Analysis of Risk versus Reward for high yield closed end funds

Post on: 16 Март, 2015 No Comment

A version of this post was also submitted to Seeking Alpha

High Yield CEFs to Spice Up Your Portfolio

High yield bond Closed End Funds (CEFs) delivered excellent performance in 2012 as investors clamored for high income. Many high yield CEFs were selling at substantial premiums to Net Asset Value (NAV) until the Fed crashed the party by discussing plans to taper their Quantitative Easing. The prices for high yield CEFs cratered in the second and third quarter of 2013, suffering their worst loss in over 2 years. Most of the CEFs are recovering but are still selling at a discount. Is this a good time to add high yield bond CEFs to your portfolio? To help you decide, I have analyzed the risk versus reward for this asset class over several time periods.

High Yield Bonds

Before I delve into the analysis, it might be instructive to review the characteristics of high yield bonds, which are popularly referred to as “junk” bonds. From a technical point of view, junk bonds are no different and any other bond. The issuer of junk bonds is a corporation that promises to repay you interest until a specified time in the future, called the maturity date, and at maturity, the corporation will repay you the principal. Default will occur if the corporation, for whatever reason, is unwilling or unable to repay the debt. For example, if the corporation goes bankrupt before the maturity date, the owner of the bond will have to stand in line with other creditors in the hope of receiving some payment.

It is therefore critical for bond investors to assess the probability of default. This is not an easy task, especially for retail investors. Therefore rating agencies, such as Moody’s, Standard and Poor’s, and Fitch have come to the rescue by assigning a rating for most bonds. The ratings range from AAA to C (or D depending on the rating agency). The lower the rating, the higher the probability of default. Bonds rated Ba or below by Moody’s (which corresponds to a BB rating by Standard and Poor’s and Fitch) are considered to be “below investment grade” and are called junk bonds. Since it is harder to sell junk bonds to investors, the corporations need to “sweeten” the deal by offering higher interest rates, hence the term high yield.

Selection Criteria

There are over 40 closed end funds that invest primarily in high yield bonds. Using data from www.CEFConnect.com. I selected candidates based on the following criteria:

- At least a 5 years of history

- Distributions of at least 6%

- Premiums less than 5%

- Market Cap greater than $200M

- Average trading volume greater than 50,000 shares per day.

The following 8 CEFs satisfied all of these conditions:

- Blackrock Senior High Income Portfolio (ARK). This CEF sells for a discount of over 7% (compared to an average premium of almost 1% over the past 12 months) and has a distribution of 7.2%. It has a portfolio of more than 660 securities comprised of bank loans and high yield bonds in about equal portions. The majority of the bonds are rated either BB or B. The bank loans in the portfolio aid in insulating this fund from increases in interest rates. It uses 28% leverage and has an expense ratio of 1.25%, including interest payments. Most (93%) of the holdings are based in the USA. This fund’s price went down almost 50% in 2008

- AllianceBerstein Global High Income (AWF). This CEF sells for a discount of over 6% (compared to an average premium of 2% over the last year) and has a distribution of 8.5%. This fund has a “go anywhere” strategy, with only about 65% of the 900 holdings being domiciled in the USA. About 25% of the bonds are investment grade with the rest being mostly BB and B (but with 15% in CCC bonds). The fund has a relatively small 10% of leverage and a relatively low expense ratio of 1%. The fund lost about 30% in price in 2008.

- BlackRock Corporate High Yield III (CYE). This CEF sells for a discount of 9% (compared to an average zero discount over the past year) and has a distribution of 8.5%. The majority of its 718 holdings are high yield bonds, mostly BB and B rated, with about 15% as CCC, almost all from the USA. The fund uses 29% leverage and has an expense ratio of 1.4%, including interest. It lost about 40% in 2008. Sister funds, BlackRock Corporate High Yield (COY). BlackRock Corporate High Yield V (HYV), and BlackRock Corporate High Yield VI (HYT) have similar portfolios and are highly correlated with CYE. Because of this similar performance, COY, HYV, and HYT were not covered in this analysis.

