An Introduction to Behavioral Finance

Post on: 10 Апрель, 2015 No Comment

Many penny stock investors envision the micro-cap and small-cap market as a person from time to time. After all, it has mood swings that turn it from euphoric to highly irritable, allowing it to react violently one day and more than make up for itself the next.

However, can human psychology actually help you understand the financial markets? Can you delve into the human psyche to uncover winning stock picking strategies? Well, proponents of behavioral finance claim it can do just that.

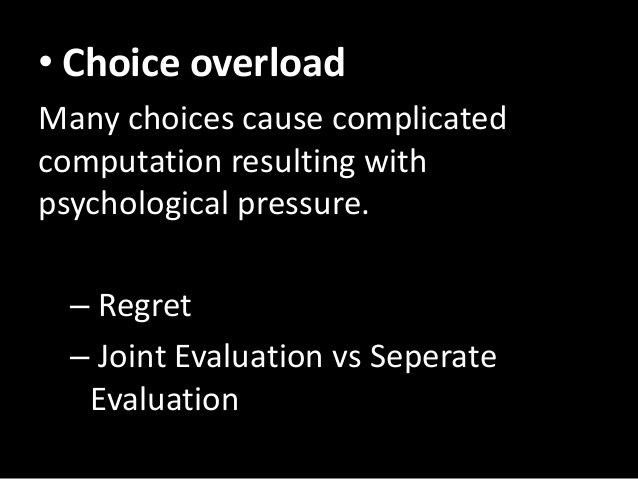

Principles of Behavioral Finance

The field of behavioral finance argues that people are less rational than traditional finance would have you believe. Behavioral finance provides some interesting explanations for investors interested in how biases and emotions control share prices.

The basic tenet that psychology is responsible for driving stock market movements is an opposite hypothesis of established theories advocating the Efficient Market Hypothesis. Proponents of the Efficient Market Hypothesis argue that new information pertaining to the value of a company is quickly evidenced in the market through the arbitrage process.

However, for any investor who has lived through the Silicon Valley tech boom and the crash that followed, efficient market theory is a hard pill to swallow. According to behavioral finance, irrational behavior is quite common and not an anomaly. In fact, market and behavioral researchers have been able to consistently reproduce market behavior through simple experimentation, proving that the psychology of investors and market behavior are far from mutually exclusive.

Understanding Losses vs. Gains

One such experiment involves offering someone a $100 bill, but also offering them the possibility of winning $200 or walking away empty-handed with the flip of a coin. In most cases, a person will take a free $100 and be on their merry way. However, research shows that when offered the possibility of doubling their money with a coin toss, a person will likely take their chances on the toss.

Although the probability of a coin landing on either side is the exact same, people will typically select a coin toss to keep from losing money even though it could lead to greater potential loss. Thus, people deem it more important to recoup a loss than it is to potentially earn a greater gain.

This same innate instinct to avoid losses rings true for investors as well. For instance, shareholders of Nortel Networks watched the value of the stock plummet from a high of $100 in early 2000 to under $2 a share. Regardless of how low a price drops, investors often hold onto stocks believing or hoping the stock will rebound.

The Herd Instinct

Investors imitate other investors due to the herd instinct. Regardless of whether a market is soaring upward or sinking downward, investors tend to fear that other investors have more information or know more than they do. Consequently, investors often feel a strong urge to buy or sell what others are buying or selling.

Behavior finance has also revealed that the majority of investors place too much value on tiny data samples from only one source. For instance, many investors believe analysts pick winning stocks based on skill rather than luck.

Unfortunately, the beliefs of an investor are not easily shaken. Throughout the 1990s, investors held strong to the belief that any dip in the market represented ideal buying opportunities. While this belief still holds strong for many today, behavioral finance suggests that investors are often much too confident in their judgments as they tend to pounce on a single detail rather than focus on the overall picture.

Is Behavioral Finance Practical?

It’s perfectly viable to ask yourself if behavioral finance can help you win in the markets. After all, wise investors should be able to experience plenty of profitable trading opportunities from their rational shortcomings. However, not many penny stock investors use the principles of behavioral finance to determine stocks that may consistently provide them with significant returns. In reality, the tenets of behavioral finance remain largely entrenched in academia and not practically put to use by most modern investors.

While behavioral finance does a fine job of pointing out rational shortcomings, it provides very little solutions for penny stock investors looking to profit from market manias. In his book “Irrational Exuberance,” financial writer Robert Shiller provided evidence that the market was in a bubble during the 1990s, but he couldn’t say for certain when the bubble would pop. On a similar note, behaviorists may not be able to tell us when the market has peaked, but it can provide us with insight as to what the peak might look like.

In the end, behaviorists have yet to develop a working model that accurately predicts the future, so behavior finance theory alone doesn’t help people beat the markets. Rather, it merely tells investors that psychology leads to long-term divergence between fundamental values and market prices. If you’re looking for a miracle, behavioral finance isnt it, but it may just be able to help you pay attention to your behavior and avoid mistakes that could prove costly to your bottom line.