American Funds Lose Index Funds Have Record Year

Post on: 16 Март, 2015 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

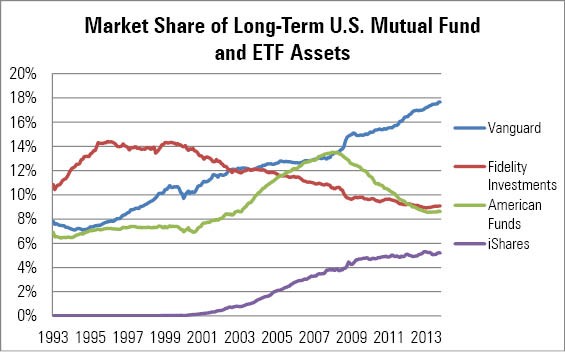

American Funds, one of the largest mutual fund families in the world was the biggest loser, in terms of assets under management last year. The biggest gainers were index funds and exchange traded funds (ETFs ). Why?

As I illustrated a few weeks ago, S&P 500 Index Funds Beat Actively-Managed Funds in 2011. This week, I read an article that announced, American Funds is the biggest loser in shift toward passive investments. It is no coincidence that the challenging market conditions of the past few years has clearly demonstrated that even the best fund managers are not able to consistently outperform the market averages.

Intuitively one might guess that the incredible volatility of 2011 would create what has been called a stock picker’s environment, which is to say that only the most skilled money managers can only do well in a challenging market. However, the simple and passive approach of going with the flow (index investing) has proven again that it is a wise choice for investors.

Speaking of flows, Morningstar announced that investors took away $9.4 billion of their money from American Funds in 2011 while Index Funds took in a record $76 billion last year.

- Index Funds Are Passively Managed: Because they seek to match the returns of a given benchmark, such as the S&P 500 Index, they enjoy the powerful secondary benefits of lower expenses and lower manager risk.

- Index Funds Have Lower Expenses: With no need to spend time and money on researching and analyzing prospective companies in which to invest, index funds have extremely low Expense Ratios, most of which are below 0.20%. Actively-managed funds typically charge up to 1.50% or more. This gives the index fund investor an immediate head start on performance and a disadvantage to active fund managers.

- Index Funds Don’t Create ‘Manager Risk:’ Active fund managers are human. Therefore they are susceptible to human emotion and the errors that can come along with it. By nature, actively-managed funds are built to outperform the market averages, which often means managers will take what they might call calculated risk to juice performance. This additional risk often translates into bigger losses in markets like 2011.

Over long periods of time, especially 10 years and beyond, the vast majority of actively-managed funds lose to the indexes. Passive investing reminds me of a quote from the ancient Greek philosopher, Aesop: The little reed. bend in g to the force of the wind. soon stood upright aga in when the storm had passed over.