Analyzing Investments and Recording Transactions

Post on: 28 Июнь, 2015 No Comment

Investment Analysis Form

The more closely you examine your decision making processes, the better able you will be to improve them. One great way is to record your thoughts, predictions and rationale, and later revisit them to see if and why you were wrong, so that you wont make the same mistake twice.

You may want to consider filling out the form below when youre thinking about buying or selling. It helps clarify the decision, it helps with record keeping (taxes, portfolio tracking, etc), and it helps with learning. You may want to change it to suit your own needs, or come up with a totally different one. Remember that this isnt intended to be comprehensive, its just to give you ideas. You may also want to analyze other aspects of the company.

Feel free to copy and paste it, for your own analyses.

Also periodically check the transactions you decided not to do, to see if you made the right choice and why.

- Date of Analysis

- Company Information (the results of your research). It probably makes sense to keep this in a separate document, since it will be lengthy.

- Does this investment fit into your overall strategy? Does this purchase make sense given the rest of your portfolio?

- What is this stock worth? What is the stocks price? (use the Quotes page to check the current price)

- What is the downside risk of this investment? What could go wrong? What is the upside potential? (consider best and worst case scenarios, and expected outcome).

- What news, events or trends should you watch for that might affect the stocks price, how likely are they, and what would the effect be?

- If youre considering a buy: When will you sell this investment? Will it be sold after a certain period of time? Will it be sold when you reach a certain profit level?

- If youre considering a sell: Look at the analysis form you filled out when you bought the stock to see what you thought then. Do the circumstances match your sell plan that you made?

- If you decide to buy: How much? Why that amount? What percentage of your portfolio does this represent?

- If you decide not to buy, or if you decide to sell: Under what circumstances in the future would you reconsider buying?

- Action

When youve finished the analysis, show it to some other investors you know, and see what they think of it.

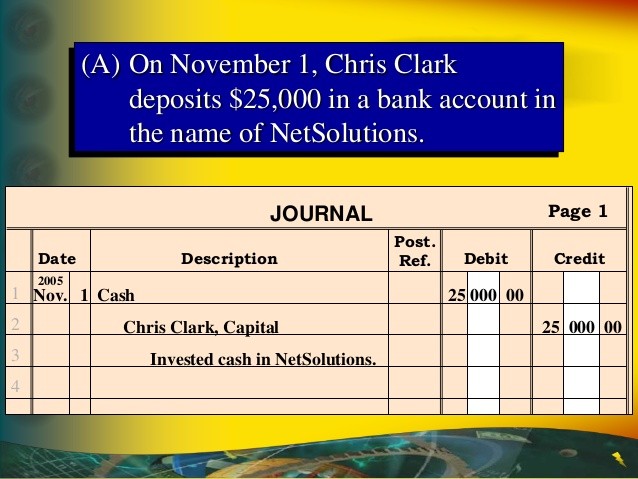

Transaction Template

Once youve completed the analysis above, if you decided to go ahead with the transaction, you will probably want to record the following information (or something similar) for record keeping.

Feel free to copy and paste it, for your own records. Also, if you dont already have a broker, youll need one to perform the transaction for you. (it may take a few days or weeks to get one, so its best to do this in advance)

- Company Name, Symbol, Exchange

- Shares

- Date Bought

- Cost

- Reason Bought

- Plan of when/why to sell

- Date Sold

- Proceeds

- Reason Sold

- Under what cirumstances would you buy again?

- Gains/Losses

- Short/Long term (for tax purposes)

Periodically, you should examine the forms youve filled out to see how well you did. Put them in order, from best to worst, and see if you can discover any patterns. Maybe your circle of competence is different than you thought; or maybe youll find that you hold too long or not long enough.