- Credit Suisse High Yield Bond (DHY). This CEF sells at a discount of 2%, compared with an average premium of almost 5%. The distribution rate is a high 10.5%. This fund holds 265 securities, of which about 85% are high yield bonds, mostly BB and B with about 13% CCC rated. This fund lost about 45% during the bear market of 2008. It utilizes 28% leverage and has a high expense ratio of 2.2%, including interest charges.

- BlackRock Debt Strategies Fund (DSU). This CEF trades at an 8% discount (compared to an average zero discount over the last year) and distributes 7.5%, paid monthly. It has holdings of 795 securities, which are comprised of about half bank loans and half high yield bonds, almost all from USA firms. The bonds are mostly B rated with some BB and some CCC. The floating rate loan component of the portfolio makes this fund more immune from interest rate hikes than many of its high yield peers. This fund lost about 50% during 2008. The fund uses 29% leverage and has an expense ratio of 1.4%, including interest.

- Wells Fargo Advantage Income Opportunity (EAD). This CEF sells at a discount of 8%, compared to an average premium of 2% over the past year. The fund’s distribution rate is 9%. The portfolio consists of 327 securities, mostly high yield bonds rated BB and B, with about 18% rated CCC. The fund lost over 40% in 2008. The fund utilizes 24% leverage and has an expense ratio of 1.3%, including interest payments.

- Western Asset High Income Opportunities (HIO). This fund sells at over an 8% discount, which is large compared to its average discount of zero). The distribution rate is 8.1%. The fund has 360 holdings, most of which are high yield bonds rated between BB and CCC. This is a global fund with only 5% of the holding domiciled within the USA. The fund lost a relatively low 25% in price (30% in NAV) in the 2008 bear market. This fund does not use leverage and has a low expense rate of 0.9%.

- Western Asset High Income Fund II (HIX). This fund sells at a discount of 5%, which is much lower than the yearly average of a 7% premium. This fund distributes a high 10.2%, paid monthly. The fund has 411 holdings, almost all high yield bonds, rated BB (13%), B (41%), and CCC (30%). The high percentage of lower grade CCC bonds is one of the reasons for the high distribution. The fund also has 7% invested in investment grade bonds. This fund lost over 40% in 2008. The fund uses leverage of 22% and has an expense ratio of 1.4%.

Since high yield bonds have attributes of both bonds and stocks, I also included the following ETFs in the analysis for reference:

- SPDR S&P 500 (SPY). This ETF tracks the S&P 500 equity index and has a yield of 2%.

- iShares Barclays 20+ Year Treasury Bond (TLT ). This ETF tracks the performance of long term treasury bonds and yield about 2.9%.

