Alpha Attribution

Post on: 11 Июль, 2015 No Comment

Alpha Attribution

Which Hedge Funds are Most Skilled at Picking Stocks?

Its not easy to isolate, but stock selection skill is at the core of how many hedge funds add value to investors. Looking at overall fund returns data, as a proxy for skill, does not deliver the same insight.

Hedge fund performance does not necessarily correspond to stock picking skill. A look at a managers returns is insufficient. Great returns may come from net exposure to the right sector or because the fund was net long when the market went up. Whether they picked the right stocks is another story. Even with great overall performance, they could have just been getting lucky.

Investors in funds should isolate how much of a hedge funds returns come from specific skills. They should ask, do these skills drive performance and are they related to the core competency of the manager? We asked these questions for more than a thousand funds and isolated each managers stock selection skill based upon their publicly disclosed portfolio and compared it to the rest of the hedge fund universe.

Many hedge funds market their stock-picking ability. This ability is at the core of why hedge fund investors feel their managers deserve to earn a two percent management fee and twenty percent of the profits. They do deep fundamental research on stocks and claim to pick the best stocks and short the worst ones. While we do think that there are skilled hedge fund managers out there who are capable of separating the winning stocks from the losing stocks, we believe that investors as group can do a better job of isolating the truly skilled stock pickers from those who are getting lucky.

Stock picking starts with honesty. Lets say you are a hedge fund manager and you held GOOG stock for a quarter. If GOOG goes up 10%, that is great, but if the technology sector goes up 7%, much of that 10% return may have been coming from the sector. You got the sector right, which is worth 7%, but your stock selection ability is only worth 3% (10%-7%). We define stock selection skill is ones ability to pick a security that outperforms its sector (with some adjustments for beta, etc).

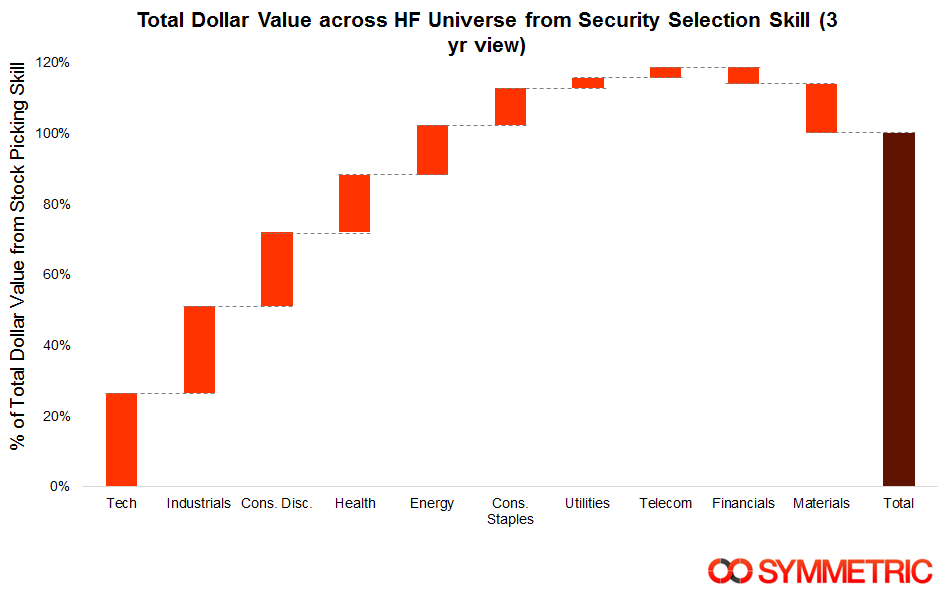

We use this framework to calculate the stock selection skill of every hedge fund manager that publicly discloses their positions. Based on the magnitude and consistency of this skill over the last 3 years, we rank order the entire hedge fund universe and produce a list of 10 hedge funds we think demonstrate high and consistent stock selection skill over the past 3 years.

Top Managers Demonstrating Consistent Stock Selection Skill over Last 3 Years