AllOnMoney Tips on Money Saving Investments Financial Planning More

Post on: 16 Март, 2015 No Comment

Sukanya Samriddhi Yojana for a girl child has started getting a very good interest amongst parents as the scheme aims to secure girls future by offering very good interest rate. The scheme required a minimum deposit of Rs.1000 to start with and maximum of Rs.1,50,000 (1.5 lakh).

So lets see how a deposit of Rs.10,000 every year (starting from the financial year 2015-2016) till 14 years will earn you Rs.6,26,750 which is a whopping 348% return. Ive assumed 9.1% interest rate for the whole period which might change and will be declared by the government every financial year.

Heres a table displaying yearly investment and interest amount earned:

Sukanya Samriddhi Interest Rate Calculation

So as you can see how your money grows every year in this small savings scheme. The returns would be on higher as you invest more money considering that you invest for a long term.

Note: You can also start investing in current financial year 2014-2015 i.e. before 31st March 2015 and still get income tax benefit which will help while declaring investment.

One of the biggest benefit which is attracting more and more people to this scheme is that the returns and investments are 100% tax free. Read all the features of SSA .

You can open this account in government post offices and 28 Indian banks (public & private) authorized by Reserve Bank of India. Also read how to get application form available at post offices.

Related posts:

Sukanya Samriddhi Yojana which is a long term savings plan for securing the future of girl child was launched by Indias honourable prime minister Shri. Narendra Modi on 22nd January 2015.

On the union budget presented on 28th February 2015 by Shri Arun Jaitely, Sukanya Samriddhi Scheme was declared as a tax free under Section 80C of income tax act. So everyone should take benefit of this scheme and secure their girls future. Moreover RBI has notified all the banks to update daily status of SSA transactions directly through the government account at its central account section. Failure in doing so will result in penal action i.e. such bank/branch can be de-authorized. Check out the benefits and features offered under this yojana.

On 11th March 2015, RBI declared the list of banks where interested parents or guardians can open account for the girl child. You can read in detail about the account opening form for SSA at India post office.

Here is the list of 28 banks (public and private) where parents can contact to open Sukanya Samriddhi Bank Account which is a small savings scheme:

- Allahabad Bank

- Andhra Bank

- Axis Bank Limited

- BoB Bank of Baroda

- BoI Bank of India

- Bank of Maharashtra

- Canara Bank

- CBI Central Bank of India

- Corporation Bank

- Dena Bank Limited

- ICICI Bank Limited

- IDBI Bank Limited

- Indian Bank

- IOB Indian Overseas Bank

- OBC Oriental Bank of Commerce

- P&SB Punjab & Sind Bank

- PNB Punjab National Bank

- SBBJ State Bank of Bikaner and Jaipur

- SBI State Bank of India

- SBH State Bank of Hyderabad

- SBM State Bank of Mysore

- SBP State Bank of Patiala

- SBT State Bank of Travancore

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

Apart from the above approved banks, Indian post offices has already started to open Sukanya Samriddhi Account. Check out interest rate calculation for this scheme where investing Rs.1,40,000 will earn you Rs.6,26,750 on maturity.

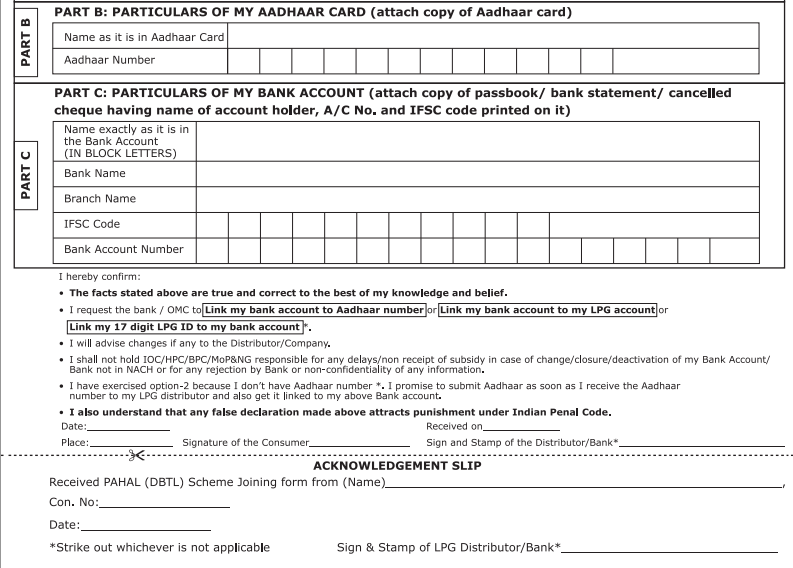

There are just 3 documents required for opening account as follows:

- Birth certificate of the girl child

- Address proof and

- Identity proof of guardian or parents

Also see Pradhan Mantri Jan Dhan Yojana and Pradhan Mantri Jeevan Jyoti Bima Yojana launched by government of India especially for poor people.