Alpha Investing with Hedge Fund ETFs

Post on: 25 Май, 2015 No Comment

Eagle Daily Investor New Member Official Contributor

When it comes to leadership qualities, it helps to be an “alpha.”

The same applies in the world of investing.

In the language of finance, “alpha” refers to the amount by which a portfolio outperforms its underlying index, adjusted for volatility.

Put more simply, alpha refers to your market gains in excess of the average buy-and-hold investor.

“Alpha” is what the sophisticated hedge funds promise their investors.

To most investors, hedge funds are the glamor boys of the investment world. Say the word “hedge fund” and you picture big gains, big yachts and big egos.

Sometimes that reverence is warranted. Sometimes it is not.

Still, there’s little doubt hedge funds are the investment world’s alpha dogs.

But here’s the problem. And it is a very big one.

Even if you pony up the big bucks to invest in a hedge fund as an “accredited investor,” these hedge funds are way too expensive.

After all, you are likely to be paying a hedge fund manager’s traditional “2 and 20” fee structure, which is a 2% management fee and 20% of any profits.

And once you pay up for the big gains, big yachts and big egos, there’s not much left over for you.

The ETF Hedge Fund Alternative

So, how can you become an investing alpha dog without the help of high-cost hedge fund managers?

Thanks to a handful of newish ETFs, you no longer have to be an accredited investor to invest like the alpha dogs that manage hedge funds.

That means that today replicating some major, stock-only hedge fund strategies is as simple as a owning a couple of easy-to-buy “hedge fund replicator” ETFs.

Each of these ETFs is designed to mirror the holdings of some of the world’s best-performing hedge funds.

In fact, in 2014 I used two of these funds to replace the hedge fund allocations in the “Ivy Plus” Investment Program offered by my firm Global Guru Capital, a Securities and Exchange Commission-registered investment adviser that is not affiliated with Eagle Financial Publications.

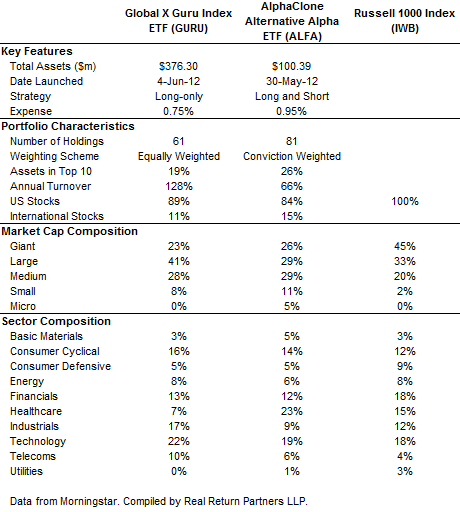

The first fund, the Global X Guru Index ETF (GURU), invests in the top hedge fund managers’ favorite stocks.

Specifically, GURU uses a proprietary approach to invest in the highest-conviction investment picks from a choice pool of hedge funds based on their “13F” disclosure information.

What is a “13F,” you ask?

Well, all hedge funds with more than $100 million in U.S. equity investments are required by law to legally reveal their holdings through a public document called the “13F” each and every quarter.

GURU then invests in the same holdings these alpha dog managers do, offering these investments in an ETF that is transparent, cost-effective and easily accessible to anyone with a brokerage account.

So how has GURU done versus the S&P 500?

Since it began trading in June 2012, GURU has delivered gains of 69.1%. Over the same time period, the S&P 500 has delivered a solid, yet comparably weak 56.5%.

Unfortunately, GURU has been in a bit of a slump during the past six months.

With its small-cap bias, GURU is actually down over the last half year by 1.6% vs. the S&P 500’s 4.6% gain.

The ETF ‘ALFA’ Alternative

GURU’s performance stands in sharp contrast to the other hedge-fund replicator ETF I use, the AlphaClone Alternative Alpha ETF (ALFA) .

ALFA tracks the performance of U.S.-traded equity securities to which hedge funds and institutional investors have disclosed significant exposure.

Like GURU, the fund uses the 13F disclosures to choose its stocks.

Unlike GURU, ALFA has the ability to bet against certain stocks — or “go short” — during extended market corrections. That said, it is probably unlikely to have done so over its short lifetime, given the overall bullish tone of the U.S. stock market.

Chart: ALFA (blue) vs. S&P 500 (red)

Over the past six months, ALFA has risen 9.9% versus 4.6% for the S&P 500.

And so far in 2015, ALFA has really caught fire, surging 4.63% vs. the S&P’s gain of less than 1%.

So what’s the secret of ALFA’s relative success?

A quick look at the top three holdings in ALFA reveals why this fund is outperforming the S&P 500 and, unlike GURU, is generating some real “alpha.”

1) Apple Inc. (AAPL)

The recent surge in Apple shares makes having this newly ordained Dow Jones Industrial Average component as ALFA’s top holding (4.06%) a boost to the ETF’s performance.

Apple’s shares are up 30.8% in the past six months. And owning this stalwart personal technology giant has been one of the premier investments of choice for both hedge funds and individual investors alike.

Chart: AAPL (blue) vs. S&P 500 (red)

2) Biogen Idec (BIIB)

Biotech star Biogen Idec is riding the huge bullish wave in the biotech sector and has been doing so for some time. Through the past six months, this maker of therapies for the treatment of neurodegenerative diseases, hemophilia and autoimmune disorders has seen its share price vault 26.7%. BIIB shares are the second-largest holding in ALFA at 3.21%.

So here, again, you see ALFA betting on a winning horse.

Chart: BIIB (blue) vs. S&P 500 (red)

3) Baidu Inc. (BIDU)

Sadly, ALFA doesn’t get them all right.

The ETF’s third-largest holding at 3.11% is Chinese Internet service provider Baidu. That stock has struggled over the past six months and is down 4.9% on fears of a slowdown in the Chinese economy.

Despite its recent struggles, it’s hard to fault the selection of BIDU in a hedge fund replicator ETF.

After all, BIDU has delivered an incredible 304% gain over the past five years and is a bellwether stock for a play on the massive growth of the Chinese Internet technology segment.

Chart: BIDU (blue) vs. S&P 500 (red)

Disclosure: I own ALFA and GURU both personally and on behalf of my clients at Global Guru Capital. NOTE: Global Guru Capital is a Securities and Exchange Commission-registered investment adviser, and is not affiliated with Eagle Financial Publications.

In case you missed it, I encourage you to read my e-letter column from last week about an update on my “bet against Warren Buffett.” I also invite you to comment in the space provided below my commentary.

Last edited by a moderator: Mar 10, 2015 at 7:18 PM