5 Year Risk versus Reward

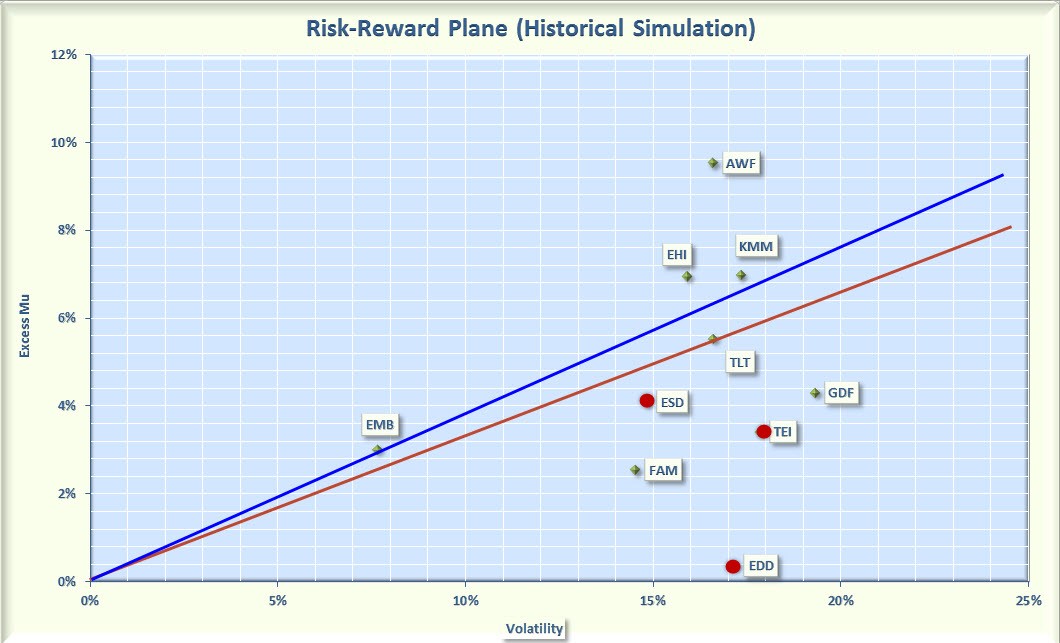

To analyze risks and return, I used the Smartfolio 3 program (www.smartfolio.com ) over the past 5 years. The results are shown in Figure 1, which plots the rate of return in excess of the risk free rate of return (called Excess Mu on the charts) against the historical volatility.

Figure 1. Risk versus Reward over past 5 years (click to expand)

As is evident from the figure, high yield bond CEFs generated excellent returns but also had breath-taking volatility. Were the returns commensurate with the increased risk? To answer this question, I calculated the Sharpe Ratio.

Sharpe Ratio

The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. In Figure 1, I plotted a red line that represents the Sharpe Ratio associated with SPY. If an asset is above the line, it has a higher Sharpe Ratio than SPY. Conversely, if an asset is below the line, the reward-to-risk is worse than SPY. Similarly, the blue line represents the Sharpe Ratio associated with TLT.

Some interesting observations are apparent from Figure 1. Most of the high yield CEFs beat both the S&P 500 and long term treasuries on risk-adjusted basis. ARK and DSU lagged but not by a tremendous amount. The best performers were AWF and DHY. However, to take advantage of these great returns, you would have had to endure about twice the volatility of TLT and about 40% to 50% more volatility than SPY. The fund, HIO, had the least volatility among the CEFs, likely because it did not use leverage. If you had invested in these CEFs five years ago (and had withstood the volatility) you would have done very well.

Diversification

Did the high yield CEFs also provide diversification? To assess this, I calculated the correlation matrix, which is shown in Figure 2. As you can see, these CEFs are good diversifiers. They are negatively correlated with long term treasuries and only moderately correlated with the S&P 500. The correlations are stronger among themselves but only about 60% to 80%, so there is good diversity even among the different CEFs.

Figure 2. Correlation matrix over past 5 years (click to expand)

3 Year Risk versus Reward

I next looked at the past 3 year period to see if the outperformance had continued. The results are shown in Figure 2. What a difference a couple of years made! Over the past 3 years, the SPY has been in a rip-roaring bull market and easily outpaced the high yield CEFs. As you might expect, the returns associated with these high yield assets fell between that of equities and treasuries. However, somewhat surprising, the high yield CEFs provided a risk-adjusted return better than TLT. The volatility associated with the CEFs was about the same as equities during this period. The laggards, ARK and DSU, during the five year period recovered nicely and landed near the top of the pack. AWF and DHY continued their good performance. CYE continued to have good performance and relatively lower volatility when compared to its peers. HIO was again the least volatile but also generated the lowest risk-adjusted return.

Risk versus Reward since 1 Jan 2012

The investment landscape became even murkier in the recent past. Since early this year, the fear of rising rates has taken its toll on high yield CEFs, causing them to give back most of the year-to-date gains. To get a more near term view, I ran the analysis from the beginning of 2012 to the present, a little over 1.5 years. This data is presented in Figure 4. The near term results are similar to the 3 year data. The performance of the high yield CEFs continued to be between that of equities and long term bonds. The SPY outperformed the group on both an absolute and risk-adjusted basis. However, the high yield CEFs handily beat TLT. DHY continued to outperform its peers, while AWF had similar performance as the other CEFs. ARK and DSU were highly volatile but provided reasonably good risk-adjusted performance.