Analyzing Differences In ETF Risk Exposure

Post on: 16 Март, 2015 No Comment

Recently, iShares launched QUAL. a Quality Factor ETF. It’s the latest in a series of ETFs launched in the last three years that provide targeted access to factors, such as low volatility and momentum.

Prima facie. it is unclear whether any of these new factor ETFs are truly different from each other. For example, is High Quality really different from High Dividends or Value exposure? Although each ETF sponsor has its own definition, generally quality is defined based on the stability of a company’s earnings and dividends. So, it is legitimate to ask whether this is a dividend or value strategy that is just repackaged with a new label. Understanding the differences in the Risk DNA of ETFs is critical for asset allocation and risk management, as well as to assess their fees.

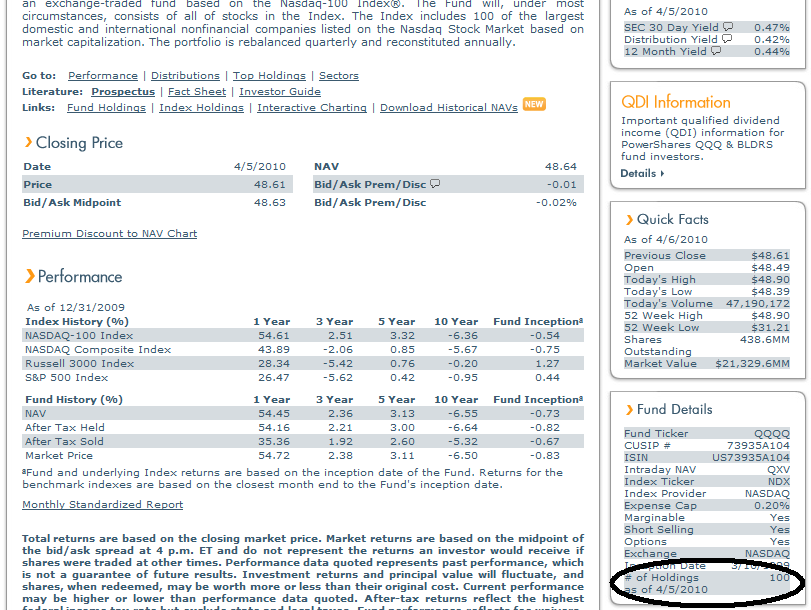

To analyze this, we compared the PowerShares S&P 500 High Quality ETF (NYSEARCA:SPHQ ) to iShares Select Dividend ETF (NYSEARCA:DVY ) and iShares Russell 3000 Value ETF (IWW). We decided to use SPHQ to represent the Quality category, since it has been trading for several years. In a future article, we plan to take a closer look at QUAL itself using historical index data.

We ran all three ETFs through our First Bridge ETF Risk DNA factor model. The model regresses the historical five-year returns of each ETF against about 40 risk factors. Each risk factor was selected based on our analysis and may represent an asset class (e.g. municipal bonds, gold, etc.), factor (e.g. value, low volatility), equity sector, or geography. It allows us to understand each ETF better by isolating which of these risk factors best explains the ETF’s returns.

The charts below present our findings in two steps. The first chart focuses on differences in exposure to specific quantitative factors or asset classes. The second focuses on differences in exposure to global equity sectors. We have presented only those factors that are significant and where there are differences between the ETFs (rather than all 40 risk factors).

As we can see in Chart 1 below, IWW moves more closely with the overall S&P 500 than the other two ETFs. However, it has no sensitivity to low volatility, while DVY and SPHQ do have some exposure to low volatility as a risk factor. Most importantly, SPHQ has a zero factor loading on value, clearly differentiating it from both SDY and IWW (the latter, as expected, has the highest value tilt).

Click to enlarge images.

The three ETFs also show differences on sector exposure (using the GICS classification), as seen in Chart 2 below. The high-quality ETF (SPHQ ) shows a historical tilt toward the consumer discretionary and industrials sectors. By contrast, DVY tilts toward the consumer staples and utilities sectors while IWW shows a slight tilt toward financials (not shown in chart).

Note that the risk model may show sector tilts at variance with today’s sector breakdown. Looking at both historical tilts and current sector holdings is important. The former sheds light on how the ETF’s underlying index behaves over time, which is important to monitor for rules based indices as they change their constituents (and resultant sector exposures) over different market cycles.

In summary, based on our analysis, there seem to be some clear differences between quality and the dividend (DVY ) and value (IWW) ETFs in both their factor and sector exposures. Based on five years of historical data, SPHQ seems to provide exposure to low volatility, consumer discretionary, and industrials risk factors, but does not have a specific value tilt.

There are also areas that merit further investigation. For instance: How would our results change if we used different representative ETF for each category, varied the time frames, etc. We will explore these questions in subsequent articles.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.