-term rates would rise, increasing Annaly’s cost of funding. Now if long-term rates rise alongside short-term rates, Annaly’s dividend-paying capacity would not really be impacted as much. If however, long-term rates remain anchored lower because of low inflation and low interest rates throughout Europe, Annaly would face higher short-term rates but lower long-term rates in 2015 than it has in 2014. This is a double whammy that could force a dividend cut, though lower rates do push up book value.

The recent movement in interest rates have interesting implications for Annaly. While lower rates will help book value, they will put pressure on the dividend, though Annaly could decide to increase leverage to maintain the dividend. I believe it would take a dramatic flattening to force Annaly to cut its dividend below $0.25 from the current $0.30. Even at the lower dividend rate, investors would still get a fantastic 8.9% yield. Given the fact that shares are upwards of 20% below book value, I believe there is sufficient margin of safety to buy Annaly. Still, investors must recognize that while a dividend cut is uncertain over the next 15 months, a dividend hike is extremely unlikely. Yield-hungry investors can do well in Annaly so long as they understand the impacts of interest rates and are comfortable with that risk. I would be a cautious buyer at current levels.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.