An Introduction To Pairs Trading With Etfs 2015

Post on: 15 Июнь, 2015 No Comment

3A%2F%2Fwww.tradingmarkets.com%2F?w=250 /% One way you can take advantage of leveraged ETFs is with a pairs trading strategy Enter your email address to get your FREE download of our Introduction to ConnorsRSI — 2nd Edition — Trading Strategy Guidebook with newly updated historical results.

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% Although most people use individual stocks in pairs trading, the technique can also work well with exchange traded funds (ETFs) that cover a particular sector or a broad market index. Here we look at ETF pairs trades and provide historical examples where

3A%2F%2Fwww.moneyshow.com%2F?w=250 /% Although most people use individual stocks in pairs trading, the technique can also work well with exchange traded funds (ETFs) that cover a particular sector or a broad market index. Here we look at ETF pairs trades and provide historical examples where

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% That is still a possibility, but even given that, buying European stocks right now looks like a trade with following the introduction of quantitative easing programs by Central Banks. On the left is the iShares MSCI Japan ETF (EWJ) in the months

3A%2F%2Fwealthmanagement.com%2F?w=250 /% The point is that there are many options, but few maximize risk/reward better than the trade I propose. One of the safest and best ways to maximize profits in the oil sector is to use an ETF pair trade (i.e. long/short) strategy focused on maximizing

3A%2F%2Fwww.forbes.com%2F?w=250 /% Read more: Actively-Managed ETFs: Risks And Benefits For Investors An Introduction To Pairs Trading With ETFs Use The Momentum Strategy To Your Advantage

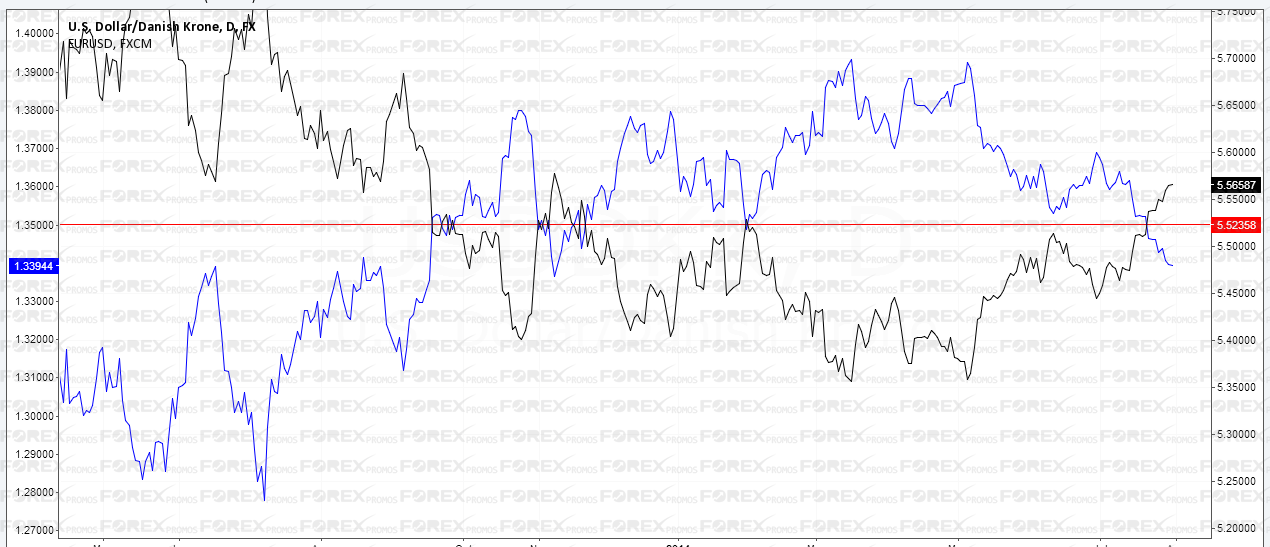

3A%2F%2Fwww.investopedia.com%2F?w=250 /% it may be best suited to foreign exchange trading, especially the major currency pairs that have abundant liquidity and low spreads. Characteristics of Guerrilla Trading A guerrilla trader’s modus operandi is to make low absolute profits per trade

3A%2F%2Fseekingalpha.com%2F?w=250 /% A spread is a type of trade in which one simultaneously holds both bullish (long) and bearish (short) positions in different securities or markets. This strategy is often called “pairs trading downward. Introduction to Spread ETFs (pdf) is a

3A%2F%2Fmoney.usnews.com%2F?w=250 /% Since its introduction in Canada in 1989 Many traders appreciate the ability to buy and sell ETFs at market price during the trading day, a feature unavailable with mutual funds, which price once a day after markets close. Other investors and traders

3A%2F%2Fwww.ibtimes.com%2F?w=250 /% The purpose of this guide is to give you an overview on how to trade the Forex market with a special focus on the EUR/USD currency pair. Forex or FX refers to the simultaneous buying and selling of currencies. It is an Over the Counter Market (OTC