Analyzing Bank Of America Part 3 Global Wealth And Investment Management Bank of America

Post on: 16 Март, 2015 No Comment

Summary

- GWIM had a mixed quarter falling short on net income, but still showing positive capital inflows for 22 consecutive quarters.

- BAC has a solid GWIM business which has been recognized for its excellence and innovation.

- GWIM offers one of the best opportunities for growth, and BAC is showing strength by gaining market share among UHNW investors.

Introduction

In this third piece in my series Analyzing Bank of America, I want to take a look at the Global Wealth and Investment Management business, known as GWIM.

GWIM Overview

GWIM is made up of two primary lines of businesses: Merrill Lynch Global Wealth Management (MLGWM) and U.S. Trust, Bank of America (NYSE:BAC ) Private Wealth Management (U.S. Trust). MLGWM focuses on clients with over $250,000 in total investable assets, and works to tailor customized solutions to their financial challenges using the full suite of solutions at Bank of America. U.S. Trust provides a comprehensive suite of solutions to high net worth and ultra high net worth clients, including private banking, investment management, and specialty asset management services.

GWIM had a mixed quarter with more bad than good in the short term. I was very disappointed with the bank’s performance in the last quarter and hope to see positive trends in the first quarter of 2015. $4.6 billion in total revenue came in lower on a QoQ basis and higher on a YoY basis. While asset management fees rose, they were offset by lower transactional activity versus the previous quarter. The overall performance for this quarter in GWIM was down, with net income of $706 million down $72 million from the 4th quarter of 2013. Pre-tax margin and return on average allocated capital were disappointing as well.

The positive trend line in net capital flows continued for the twenty-second consecutive quarter bringing in $9 billion. Period end loans were also up over 8% YoY at $129 billion, and period end deposits rose to $245 billion. The number of financial advisors rose during the period to 16,000, as did financial advisor productivity, which rose 3% to $1.07 million.

The Opportunity in GWIM

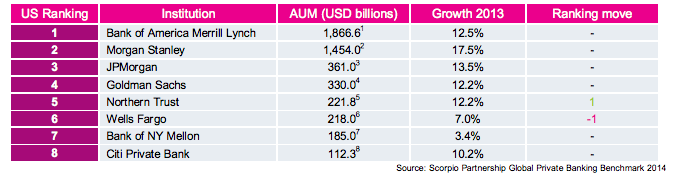

GWIM remains a top notch wealth manager. Despite mixed results in the most recent quarter, this segment has the most opportunity to grow as demographic shifts play out. A brief look at the longer term trends shows positive investments in key dimensions of the business to drive growth into the future. Client balances and other measures of fiscal health continue to be trending positively over the longer term, and BAC remains a leading wealth manager as recognized by Barron’s. Money Market Institute, and Private Asset Management.

BAC continues to roll out new and innovative solutions to meet the complex needs of their clients. Merrill Lynch One is one such example. With Merrill Lynch One, multiple advisor platforms were rolled into one, reducing cost and creating a simplified and effective way for advisors to manage client assets, and it is just one example of the industry-leading innovation that is taking place within GWIM.

Another example is the firm’s shift towards goals based investment strategies that seek to utilize the tools of behavioral finance to create a plan tailored to each individual. The $40 million projected to be spent on goals based investment training will be money well invested, as advisors will be better equipped to help clients achieve their objectives in a simple, transparent, and personally-tailored manner.

The prospect to further cross sell products and solutions within GWIM is huge. While many of the cross sales opportunities take place with CBB, there is a tremendous opportunity to cross sell a wide suite of products to clients coming into GWIM. I believe this opportunity for customers to deepen their relationships with the bank will continue to drive the long-term revenue of this business segment.

A recent study by Spectrem Group ranked Bank of America as the top choice for the Ultra High Net Worth (UHNW) to bank.

Main Findings from the study were as follows

- Bank of America took the top spot as the choice for UHNW investors with between $5 million and $25 million in assets.

- When broken down by age, Bank of America had 18% of investors over the age of 64, giving Bank of America the top spot with baby boomers.

- Among investors with a net worth of $15 million-$25 million, Bank of America came in second with 17%, and with Wells Fargo taking the top spot at 20%.

- Key quote from the study is the trend line; Bank of America is taking market share from their competitors: There was some change from the bank usage report from 2013. For instance, Wells Fargo dropped from 20 percent overall to 16 percent, while Bank of America increased its UHNW investors from 14 percent to 16 percent. JPMorgan Chase also dropped from 13 percent to 11 percent overall. Source

Conclusion

The GWIM business had mixed results in the quarter. Despite these results, key investments in the business, along with positive demographic trends, and an increasing opportunity to expand existing banking relationships, bodes well for the GWIM segment of Bank of America in the future.